Wages - Illness Benefit (Disability Benefit)

What is Illness Benefit?

Illness Benefit is a payment made to a person who cannot work due to Illness. To qualify for Illness Benefit the individual must meet the necessary Pay Related Social Insurance contribution conditions. The benefit is paid by the Department of Employment Affairs and Social Protection or DEASP for short.

Illness Benefit is made up of a personal rate for the employee and can also include extra amounts for any dependents. An employee is entitled to claim Illness Benefit from the DEASP even if the company/employer operates a company paid illness benefit scheme for employees.

What about Illness Benefit and Tax?

Illness Benefit (excluding any increases for dependents) is considered as income for tax purposes and it is taxed from the first day of payment. The Illness benefit payment is subject to PAYE tax but not subject to PRSI or USC tax.

Effective from 1 January 2018 Revenue tax the Illness Benefit by reducing the employee's annual tax credit and cut off rates. (It is taxed at source).

From 1 January 2019 DEASP notify Revenue of the amount of Illness benefit received. Tax credits and cut off rates are adjusted and a new employee Revenue Payroll Notification (RPN) is issued to the employer.

How Should the Employer process Illness Benefit?

From the point of view of an employer there are a number of ways in which Illness Benefit can be treated:

1. Employer does not pay any wages to the employee during the period of illness.

2. Employer pays the employee a payment (a top-up), and the employee retains the Illness Benefit payment.

3. Employer pays the employee their full wages as normal and recovers the Illness Benefit cheque from the employee.

The following sections explain how to use CollSoft Payroll in each of these scenarios.

1. Employer does not pay any wages to the employee during the period of illness.

In this case the employer does not process or save any wages for this employee until they return to work.

2. Employer pays the employee a payment (a top-up) and the employee retains the Illness Benefit payment.

In this case, the employer is paying the employee a portion of their normal wage while the employee receives their illness benefit. This top-up is treated as a normal wage payment and is entered in Payroll as the new wage.

3. Employer pays the employee their full wages as normal and recovers the Illness Benefit cheque from the employee.

In this scenario, the employer is paying the employee their full wage and the employee is handing over the benefit payment directly to the employer.

To process this in CollSoft Payroll the user needs to reduce the employee’s salary by the amount of the illness Benefit and enter the Illness Benefit as a new addition in payroll.

Example

Patrick usually earns a Gross salary of €500 each week. He then becomes ill and now receives an Illness Benefit of €188.00 per week. His employer agrees to pay him his full wages, but Patrick must surrender his illness benefit payments to his employer.

The employer would records the wage as follows:

Firstly, you should enter a salary of €312 (€500 - €188) on the wage entry screen

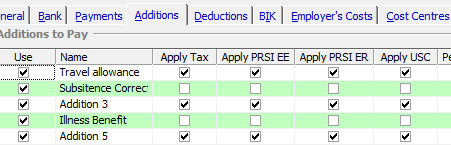

Secondly, you enter the €188 under additions tab, by creating a line item entitled "Illness Benefit". Remember to untick all applicable Tax for this particular line item.

Payroll will now factor the benefit into its tax calculation.

Illness Benefit is a payment made to a person who cannot work due to Illness. To qualify for Illness Benefit the individual must meet the necessary Pay Related Social Insurance contribution conditions. The benefit is paid by the Department of Employment Affairs and Social Protection or DEASP for short.

Illness Benefit is made up of a personal rate for the employee and can also include extra amounts for any dependents. An employee is entitled to claim Illness Benefit from the DEASP even if the company/employer operates a company paid illness benefit scheme for employees.

What about Illness Benefit and Tax?

Illness Benefit (excluding any increases for dependents) is considered as income for tax purposes and it is taxed from the first day of payment. The Illness benefit payment is subject to PAYE tax but not subject to PRSI or USC tax.

Effective from 1 January 2018 Revenue tax the Illness Benefit by reducing the employee's annual tax credit and cut off rates. (It is taxed at source).

From 1 January 2019 DEASP notify Revenue of the amount of Illness benefit received. Tax credits and cut off rates are adjusted and a new employee Revenue Payroll Notification (RPN) is issued to the employer.

How Should the Employer process Illness Benefit?

From the point of view of an employer there are a number of ways in which Illness Benefit can be treated:

1. Employer does not pay any wages to the employee during the period of illness.

2. Employer pays the employee a payment (a top-up), and the employee retains the Illness Benefit payment.

3. Employer pays the employee their full wages as normal and recovers the Illness Benefit cheque from the employee.

The following sections explain how to use CollSoft Payroll in each of these scenarios.

1. Employer does not pay any wages to the employee during the period of illness.

In this case the employer does not process or save any wages for this employee until they return to work.

2. Employer pays the employee a payment (a top-up) and the employee retains the Illness Benefit payment.

In this case, the employer is paying the employee a portion of their normal wage while the employee receives their illness benefit. This top-up is treated as a normal wage payment and is entered in Payroll as the new wage.

3. Employer pays the employee their full wages as normal and recovers the Illness Benefit cheque from the employee.

In this scenario, the employer is paying the employee their full wage and the employee is handing over the benefit payment directly to the employer.

To process this in CollSoft Payroll the user needs to reduce the employee’s salary by the amount of the illness Benefit and enter the Illness Benefit as a new addition in payroll.

Example

Patrick usually earns a Gross salary of €500 each week. He then becomes ill and now receives an Illness Benefit of €188.00 per week. His employer agrees to pay him his full wages, but Patrick must surrender his illness benefit payments to his employer.

The employer would records the wage as follows:

Firstly, you should enter a salary of €312 (€500 - €188) on the wage entry screen

Secondly, you enter the €188 under additions tab, by creating a line item entitled "Illness Benefit". Remember to untick all applicable Tax for this particular line item.

Payroll will now factor the benefit into its tax calculation.

| Files | ||

|---|---|---|

| Illness Benefit- Line Item set up.png | ||

Get help for this page

Get help for this page