File your Payroll Submission (PSR) with Revenue

A PSR contains detailed information for the payments that you have made to each employee including items like payment date, pay before allowable deductions, pay after allowable deductions, PAYE, PRSI, USC, and LPT. It also contains information about the RPN or tax credits and cut-off points, used in the various tax calculations as well as information on benefits in kind and pension deductions.

Your PSR must be reported by you to Revenue on or before the date the employees are paid.

‘Date paid’ in the context of PAYE modernisation is defined as the date on which the funds are made available. These dates can be different depending on how you pay the employee. If you pay the employee by:

· Cash - it is the date the cash is given to the employee

· Cheque - it will be the date on the cheque

· Bank Transfer - it is the date which the funds are scheduled to be made available in the individual’s bank account.

How Can i File my PSR?

There are three methods by which you can file your PSR with Revenue;

1. Direct Payroll Reporting – allows payroll software to communicate seamlessly with Revenue Online System (ROS) and exchange the required information.

2. ROS Payroll Reporting - allows you to use files created by payroll software and upload these through ROS.

3. Manual ROS Entry – allows you to enter your PSR manually via a form on ROS.

CollSoft Payroll supports both Direct Payroll Reporting and ROS Payroll Reporting. We would recommend that customers use the Direct Payroll Reporting option where at all possible as it enables the Payroll Software to easily reconcile your payroll submissions with the data held in the Payroll Software.

Important Note: Users should decide which method of reporting that they are going to use and stick to that method for the whole tax year. Making submissions using a variety of methods may lead to a situation where the Payroll Software will not be able to reconcile any submissions that were made outside of the Payroll Software. CollSoft recommend that users file their submissions using the Direct Payroll Reporting option.

Depending on how you administer process your payroll you may only need to make a single Payroll Submission for each payroll period, or you may need to make more than one submission for a pay period.

CollSoft Payroll allows you to file multiple Payroll Submissions for any particular payroll period, so if you process your payroll in batches, you will be able to file your submissions accordingly.

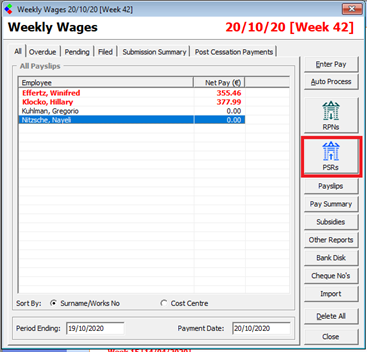

In this example we are going to be processing two wages initially and then filing a PSR. Then we will process the remaining wages and then file a second PSR for the payroll period

So the first two wages have been processed as normal and are ready to be filed. You will notice, that the employees are highlighted in red. To begin filing press the “PSRs” button on the wages listing screen:

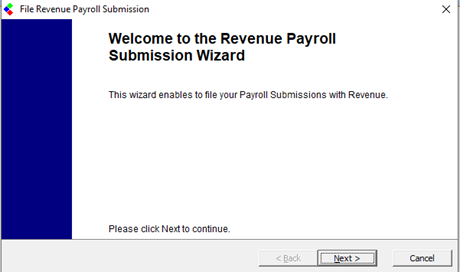

This will start the “Revenue Payroll Submission Wizard” – press “Next” to continue.

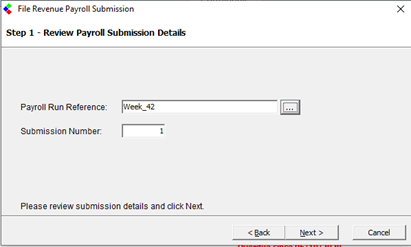

The first step of the wizard confirms the Payroll Period and the Submission Number that you are going to file.

Each Payroll Period can have multiple submissions, and Payroll will automatically increment the submission number as you make more submissions for that payroll period.

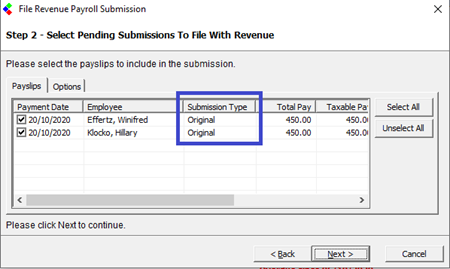

Press Next to continue to select the payroll that are to be included in the submission. You can opt to exclude an employee from a submission, in which case they will be picked up on the next submission that you make.

This screen will also identify if the submission line items are “Original” or “Amended” submissions. Original submissions are the first submissions that you make for an employee in that pay period. Any modifications that you make after you have submitted an original submission are classified as amendments.

