Year End Webinars

Year End Webinars

Slides from the webinars can be downloaded from here>>

You can watch a recording of these webinars using the following links

Watch Year End Webinar From 16th December 2021

Watch Year End Webinar From 9th December 2021

We will also be holding another two Year End Webinars on Monday 20th at 11AM and Tuesday 21st at 2:30PM.

If you would like to attend any of these webinars please REGISTER HERE>>

Some of the topics that we will be covering are;

1) Running your final payrolls in 2021.

2) Week 53 - Does it apply to you, and if so how must it be operated.

3) Year End reporting.

4) Getting started with your 2022 Payroll.

As always we will be happy to answer any questions that you might have on the day.

New EWSS rates apply from 1st December

We have released an update to Payroll 2021 to implement the EWSS reductions which apply from 1st December.

Your Payroll software should notify you of this update, but if you are not sure you can always select the "Check For Updates" option in the "Help" menu of Payroll 2021.

We are obviously aware that there is much public discussion regarding a rolling back of the reductions to EWSS, and we will be releasing an update if the situation changes.

But we would like to advise you that while we always recommend that everybody installs updates as they become available, you will still recieve your EWSS subsidy even if you are not running the latest version of Payroll.

Payroll software merely makes your claim for EWSS to Revenue - essentially we "Tick a Box". The Payroll software does not actually request any particular amount of subsidy from Revenue.

Rather, Revenue calculates your EWSS entitlements on ROS based on the Gross Pay that you report in your Payroll Submissions.

The EWSS subsidy reports are just an estimate of what our software thinks you are entitled to so that you can check this against the payments from Revenue.

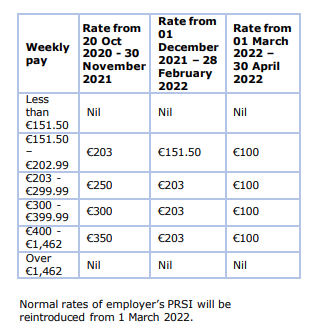

The following weekly rates of EWSS will apply until the end of April - but this could change at any time!

There will not be any changes to EWSS for the month of October

The Government has announced today that EWSS will continue to operate with the existing rates and bands for the month of October.

This means that the EWSS will continue to operate in its current form during October 2021, so that the main eligibility requirement is a 30% decrease in turnover or customer orders in the full year 2021 compared to the full year 2019. The enhanced rates of support and the reduced rate of Employers’ PRSI will continue to apply for the month of October 2021.

No decisions have been made for how EWSS will operate after October, or its possible extension into 2020. These decisions are expected to be made as part of Budget 2022 which will be announced on 12th October.

For more details see the official announcement here>>

Employers must file ERFs for June and July before Wednesday to avoid disruption to EWSS payments

Employers who have not filed all of their outstanding EWSS Eligibility Review Forms (ERFs) by Wednesday 1st September will have their EWSS payments put on hold by Revenue.

As of last Friday up to 27% of employers claiming EWSS had an outstanding ERF which would result in their EWSS payment being held from next Wednesday.

Part of the confusion seems to have been caused by the fact that employers were required to file two separate ERFs before the 15th August deadline;

1) The Initial ERF which included all of the 2019 actual figures, along with actual figures for Jan - Jun 2021, and projected figures for July - Dec 2021.

2) The July 2021 ERF which confirmed the actual figures for that month.

Many employers assumed that because they were filing the initial ERF in August that Revenue would treat the July figure as an actual figure rather than a projected figure - this is not the case. Employers must confirm the actual July figure via a separate ERF.

Employer can complete this form by logging into ROS and clicking into the "EWSS Eligibility Review"

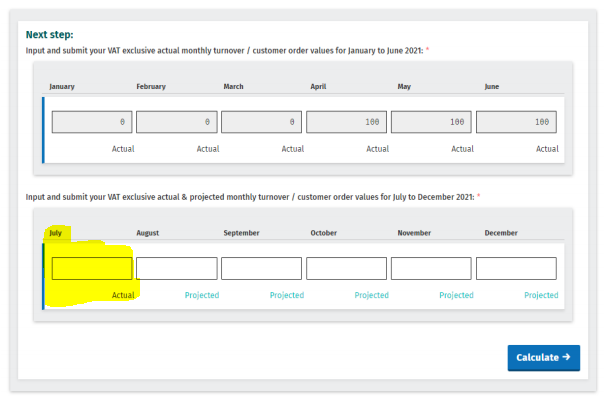

The actual figures for July can then be entered in the following screen

This will then recalculate your eligibility to continue claiming EWSS into August.

Going forward employers will be required to update their eligibility by entering actual figures for the previous month before the 15th of the current month.

Delays to some EWSS Payments (Updated 10th August 2021)

In the past couple of days we have had a small but noticeable number of employers contact us stating that they had not received last week's EWSS payment.

We have raised the matter with Revenue who have come back to us to advise that

"Just to come on the issue around the payments. We have discovered a bug in our Debits/Credits application that has resulted in an issue with some EWSS payments. We are releasing a fix today and those payments should process tonight."

So if you have been impacted by this problem you should receive any outstanding payment in the next day or so.

Clarifications on EWSS Eligibility Review Queries

A number of questions were raised during the course of last weeks webinar regarding the EWSS eligibility review.

In particular there were a number of questions around the issue of eligibility for a business which commenced trading some time between 1st January 2019 and 31st October 2019, and how eligibility is assessed.

Revenue have confirmed that the eligibility process on their website takes your 2019 turnover and converts it into an annualised equivalent figure for 2019, and this is then compared against the full figures for 2021 (actual and forecast).

For example, if you commenced trading on 1st August 2019 you would have 5 months of turnover data. Lets say this was €100,000. Revenue would take this figure, divide it by 5 months and then multiply by 12 months to arrive at a figure of €240,000 for a full year which is then compared against the full year figures for 2021, and eligibility is determined on that basis.

I don't agree that this is the correct way to perform this calculation as its not in line with the actual calculation as specified in the guidelines, however, that's the way that it is currently being approached by Revenue.

As a result of the way that Revenue are carrying out the calculation, there will be cases where Revenue will incorrectly deem an employer to be eligible or ineligible.

If your business is one of these borderline cases please proceed with caution and check your own eligibility using the correct calculation. If you are not eligible then please do not claim EWSS, even if the Revenue screens state that you are eligible.

