Preferential Loans

Information relating to the principles of Benefit in Kind can be found in the Introduction to Benefit in Kind article.

PREFERENTIAL LOANS

A Benefit In Kind arises where an employer extends certain types of loans to an employee at preferential rates of interest.

WHAT IS A PREFERENTIAL LOAN

A "preferential loan" means a loan, made by an employer to an employee or former employee, the spouse of an employee or former employee in respect of which no interest is payable, or interest is payable at a rate lower than the normal commercial rate of loan interest. In order to benchmark what the commercial rate of interest is, it is specified annually by the Department of Finance as a "specified rate".

WHEN IS A LOAN NOT A PREFERENTIAL LOAN (NON-TAXABLE)

Where an employer extends a loan to an employee where the rate of interest is NOT less than the rate of interest at which the employer, in the course of the employer's trade, makes equivalent loans for similar purposes at arm's length to persons other than employees or their spouses or civil partners, then these loans are not preferential loans and so are non-taxable.

TWO TYPES OF LOANS

The specified rate is dependent on the category (purpose) of the loan:

The specified rate is set by the Department of Finance in the annual budget and changes in line with commercial rates. Click here for the latest rates as per Revenue.

The benefit arises from the employee receiving a loan from the employer at a rate lower than would be payable commercially (i.e. at the specified rate). It is the difference in these rates which is the actual benefit.

CALCULATING THE NOTIONAL PAY

The interest that would have been payable at the specified rate less the actual interest paid is the monetary value of the benefit. This monetary difference, i.e. the notional pay, is taxable.

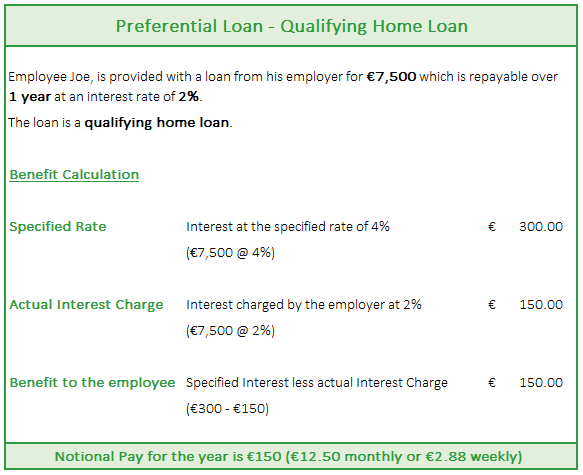

QUALIFYING LOANS - NOTIONAL PAY

A qualifying home loan is a loan which qualifies for mortgage interest relief.

Preferential Loan: Notional Pay calculation on a qualifying home loan

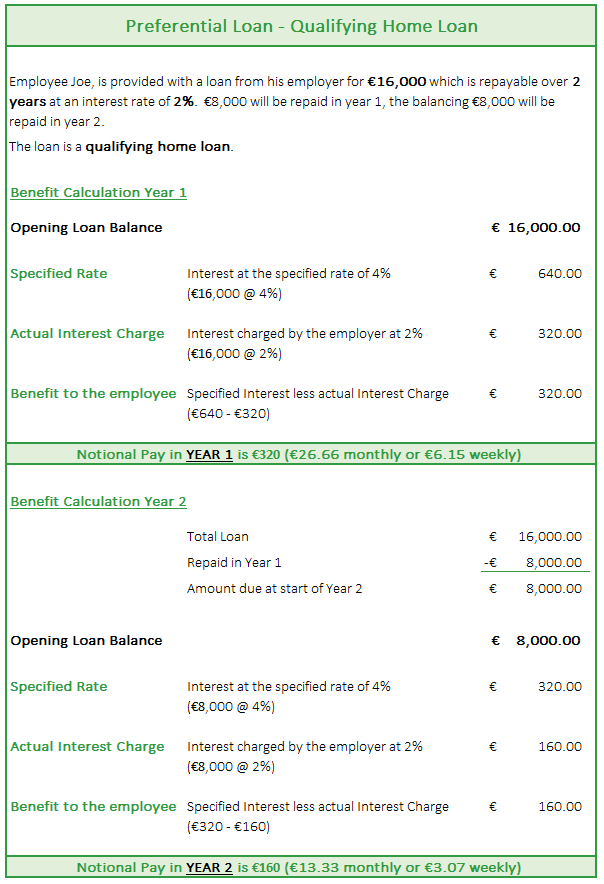

Reset the Loan at the start of each tax year

Where a loan is repayable over a number of tax years, the opening balance should be reduced at the start of each new tax year.

