P30 - Submit final periodical return

Some employers neglect to submit the final P30 as they will be filing their P35 prior to the P30 submission date. It is important to note that an employer is obliged to complete and submit all payroll returns, this includes all P30s, to cover the entire tax year, regardless of the timing of the P35 submission.

On completion of the final payroll and reconciliation of all processed payroll, prepare and submit the final P30 for the tax year.

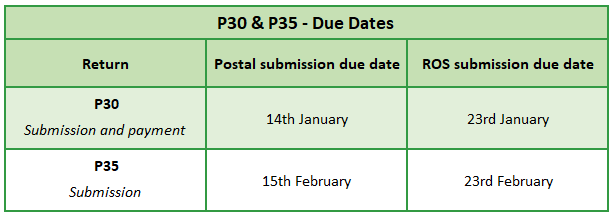

SUBMISSION DATE VARIANCES

The date that Revenue debit the final P30 payment from your bank account may be after the P35 submission date, therefore this amount may show as outstanding when submitting your P35.

It is important to be aware of the date variance between P35 submission and final P30 debit date so that it is not paid again at the time of submitting the P35.

Please NOTE: From 1 January 2019, the P35 and P30 is abolished in line with PAYE Modernisation.

On completion of the final payroll and reconciliation of all processed payroll, prepare and submit the final P30 for the tax year.

SUBMISSION DATE VARIANCES

The date that Revenue debit the final P30 payment from your bank account may be after the P35 submission date, therefore this amount may show as outstanding when submitting your P35.

It is important to be aware of the date variance between P35 submission and final P30 debit date so that it is not paid again at the time of submitting the P35.

Please NOTE: From 1 January 2019, the P35 and P30 is abolished in line with PAYE Modernisation.

| Files | ||

|---|---|---|

| Due Dates.png | ||

| P30_P35 Filing Due Dates.png | ||

Get help for this page

Get help for this page