On the other hand, if Revenue deemed you ineligible but you feel that you are, you will need to contact myEnqueries and ask for the stop on your EWSS payment to be removed.

The full text of the response from Revenue can be viewed here>>

EWSS Eligibility Review Webinar

EWSS Eligibility Review Webinar

A recording of the EWSS Eligibility Review Webinar is available to watch here>>

The slides are available here>>

EWSS Eligibility Review Deadline Extended to 15th August

If you are an employer who is currently availing of EWSS then there is some important action that you must take to confirm your eligibility for EWSS with Revenue online on ROS.

This includes all EWSS employers including those in the childcare sector who currently do not have to show any reduction in turnover, however they still need to confirm their eligibility.

Failure to complete this online eligibility review by Sunday 15th August (new extended deadline) could result in your EWSS payments being delayed.

Revenue have written to all relevant employers, but the deadline outlined in the letter has now been extended from 30th July to the 15th August in order to give employer some additional time to prepare their figures.

An updated press release has been published by Revenue on their website here>>

Revenue have published guidance on the process, however the documents refer to the old deadline;

https://www.revenue.ie/en/employing-people/documents/ewss/guidelines-on-eligibility-for-ewss.pdf

and

https://www.revenue.ie/en/employing-people/documents/ewss/ewss-guidelines.pdf

We will be hosting a webinar to discuss the process on Wednesday 4th August at 11AM - attendance is free but you must register here>>

Also, Revenue have acknowledged that some employers may find it difficult to gather the required monthly figures from 2019 and 2021, and so they have confirmed that they are prepared to accept average monthly figures derived from their bi-monthly (or other periodic) VAT returns. This was confirmed by Revenue in a letter sent to The Institute Of Chartered Accountants. For more details see here>>

Updated Revenue Guidance on Employers paying their Employee's TWSS Tax Liabilities

Revenue have published an e-Bief with updated guidance for employers who are looking at paying their employee's TWSS tax liabilities.

The eBrief can be downloaded at https://www.revenue.ie/en/tax-professionals/ebrief/2021/no-0972021.aspx

There are two main clarifications in this eBrief;

1) The deadline has been extended until the end of September 2021

2) The scheme is now open to proprietary Directors provided the employer is paying the TWSS tax liabilities of all other employees.

Revenue TWSS Reconciliation Guidance Documentation

The Revenue TWSS Reconciliation web page can be found at https://revenue.ie/en/employing-people/twss/reconciliation/index.aspx

General TWSS Reconciliation Guidance Document (PDF)

TWSS PRSI Corrections

TWSS FAQ Version 18 - Operational Phase 4th May - 31st August

TWSS FAQ Version 8 - Temporary Phase 26th March - 3rd May

TWSS Reconciliation Webinar 6th May 2021

The video and slides from today's webinar on the TWSS Reconciliation process are now available to watch/download

Click here to watch a recording of todays webinar on the CollSoft Vimeo page

Click here to download the slides from this webinar

Revenue Video explaining how they handle an employee's tax credits and SRCOP when an employee returns to work after being on PUP

Revenue have prepared a short 15 minute presentation explaining how they process an employee's tax credits when the employee returns to work after being on PUP.

They have some worked examples showing how this impacts on a single person as well as a jointly assessed person, and they outline the timelines involved in processing the updated RPNs.

You can watch this presentation on our Vimeo page here>>

Potential problems for employees returning to work on April 12th after being on PUP

Under current Government guidelines from 12 April, all residential construction can restart as well as early-learning and childcare projects.

Under these plans there are likely to be a large number of employees who will be returning to work next week and signing off PUP.

Payroll operators should be aware of the following;

1) While employees are on PUP Revenue will have reduced their tax credits and Standard Rate Cut Off Points (SRCOP). In most cases credits will have been reduced to zero. Revenue have explained the process in a document on their website available here>>

2) An employee's tax credits will be recalculated after Revenue have been informed by Social Welfare that the employee has stopped receiving PUP - however, this process may take a couple of weeks.

3) After an employee closes their PUP claim there may still be payments due to be paid to the employee because the Social Welfare week runs from Friday to Thursday, and if an employee is still signed on for Friday 9th April they will be entitled to a full payment for the week up to Thursday 15th April, even if they recommence work on Monday 12th April. Social Welfare will consider this claim to be open until the last payment has been made to the employee.

4) The Department of Social Welfare will only inform Revenue that the employee has closed their PUP claim after the final payment has been made, so for many employees Revenue wont have recalculated their tax credits before you process their first wages.

5) This may result in the first couple of weeks wages being calculated with very low (or zero) tax credits on a Week 1 Basis

6) Employers should pay special attention to any employees whom they are paying on a "Net To Gross" basis as the re-grossed pay is likely to be very high, and because of the nature of a Week 1 calculation this may not be recouped by the employer for a long time (if it can be recouped at all)

7) Employees who are jointly assessed and their spouse continues to receive PUP may not have their tax credits restored.

8) You are required to always use the most up to date RPN available on Revenue when running your wages.

Processing your Payroll for Good Friday or Easter Monday 2021

As you are aware Friday 2nd April is "Good Friday" and as such it is a "Bank Holiday" so you wont be able to process any payments for that date.

If you normally pay your wages on a Friday then this is what you need to do with this weeks wages;

Under the rules of PAYE Modernisation when your payment day falls on a bank holiday Revenue allow you to actually bring your payment forward to the previous banking day, but you still report to Revenue that the payment was made on the bank holiday.

The same rule will apply to anybody who would normally report wages on Monday 5th April - you report the payment date as 5th April to Revenue but you can actually pay your employees on Thursday 1st April as this is the previous valid banking day before the bank holiday on Monday.

Whatever you do, do not under any circumstances change the payment date in CollSoft from Friday 2nd April to Thursday 1st April because the Thursday belongs to Week 13 and Friday belongs to Week 14 which would result in completely calculations for PAYE and USC.

If you have any doubts please contact our helpdesk.

TWSS Reconciliation Guidance Documents and Webinar Slides

Slides from TWSS Reconciliation Webinars available to download here>>

Revenue Guidance Document for TWSS Reconciliation can be downloaded here>>

PRSI Corrections Guidance Document for employees or payslips which were ineligible for TWSS available here>>

TWSS Reconciliation CSV Files to be made available to employers on 22nd March 2021

Almost one year after the introduction of the Temporary Wage Subsidy Scheme (TWSS) Revenue are now ready to commence the final part of the TWSS reconciliation process.