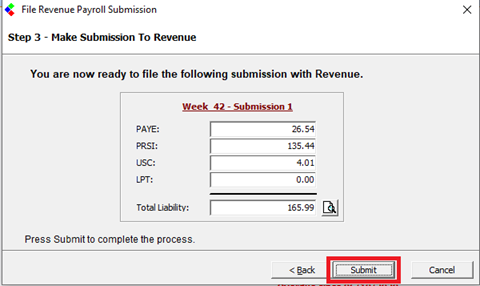

Press Next to continue to the submission screen where you can view the totals of PAYE, PRSI, USC and LPT that are about to be submitted.

You should verify that these totals are correct and if so press the Submit button to begin filing the submission with Revenue.

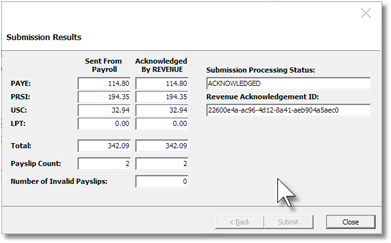

Payroll will then transmit your Payroll Submission to Revenue and wait for revenue to process your submission.

Once Revenue has processed your submission Payroll will receive an acknowledgement message with a unique “Acknowledgement ID” and confirmation of the count of payslips received along with the totals of PAYE, PRSI, USC and LPT.

The relevant employee payslips are then updated and marked as filed and the Payroll Submission process is complete.

Your PSR must be reported by you to Revenue on or before the date the employees are paid.

‘Date paid’ in the context of PAYE modernisation is defined as the date on which the funds are made available. These dates can be different depending on how you pay the employee. If you pay the employee by:

· Cash - it is the date the cash is given to the employee

· Cheque - it will be the date on the cheque

· Bank Transfer - it is the date which the funds are scheduled to be made available in the individual’s bank account.

How Can i File my PSR?

There are three methods by which you can file your PSR with Revenue;

1. Direct Payroll Reporting – allows payroll software to communicate seamlessly with Revenue Online System (ROS) and exchange the required information.

2. ROS Payroll Reporting - allows you to use files created by payroll software and upload these through ROS.

3. Manual ROS Entry – allows you to enter your PSR manually via a form on ROS.

CollSoft Payroll supports both Direct Payroll Reporting and ROS Payroll Reporting. We would recommend that customers use the Direct Payroll Reporting option where at all possible as it enables the Payroll Software to easily reconcile your payroll submissions with the data held in the Payroll Software.

Important Note: Users should decide which method of reporting that they are going to use and stick to that method for the whole tax year. Making submissions using a variety of methods may lead to a situation where the Payroll Software will not be able to reconcile any submissions that were made outside of the Payroll Software. CollSoft recommend that users file their submissions using the Direct Payroll Reporting option.

Depending on how you administer process your payroll you may only need to make a single Payroll Submission for each payroll period, or you may need to make more than one submission for a pay period.

CollSoft Payroll allows you to file multiple Payroll Submissions for any particular payroll period, so if you process your payroll in batches, you will be able to file your submissions accordingly.

In this example we are going to be processing two wages initially and then filing a PSR. Then we will process the remaining wages and then file a second PSR for the payroll period

So the first two wages have been processed as normal and are ready to be filed. You will notice, that the employees are highlighted in red. To begin filing press the “PSRs” button on the wages listing screen:

This will start the “Revenue Payroll Submission Wizard” – press “Next” to continue.

The first step of the wizard confirms the Payroll Period and the Submission Number that you are going to file.

Each Payroll Period can have multiple submissions, and Payroll will automatically increment the submission number as you make more submissions for that payroll period.

Press Next to continue to select the payroll that are to be included in the submission. You can opt to exclude an employee from a submission, in which case they will be picked up on the next submission that you make.

This screen will also identify if the submission line items are “Original” or “Amended” submissions. Original submissions are the first submissions that you make for an employee in that pay period. Any modifications that you make after you have submitted an original submission are classified as amendments.

Press Next to continue to the submission screen where you can view the totals of PAYE, PRSI, USC and LPT that are about to be submitted.

You should verify that these totals are correct and if so press the Submit button to begin filing the submission with Revenue.

Payroll will then transmit your Payroll Submission to Revenue and wait for revenue to process your submission.

Once Revenue has processed your submission Payroll will receive an acknowledgement message with a unique “Acknowledgement ID” and confirmation of the count of payslips received along with the totals of PAYE, PRSI, USC and LPT.

The relevant employee payslips are then updated and marked as filed and the Payroll Submission process is complete.

| Files | ||

|---|---|---|

| Acknow.png | ||

| Sub.png | ||

| Subnames.png | ||

| SubNum.png | ||

| Subsum.png | ||

| Week42.png | ||

Get help for this page

Get help for this page