All employers who participated in TWSS will be able to download their reconciliation CSV file from ROS on Monday 22nd March 2021.

This CSV file will list all J9 payslips submitted to Revenue by the employer along with details of the amounts paid to the employee (as reported by the employer), the amount of TWSS to which the employee was entitled, and the amount of TWSS paid to the employer by Revenue at the time. Based on those figures Revenue will determine the reconciled amount for each payslip and calculate if an under or overpayment has been made.

Employers will then have until the end of June 2021 to review their reconciliation and make any adjustments that are required. Once the employer is satisfied with the final balance they will be able to accept the reconciliation calculation and Revenue will either collect any amount owed or pay any amounts due to the employer.

We would like to draw attention to the fact that employer have until the 30th June to finally accept their reconciliation, so there is no need to immediately finalise your reconciliation – it is better to take the time available and check the figures thoroughly.

CollSoft will be releasing some updates to our 2020 software to help employers with any issues that arise from the process and while we do expect support to be busy in the initial days as employers study their files, please bear with us and rest assured that as always our support desk will be happy to assist you in any way that we can.

We will also be hosting webinars to discuss the TWSS reconciliation process on the following dates;

As always these webinars are free to attend but you are required to book your place on our website at https://www.collsoft.ie/events

Issues with RPN's that have zero or very low tax credits

Revenue have provided some clarification on this matter and we have posted a more detailed explanation of the issue here>>

In short this is an issue around the timing of the closing of a PUP claim.

Most employees who have returned to work this week with reduced tax credits should also still be receiving a PUP payment from Social Welfare which will more than offset the reduced tax credits.

Employers should be aware that there are currently around 479,000 employees on PUP, and most of these will have had their tax credits reduced.

As these employees return to work you should expect the credits to remain very low (or zero) for the first couple of weeks until the last PUP payment has been paid and the benefit is closed. Again, most of these employees will still be receiving a PUP payment in the interim even though they have recommenced employment.

Webinar on the topic of Employers Paying an Employees 2020 Tax Liabilities

We have uploaded a recording of this webinar to our Vimeo page at

The slides from the webinar can be downloaded here>>

Employers paying employees' 2020 tax liability

As we had previously advised Revenue will facilitate employers who wish to pay employees' 2020 tax liabilities. This applies to Income Tax (IT) and Universal Social Charge (USC) liabilities which arise due to the TWSS (and possibly PUP).

This is completely discretionary - employers are not obliged to make any such payments as the liability rests with the employee. However there are many employers who may want to make some contribution (either in part or in full) towards their employees liabilities arising from TWSS.

Revenue have published a brief guide to the process at https://www.revenue.ie/en/employing-people/twss/employers/index.aspx

CollSoft will be releasing an update to Payroll 2020 to facilitate such payments to be recorded and reported in the Payroll Software. We expect to have this update ready to release around 8th February.

This update will include a new Year End Adjustments Payroll Period where the user will be able to record such payments and report them to Revenue as an adjustment to their December Monthly Statement. Revenue will collect any payments through the December monthly statement and your employees final liabilities will be updated to reflect any payments made by the employer.

Over the last week we have been asked by many employers if there is a report in the Payroll software that can help them calculate the employee's liability. We are working on an update to add a report to Payroll 2020 that will help employers to estimate the tax liabilities that an employee has as a result of TWSS.

However, please be aware that such a report is only an estimate. It is impossible for CollSoft to perform the same calculations as Revenue because of the following reasons;

1) Employees may have been on both TWSS and PUP. Payroll will not know what PUP was paid and what PAYE is due from the PUP.

2) Many employees are jointly assessed with their spouses by Revenue. Therefore an employee's overall liability will depend on their partners own tax situation. Again Payroll cannot account for this.

3) The employee may have had multiple part time employments in which they were on TWSS and their final tax liability is a result of all the TWSS paid in these employments. Your CollSoft software will not have the details from those other employments.

If employers are going to be making payments towards their employees tax liabilities then they will have to engage directly with the employee to asses the actual liability.

Updated Guidance for the operation of BIK on Vehicles during the current Level 5 lockdown (Jan 2021)

Revenue are extending the short term concession whereby BIK on a company vehicle will not be applied in certain circumstances.

For more information please refer to the following information here>>

There are other concession that ended on 31st December just prior to the current Level 5 lockdown and these are also under review.

Getting started with Employment Wage Subsidy Scheme (EWSS) - Webinars

With the new lockdown there are many of our customers who are now looking to avail of the EWSS for the first time.

Some of you will have used the old Temporary Wage Subsidy Scheme (TWSS) between March and August of 2020 but never actually joined the new EWSS in September.

To help such employers we are hosting some webinars to discuss getting started with EWSS specifically. These will be geared towards explaining how EWSS works for those trying to use it for the first time. These webinars will include a presentation going over the basics of the scheme, followed by a demonstration of how to use EWSS in the Payroll software and finishing with an open Questions and Answers session at the end.

The first webinar will be tomorrow Friday 8th January at 3PM followed by another on Monday 11th at 11AM

You can register for the webinar at www.collsoft.ie/events

The slides for the EWSS Webinar can be downloaded here>>

We are currently preparing an FAQ document based on the questions that we are seeing on our helpline which will be published tomorrow.

Payroll 2021 in now available to download.

Payroll 2021 is now available to download from our website at www.collsoft.ie

We have published a video that shows you how to install the 2021 software onto your PC, and how to carry forward your companies and employees from Payroll 2020.

You can watch this video here>>

Important changes to the EWSS eligibility criteria for employers from 1st January 2021

The Finance Bill 2020 which is currently making its way through the Dáil at the moment contains a change to the eligibility criteria for all employers availing of EWSS after 31st December.

The eligibility will be based on the employers turnover/orders from 1st January to 30th June 2021 compared to the same period in 2019 (i.e. 1st Jan - 30 June 2019).

This is different from the eligibility periods currently used in EWSS.

Employers will need to check that they continue to be eligible under the new rules if they plan to use EWSS from 1st January.

Note: The legislation is still at committee stage in the Dáil so it has not actually been passed yet, and there is always the possibility that it will change between now and then.

Revenue announced that Employers will be allowed to make payments towards an Employee's 2020 Tax Liability

Revenue will facilitate employers who wish to make a contribution towards an employees' 2020 tax liabilities that have arisen due to the payment of TWSS in 2020.

Revenue will not apply the usual BIK rules to these payments but employers should be aware that these payments would not be regarded as wholly and exclusively incurred for the purposes of the employer’s trade or profession, and therefore they will not receive a deduction for corporation tax purposes.

If employers wish to make a payment towards their employee's 2020 tax liability then they will need to engage directly with the employee in order to determine the amount of PAYE and USC that is being paid. Revenue will issue employees with a Preliminary End of Year Statement in the middle of January 2021 which will help in this regard.

There are two methods by which the employer can make a payment towards the employee's tax liability;

We think that the second option is the best method to use as the employer can guarantee that the money is actually paid to Revenue. As such we will be releasing an update to the 2020 software which will enable employers to report these payments in a special Payroll Run. This update will be made available in January 2020.

Employers will have until the end of June 2021 to avail of this facility and they will be required to keep some documentary proof showing the engagement with the employee and the arrangements agreed in order to undertake these payments.

More information is available on the Revenue website at

https://www.revenue.ie/en/employing-people/twss/employers-paying-employees-tax-liability.aspx

TWSS Reversal Tools added to Payroll

Some employers are now in the process of repaying TWSS back to Revenue along with any PRSI that would have been paid if TWSS was not used. For some this is a voluntary process, for others they have been advised that they were not eligible for all or part of the time that they were using TWSS.

We have added a wizard which recalculates the amount of PRSI that would have been paid and prepares some reports that can be sent to Revenue for approval.

We are still working on a tool that will also allow you to adjust the insurable weeks to take the J9's off the employees record - this will be available as part of our Year End update.

We have more information available here>>

Revenue Employer Notice regarding TWSS Reconciliation Process

Employers who were operating TWSS will have received an Employer Notice via their ROS Inbox this morning discussing various aspects of the TWSS reconciliation process.

This is a generic notice and is being sent to all TWSS employers to remind them that the deadline for reporting all TWSS payments made to employees is the 31st October. They have however recognised that due to the current Level 5 shutdown some employers may not be able to meet that deadline, but they are requesting that everybody makes their best effort to do so.

We would just like to remind our customers that as long as you have installed one of the latest versions of our software (Build 145 or higher) then the software will warn you if you have any outstanding payments to be reported.

At this stage it looks like well over 95% of TWSS payments made through CollSoft Payroll have already been reported to Revenue, so as long as you have updated your software there is nothing for you to worry about.

Revenue have announced changes to the way EWSS will be paid to employers

Revenue will be changing the way that EWSS is paid to employers early in November so that EWSS payments will be paid on a daily basis. This will be similar to how TWSS was paid where an employer usually received payment within 48Hours after making a Payroll Submission to Revenue.

Revenue have indicated that they expect these new daily EWSS payments to start around the 9th November.

The official press release reads as follows;

"Frequency of EWSS payments

The EWSS was originally designed to pay the subsidy due once a month in arrears as soon as possible after the due date of the relevant monthly Employer PAYE return (the 14th of the following month).

On 6 October 2020, Revenue announced that it had brought forward the date for EWSS payments to the fifth day of the following month. October EWSS payments, including the increased rates announced by the Minister for Finance in respect of payroll submissions with pay dates on or after 20 October 2020, will be paid by 5 November 2020.

Revenue is currently working to further significantly shorten the EWSS payment timeframe. In this regard, the first EWSS payments in respect of November payrolls will be made in early November, rather than by 5 December. Thereafter, subsequent payments for November will be paid following the receipt of a payroll submission containing an EWSS claim. This means EWSS will be paid on a similar basis to the Temporary Wage Subsidy Scheme (TWSS), providing a significant positive cashflow boost for businesses.

Finally, due to the current Level 5 public health restrictions, employers who previously did not qualify for EWSS may now be able to show the necessary 30% reduction in turnover or customer orders between 1 July and 31 December 2020. Revenue is reminding employers that it is still possible to register for EWSS once all qualifying criteria are met. Once registered, employers can then claim subsidy payments in respect of payroll submissions with a pay date on or after their registration date."

Note: We appreciate that over the last number of days many customers have asked us if Revenue were going to make any changes in this area, and we advised them that Revenue were still going to pay a month in arrears. We had asked Revenue for clarity on this matter (as well as others) on Monday night and we were told on Tuesday morning that it was definitely not going to change - but now they have. I know many employers are trying to decide if they should use EWSS or lay staff off for PUP, and this particular issue of cash flow is a large factor in making that decision.

We are trying to ensure that we always give you the most accurate answer, but sometimes the official position of government will change without much notice.

New EWSS rates effective from 20th October

The Government have confirmed that the new increased rates of EWSS will apply to all wages submitted with a Payment Date on or after 20th October, including any such wages that were submitted to Revenue before the announcement last night. (New rates listed below)

So any wages submitted to Revenue with a payment date of the 20th October or later will have the subsidy paid at the new rates.

As far as we can tell, if you are running a monthly payroll dated after the 20th October, you will receive a full month at the higher rates.

CollSoft Webinars

We have scheduled a webinar to discuss the changes to EWSS for Wednesday afternoon, and there is another webinar to discuss the TWSS reconciliation process on Thursday morning.

You can register for the webinars on our website at https://www.collsoft.ie/events

Do I need to update my Payroll?

Yes and No!!!

EWSS continues to apply where Gross Pay is between €151.50 and €1462 per week. This has always been the case since EWSS was introduced on 1st September 2020, and CollSoft uses these values to apply for the subsidy.

The way the system works is that when the Gross Pay is within the range valid for EWSS the software sets an "EWSS Flag" that indicates to Revenue that the employee is eligible for EWSS. The payroll software does not tell Revenue what that amount of subsidy is, Revenue actually calculate it themselves on ROS - we just set the "EWSS Flag" for Revenue.

Revenue will calculate your subsidy based on the payment date of your payslips, and will apply the new rates automatically to any payslip with a payment date on or after the 20th October.

So, anybody who was submitting payslips today will have their subsidy calculated at the new rates, and even if you submitted your wages earlier in the week for any payment date from 20th, you will also get the new rates.

But there is one problem:

The subsidies reported in CollSoft Payroll will be showing the old rates, and indeed the current reports on Revenue will also be showing the old rates.

CollSoft will issue an update by next Monday to update the reports to the new rates, and this will fix any amounts that have been reported incorrectly in the software.

The main thing to remember is that even if you are using the old software, you will still get the updated rates from Revenue when they pay your subsidy.

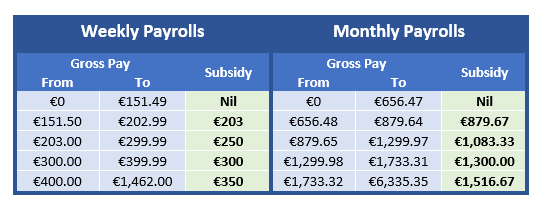

The new rates for EWSS from 20th October are as follows;

Slides from the webinars can be downloaded from here>>

You can watch a recording of these webinars using the following links

Watch Year End Webinar From 16th December 2021

Watch Year End Webinar From 9th December 2021

We will also be holding another two Year End Webinars on Monday 20th at 11AM and Tuesday 21st at 2:30PM.

If you would like to attend any of these webinars please REGISTER HERE>>

Some of the topics that we will be covering are;

1) Running your final payrolls in 2021.

2) Week 53 - Does it apply to you, and if so how must it be operated.

3) Year End reporting.

4) Getting started with your 2022 Payroll.

As always we will be happy to answer any questions that you might have on the day.

New EWSS rates apply from 1st December

We have released an update to Payroll 2021 to implement the EWSS reductions which apply from 1st December.

Your Payroll software should notify you of this update, but if you are not sure you can always select the "Check For Updates" option in the "Help" menu of Payroll 2021.

We are obviously aware that there is much public discussion regarding a rolling back of the reductions to EWSS, and we will be releasing an update if the situation changes.

But we would like to advise you that while we always recommend that everybody installs updates as they become available, you will still recieve your EWSS subsidy even if you are not running the latest version of Payroll.

Payroll software merely makes your claim for EWSS to Revenue - essentially we "Tick a Box". The Payroll software does not actually request any particular amount of subsidy from Revenue.

Rather, Revenue calculates your EWSS entitlements on ROS based on the Gross Pay that you report in your Payroll Submissions.

The EWSS subsidy reports are just an estimate of what our software thinks you are entitled to so that you can check this against the payments from Revenue.

The following weekly rates of EWSS will apply until the end of April - but this could change at any time!

There will not be any changes to EWSS for the month of October

The Government has announced today that EWSS will continue to operate with the existing rates and bands for the month of October.

This means that the EWSS will continue to operate in its current form during October 2021, so that the main eligibility requirement is a 30% decrease in turnover or customer orders in the full year 2021 compared to the full year 2019. The enhanced rates of support and the reduced rate of Employers’ PRSI will continue to apply for the month of October 2021.

No decisions have been made for how EWSS will operate after October, or its possible extension into 2020. These decisions are expected to be made as part of Budget 2022 which will be announced on 12th October.

For more details see the official announcement here>>

Employers must file ERFs for June and July before Wednesday to avoid disruption to EWSS payments

Employers who have not filed all of their outstanding EWSS Eligibility Review Forms (ERFs) by Wednesday 1st September will have their EWSS payments put on hold by Revenue.

As of last Friday up to 27% of employers claiming EWSS had an outstanding ERF which would result in their EWSS payment being held from next Wednesday.

Part of the confusion seems to have been caused by the fact that employers were required to file two separate ERFs before the 15th August deadline;

1) The Initial ERF which included all of the 2019 actual figures, along with actual figures for Jan - Jun 2021, and projected figures for July - Dec 2021.

2) The July 2021 ERF which confirmed the actual figures for that month.

Many employers assumed that because they were filing the initial ERF in August that Revenue would treat the July figure as an actual figure rather than a projected figure - this is not the case. Employers must confirm the actual July figure via a separate ERF.

Employer can complete this form by logging into ROS and clicking into the "EWSS Eligibility Review"

The actual figures for July can then be entered in the following screen

This will then recalculate your eligibility to continue claiming EWSS into August.

Going forward employers will be required to update their eligibility by entering actual figures for the previous month before the 15th of the current month.

Delays to some EWSS Payments (Updated 10th August 2021)

In the past couple of days we have had a small but noticeable number of employers contact us stating that they had not received last week's EWSS payment.

We have raised the matter with Revenue who have come back to us to advise that

"Just to come on the issue around the payments. We have discovered a bug in our Debits/Credits application that has resulted in an issue with some EWSS payments. We are releasing a fix today and those payments should process tonight."

So if you have been impacted by this problem you should receive any outstanding payment in the next day or so.

Clarifications on EWSS Eligibility Review Queries

A number of questions were raised during the course of last weeks webinar regarding the EWSS eligibility review.

In particular there were a number of questions around the issue of eligibility for a business which commenced trading some time between 1st January 2019 and 31st October 2019, and how eligibility is assessed.

Revenue have confirmed that the eligibility process on their website takes your 2019 turnover and converts it into an annualised equivalent figure for 2019, and this is then compared against the full figures for 2021 (actual and forecast).

For example, if you commenced trading on 1st August 2019 you would have 5 months of turnover data. Lets say this was €100,000. Revenue would take this figure, divide it by 5 months and then multiply by 12 months to arrive at a figure of €240,000 for a full year which is then compared against the full year figures for 2021, and eligibility is determined on that basis.

I don't agree that this is the correct way to perform this calculation as its not in line with the actual calculation as specified in the guidelines, however, that's the way that it is currently being approached by Revenue.

As a result of the way that Revenue are carrying out the calculation, there will be cases where Revenue will incorrectly deem an employer to be eligible or ineligible.

If your business is one of these borderline cases please proceed with caution and check your own eligibility using the correct calculation. If you are not eligible then please do not claim EWSS, even if the Revenue screens state that you are eligible.

On the other hand, if Revenue deemed you ineligible but you feel that you are, you will need to contact myEnqueries and ask for the stop on your EWSS payment to be removed.

The full text of the response from Revenue can be viewed here>>

EWSS Eligibility Review Webinar

EWSS Eligibility Review Webinar

A recording of the EWSS Eligibility Review Webinar is available to watch here>>

The slides are available here>>

EWSS Eligibility Review Deadline Extended to 15th August

If you are an employer who is currently availing of EWSS then there is some important action that you must take to confirm your eligibility for EWSS with Revenue online on ROS.

This includes all EWSS employers including those in the childcare sector who currently do not have to show any reduction in turnover, however they still need to confirm their eligibility.

Failure to complete this online eligibility review by Sunday 15th August (new extended deadline) could result in your EWSS payments being delayed.

Revenue have written to all relevant employers, but the deadline outlined in the letter has now been extended from 30th July to the 15th August in order to give employer some additional time to prepare their figures.

An updated press release has been published by Revenue on their website here>>

Revenue have published guidance on the process, however the documents refer to the old deadline;

https://www.revenue.ie/en/employing-people/documents/ewss/guidelines-on-eligibility-for-ewss.pdf

and

https://www.revenue.ie/en/employing-people/documents/ewss/ewss-guidelines.pdf

We will be hosting a webinar to discuss the process on Wednesday 4th August at 11AM - attendance is free but you must register here>>

Also, Revenue have acknowledged that some employers may find it difficult to gather the required monthly figures from 2019 and 2021, and so they have confirmed that they are prepared to accept average monthly figures derived from their bi-monthly (or other periodic) VAT returns. This was confirmed by Revenue in a letter sent to The Institute Of Chartered Accountants. For more details see here>>

Updated Revenue Guidance on Employers paying their Employee's TWSS Tax Liabilities

Revenue have published an e-Bief with updated guidance for employers who are looking at paying their employee's TWSS tax liabilities.

The eBrief can be downloaded at https://www.revenue.ie/en/tax-professionals/ebrief/2021/no-0972021.aspx

There are two main clarifications in this eBrief;

1) The deadline has been extended until the end of September 2021

2) The scheme is now open to proprietary Directors provided the employer is paying the TWSS tax liabilities of all other employees.

Revenue TWSS Reconciliation Guidance Documentation

The Revenue TWSS Reconciliation web page can be found at https://revenue.ie/en/employing-people/twss/reconciliation/index.aspx

General TWSS Reconciliation Guidance Document (PDF)

TWSS PRSI Corrections

TWSS FAQ Version 18 - Operational Phase 4th May - 31st August

TWSS FAQ Version 8 - Temporary Phase 26th March - 3rd May

TWSS Reconciliation Webinar 6th May 2021

The video and slides from today's webinar on the TWSS Reconciliation process are now available to watch/download

Click here to watch a recording of todays webinar on the CollSoft Vimeo page

Click here to download the slides from this webinar

Revenue Video explaining how they handle an employee's tax credits and SRCOP when an employee returns to work after being on PUP

Revenue have prepared a short 15 minute presentation explaining how they process an employee's tax credits when the employee returns to work after being on PUP.

They have some worked examples showing how this impacts on a single person as well as a jointly assessed person, and they outline the timelines involved in processing the updated RPNs.

You can watch this presentation on our Vimeo page here>>

Potential problems for employees returning to work on April 12th after being on PUP

Under current Government guidelines from 12 April, all residential construction can restart as well as early-learning and childcare projects.

Under these plans there are likely to be a large number of employees who will be returning to work next week and signing off PUP.

Payroll operators should be aware of the following;

1) While employees are on PUP Revenue will have reduced their tax credits and Standard Rate Cut Off Points (SRCOP). In most cases credits will have been reduced to zero. Revenue have explained the process in a document on their website available here>>

2) An employee's tax credits will be recalculated after Revenue have been informed by Social Welfare that the employee has stopped receiving PUP - however, this process may take a couple of weeks.

3) After an employee closes their PUP claim there may still be payments due to be paid to the employee because the Social Welfare week runs from Friday to Thursday, and if an employee is still signed on for Friday 9th April they will be entitled to a full payment for the week up to Thursday 15th April, even if they recommence work on Monday 12th April. Social Welfare will consider this claim to be open until the last payment has been made to the employee.

4) The Department of Social Welfare will only inform Revenue that the employee has closed their PUP claim after the final payment has been made, so for many employees Revenue wont have recalculated their tax credits before you process their first wages.

5) This may result in the first couple of weeks wages being calculated with very low (or zero) tax credits on a Week 1 Basis

6) Employers should pay special attention to any employees whom they are paying on a "Net To Gross" basis as the re-grossed pay is likely to be very high, and because of the nature of a Week 1 calculation this may not be recouped by the employer for a long time (if it can be recouped at all)

7) Employees who are jointly assessed and their spouse continues to receive PUP may not have their tax credits restored.

8) You are required to always use the most up to date RPN available on Revenue when running your wages.

Processing your Payroll for Good Friday or Easter Monday 2021

As you are aware Friday 2nd April is "Good Friday" and as such it is a "Bank Holiday" so you wont be able to process any payments for that date.

If you normally pay your wages on a Friday then this is what you need to do with this weeks wages;

- Continue to process your wages in CollSoft using a Payment Date of Friday 2nd April as normal.

- You will report to Revenue that the wages are being paid on Friday 2nd April, and that is the date that will appear on your payslips.

- When you create your bank disk (or write your cheques) you arrange to actually make the payment for Thursday 1st April.

Under the rules of PAYE Modernisation when your payment day falls on a bank holiday Revenue allow you to actually bring your payment forward to the previous banking day, but you still report to Revenue that the payment was made on the bank holiday.

The same rule will apply to anybody who would normally report wages on Monday 5th April - you report the payment date as 5th April to Revenue but you can actually pay your employees on Thursday 1st April as this is the previous valid banking day before the bank holiday on Monday.

Whatever you do, do not under any circumstances change the payment date in CollSoft from Friday 2nd April to Thursday 1st April because the Thursday belongs to Week 13 and Friday belongs to Week 14 which would result in completely calculations for PAYE and USC.

If you have any doubts please contact our helpdesk.

TWSS Reconciliation Guidance Documents and Webinar Slides

Slides from TWSS Reconciliation Webinars available to download here>>

Revenue Guidance Document for TWSS Reconciliation can be downloaded here>>

PRSI Corrections Guidance Document for employees or payslips which were ineligible for TWSS available here>>

TWSS Reconciliation CSV Files to be made available to employers on 22nd March 2021

Almost one year after the introduction of the Temporary Wage Subsidy Scheme (TWSS) Revenue are now ready to commence the final part of the TWSS reconciliation process.

All employers who participated in TWSS will be able to download their reconciliation CSV file from ROS on Monday 22nd March 2021.

This CSV file will list all J9 payslips submitted to Revenue by the employer along with details of the amounts paid to the employee (as reported by the employer), the amount of TWSS to which the employee was entitled, and the amount of TWSS paid to the employer by Revenue at the time. Based on those figures Revenue will determine the reconciled amount for each payslip and calculate if an under or overpayment has been made.

Employers will then have until the end of June 2021 to review their reconciliation and make any adjustments that are required. Once the employer is satisfied with the final balance they will be able to accept the reconciliation calculation and Revenue will either collect any amount owed or pay any amounts due to the employer.

We would like to draw attention to the fact that employer have until the 30th June to finally accept their reconciliation, so there is no need to immediately finalise your reconciliation – it is better to take the time available and check the figures thoroughly.

CollSoft will be releasing some updates to our 2020 software to help employers with any issues that arise from the process and while we do expect support to be busy in the initial days as employers study their files, please bear with us and rest assured that as always our support desk will be happy to assist you in any way that we can.

We will also be hosting webinars to discuss the TWSS reconciliation process on the following dates;

- Tuesday 23rd March @ 2:30 PM

- Thursday 25th March @ 11:00 AM

- Wednesday 31st March @11:00 AM

- Wednesday 7th April @ 11:00 AM

As always these webinars are free to attend but you are required to book your place on our website at https://www.collsoft.ie/events

Issues with RPN's that have zero or very low tax credits

Revenue have provided some clarification on this matter and we have posted a more detailed explanation of the issue here>>

In short this is an issue around the timing of the closing of a PUP claim.

Most employees who have returned to work this week with reduced tax credits should also still be receiving a PUP payment from Social Welfare which will more than offset the reduced tax credits.

Employers should be aware that there are currently around 479,000 employees on PUP, and most of these will have had their tax credits reduced.

As these employees return to work you should expect the credits to remain very low (or zero) for the first couple of weeks until the last PUP payment has been paid and the benefit is closed. Again, most of these employees will still be receiving a PUP payment in the interim even though they have recommenced employment.

Webinar on the topic of Employers Paying an Employees 2020 Tax Liabilities

We have uploaded a recording of this webinar to our Vimeo page at

The slides from the webinar can be downloaded here>>

Employers paying employees' 2020 tax liability

As we had previously advised Revenue will facilitate employers who wish to pay employees' 2020 tax liabilities. This applies to Income Tax (IT) and Universal Social Charge (USC) liabilities which arise due to the TWSS (and possibly PUP).

This is completely discretionary - employers are not obliged to make any such payments as the liability rests with the employee. However there are many employers who may want to make some contribution (either in part or in full) towards their employees liabilities arising from TWSS.

Revenue have published a brief guide to the process at https://www.revenue.ie/en/employing-people/twss/employers/index.aspx

CollSoft will be releasing an update to Payroll 2020 to facilitate such payments to be recorded and reported in the Payroll Software. We expect to have this update ready to release around 8th February.

This update will include a new Year End Adjustments Payroll Period where the user will be able to record such payments and report them to Revenue as an adjustment to their December Monthly Statement. Revenue will collect any payments through the December monthly statement and your employees final liabilities will be updated to reflect any payments made by the employer.

Over the last week we have been asked by many employers if there is a report in the Payroll software that can help them calculate the employee's liability. We are working on an update to add a report to Payroll 2020 that will help employers to estimate the tax liabilities that an employee has as a result of TWSS.

However, please be aware that such a report is only an estimate. It is impossible for CollSoft to perform the same calculations as Revenue because of the following reasons;

1) Employees may have been on both TWSS and PUP. Payroll will not know what PUP was paid and what PAYE is due from the PUP.

2) Many employees are jointly assessed with their spouses by Revenue. Therefore an employee's overall liability will depend on their partners own tax situation. Again Payroll cannot account for this.

3) The employee may have had multiple part time employments in which they were on TWSS and their final tax liability is a result of all the TWSS paid in these employments. Your CollSoft software will not have the details from those other employments.

If employers are going to be making payments towards their employees tax liabilities then they will have to engage directly with the employee to asses the actual liability.

Updated Guidance for the operation of BIK on Vehicles during the current Level 5 lockdown (Jan 2021)

Revenue are extending the short term concession whereby BIK on a company vehicle will not be applied in certain circumstances.

For more information please refer to the following information here>>

There are other concession that ended on 31st December just prior to the current Level 5 lockdown and these are also under review.

Getting started with Employment Wage Subsidy Scheme (EWSS) - Webinars

With the new lockdown there are many of our customers who are now looking to avail of the EWSS for the first time.

Some of you will have used the old Temporary Wage Subsidy Scheme (TWSS) between March and August of 2020 but never actually joined the new EWSS in September.

To help such employers we are hosting some webinars to discuss getting started with EWSS specifically. These will be geared towards explaining how EWSS works for those trying to use it for the first time. These webinars will include a presentation going over the basics of the scheme, followed by a demonstration of how to use EWSS in the Payroll software and finishing with an open Questions and Answers session at the end.

The first webinar will be tomorrow Friday 8th January at 3PM followed by another on Monday 11th at 11AM

You can register for the webinar at www.collsoft.ie/events

The slides for the EWSS Webinar can be downloaded here>>

We are currently preparing an FAQ document based on the questions that we are seeing on our helpline which will be published tomorrow.

Payroll 2021 in now available to download.

Payroll 2021 is now available to download from our website at www.collsoft.ie

We have published a video that shows you how to install the 2021 software onto your PC, and how to carry forward your companies and employees from Payroll 2020.

You can watch this video here>>

Important changes to the EWSS eligibility criteria for employers from 1st January 2021

The Finance Bill 2020 which is currently making its way through the Dáil at the moment contains a change to the eligibility criteria for all employers availing of EWSS after 31st December.

The eligibility will be based on the employers turnover/orders from 1st January to 30th June 2021 compared to the same period in 2019 (i.e. 1st Jan - 30 June 2019).

This is different from the eligibility periods currently used in EWSS.

Employers will need to check that they continue to be eligible under the new rules if they plan to use EWSS from 1st January.

Note: The legislation is still at committee stage in the Dáil so it has not actually been passed yet, and there is always the possibility that it will change between now and then.

Revenue announced that Employers will be allowed to make payments towards an Employee's 2020 Tax Liability

Revenue will facilitate employers who wish to make a contribution towards an employees' 2020 tax liabilities that have arisen due to the payment of TWSS in 2020.

Revenue will not apply the usual BIK rules to these payments but employers should be aware that these payments would not be regarded as wholly and exclusively incurred for the purposes of the employer’s trade or profession, and therefore they will not receive a deduction for corporation tax purposes.

If employers wish to make a payment towards their employee's 2020 tax liability then they will need to engage directly with the employee in order to determine the amount of PAYE and USC that is being paid. Revenue will issue employees with a Preliminary End of Year Statement in the middle of January 2021 which will help in this regard.

There are two methods by which the employer can make a payment towards the employee's tax liability;

- Make a payment directly to the employee - the employee must then pay their tax liability using RevPay in myAccount

- The employer can amend their last 2020 Payroll Submission to report the amount of PAYE and USC being paid. This will trigger a revised Monthly Statement for December and the money will be collected by Revenue in the normal manner.

We think that the second option is the best method to use as the employer can guarantee that the money is actually paid to Revenue. As such we will be releasing an update to the 2020 software which will enable employers to report these payments in a special Payroll Run. This update will be made available in January 2020.

Employers will have until the end of June 2021 to avail of this facility and they will be required to keep some documentary proof showing the engagement with the employee and the arrangements agreed in order to undertake these payments.

More information is available on the Revenue website at

https://www.revenue.ie/en/employing-people/twss/employers-paying-employees-tax-liability.aspx

TWSS Reversal Tools added to Payroll

Some employers are now in the process of repaying TWSS back to Revenue along with any PRSI that would have been paid if TWSS was not used. For some this is a voluntary process, for others they have been advised that they were not eligible for all or part of the time that they were using TWSS.

We have added a wizard which recalculates the amount of PRSI that would have been paid and prepares some reports that can be sent to Revenue for approval.

We are still working on a tool that will also allow you to adjust the insurable weeks to take the J9's off the employees record - this will be available as part of our Year End update.

We have more information available here>>

Revenue Employer Notice regarding TWSS Reconciliation Process

Employers who were operating TWSS will have received an Employer Notice via their ROS Inbox this morning discussing various aspects of the TWSS reconciliation process.

This is a generic notice and is being sent to all TWSS employers to remind them that the deadline for reporting all TWSS payments made to employees is the 31st October. They have however recognised that due to the current Level 5 shutdown some employers may not be able to meet that deadline, but they are requesting that everybody makes their best effort to do so.

We would just like to remind our customers that as long as you have installed one of the latest versions of our software (Build 145 or higher) then the software will warn you if you have any outstanding payments to be reported.

At this stage it looks like well over 95% of TWSS payments made through CollSoft Payroll have already been reported to Revenue, so as long as you have updated your software there is nothing for you to worry about.

Revenue have announced changes to the way EWSS will be paid to employers

Revenue will be changing the way that EWSS is paid to employers early in November so that EWSS payments will be paid on a daily basis. This will be similar to how TWSS was paid where an employer usually received payment within 48Hours after making a Payroll Submission to Revenue.

Revenue have indicated that they expect these new daily EWSS payments to start around the 9th November.

The official press release reads as follows;

"Frequency of EWSS payments

The EWSS was originally designed to pay the subsidy due once a month in arrears as soon as possible after the due date of the relevant monthly Employer PAYE return (the 14th of the following month).

On 6 October 2020, Revenue announced that it had brought forward the date for EWSS payments to the fifth day of the following month. October EWSS payments, including the increased rates announced by the Minister for Finance in respect of payroll submissions with pay dates on or after 20 October 2020, will be paid by 5 November 2020.

Revenue is currently working to further significantly shorten the EWSS payment timeframe. In this regard, the first EWSS payments in respect of November payrolls will be made in early November, rather than by 5 December. Thereafter, subsequent payments for November will be paid following the receipt of a payroll submission containing an EWSS claim. This means EWSS will be paid on a similar basis to the Temporary Wage Subsidy Scheme (TWSS), providing a significant positive cashflow boost for businesses.

Finally, due to the current Level 5 public health restrictions, employers who previously did not qualify for EWSS may now be able to show the necessary 30% reduction in turnover or customer orders between 1 July and 31 December 2020. Revenue is reminding employers that it is still possible to register for EWSS once all qualifying criteria are met. Once registered, employers can then claim subsidy payments in respect of payroll submissions with a pay date on or after their registration date."

Note: We appreciate that over the last number of days many customers have asked us if Revenue were going to make any changes in this area, and we advised them that Revenue were still going to pay a month in arrears. We had asked Revenue for clarity on this matter (as well as others) on Monday night and we were told on Tuesday morning that it was definitely not going to change - but now they have. I know many employers are trying to decide if they should use EWSS or lay staff off for PUP, and this particular issue of cash flow is a large factor in making that decision.

We are trying to ensure that we always give you the most accurate answer, but sometimes the official position of government will change without much notice.

New EWSS rates effective from 20th October

The Government have confirmed that the new increased rates of EWSS will apply to all wages submitted with a Payment Date on or after 20th October, including any such wages that were submitted to Revenue before the announcement last night. (New rates listed below)

So any wages submitted to Revenue with a payment date of the 20th October or later will have the subsidy paid at the new rates.

As far as we can tell, if you are running a monthly payroll dated after the 20th October, you will receive a full month at the higher rates.

CollSoft Webinars

We have scheduled a webinar to discuss the changes to EWSS for Wednesday afternoon, and there is another webinar to discuss the TWSS reconciliation process on Thursday morning.

You can register for the webinars on our website at https://www.collsoft.ie/events

Do I need to update my Payroll?

Yes and No!!!

EWSS continues to apply where Gross Pay is between €151.50 and €1462 per week. This has always been the case since EWSS was introduced on 1st September 2020, and CollSoft uses these values to apply for the subsidy.

The way the system works is that when the Gross Pay is within the range valid for EWSS the software sets an "EWSS Flag" that indicates to Revenue that the employee is eligible for EWSS. The payroll software does not tell Revenue what that amount of subsidy is, Revenue actually calculate it themselves on ROS - we just set the "EWSS Flag" for Revenue.

Revenue will calculate your subsidy based on the payment date of your payslips, and will apply the new rates automatically to any payslip with a payment date on or after the 20th October.

So, anybody who was submitting payslips today will have their subsidy calculated at the new rates, and even if you submitted your wages earlier in the week for any payment date from 20th, you will also get the new rates.

But there is one problem:

The subsidies reported in CollSoft Payroll will be showing the old rates, and indeed the current reports on Revenue will also be showing the old rates.

CollSoft will issue an update by next Monday to update the reports to the new rates, and this will fix any amounts that have been reported incorrectly in the software.

The main thing to remember is that even if you are using the old software, you will still get the updated rates from Revenue when they pay your subsidy.

The new rates for EWSS from 20th October are as follows;

Get help for this page

Get help for this page