Preferential Loan: Notional Pay calculation on a qualifying loan repayable over 2 years

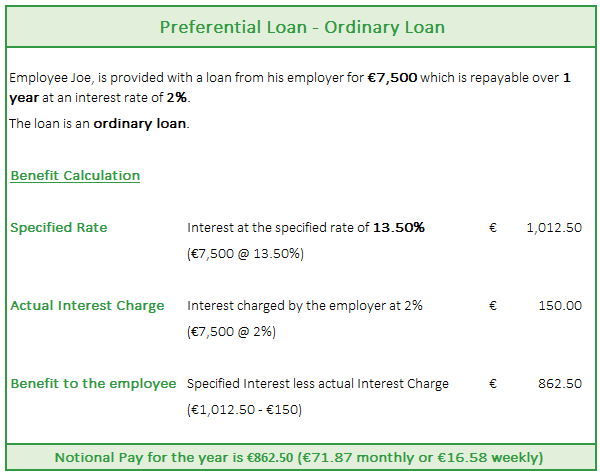

ORDINARY LOANS

Ordinary loans are all loans that do not qualify for mortgage interest relief.

Preferential Loan: Notional Pay calculation on an ordinary loan

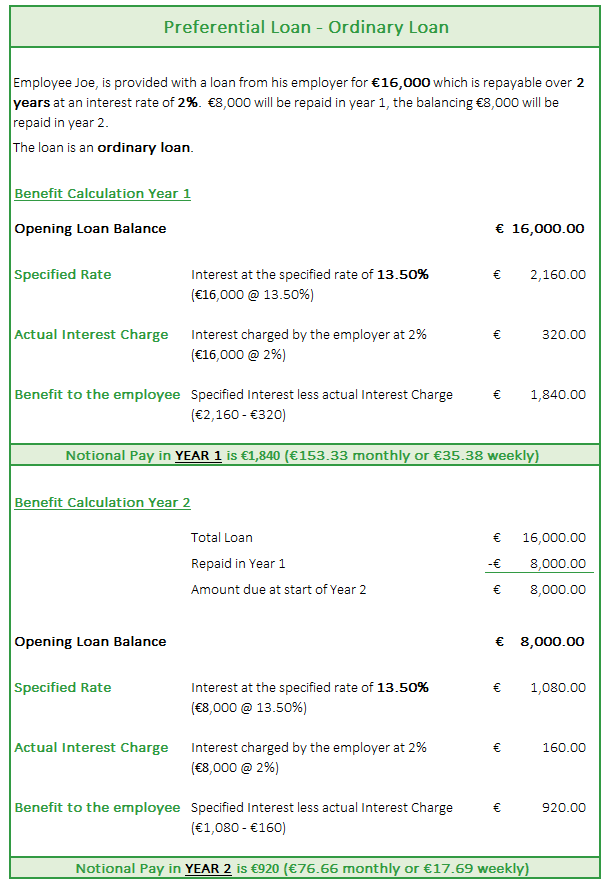

Reset the Loan at the start of each tax year

Where a loan is repayable over a number of tax years, the opening balance should be reduced at the start of each new tax year.

Preferential Loan: Notional Pay calculation on a qualifying loan repayable over 2 years

SETTING UP PREFERENTIAL LOANS IN COLLSOFT PAYROLL

BIK must be set up at company level prior to entering specific benefits at employee level. See Benefit in Kind Settings at Company Level.

The specific detail relevant to each employees individual employment are then entered against the employee record so that the notional pay will flow through to the payroll for tax purposes. This will be itemised on the employee payslip as well.

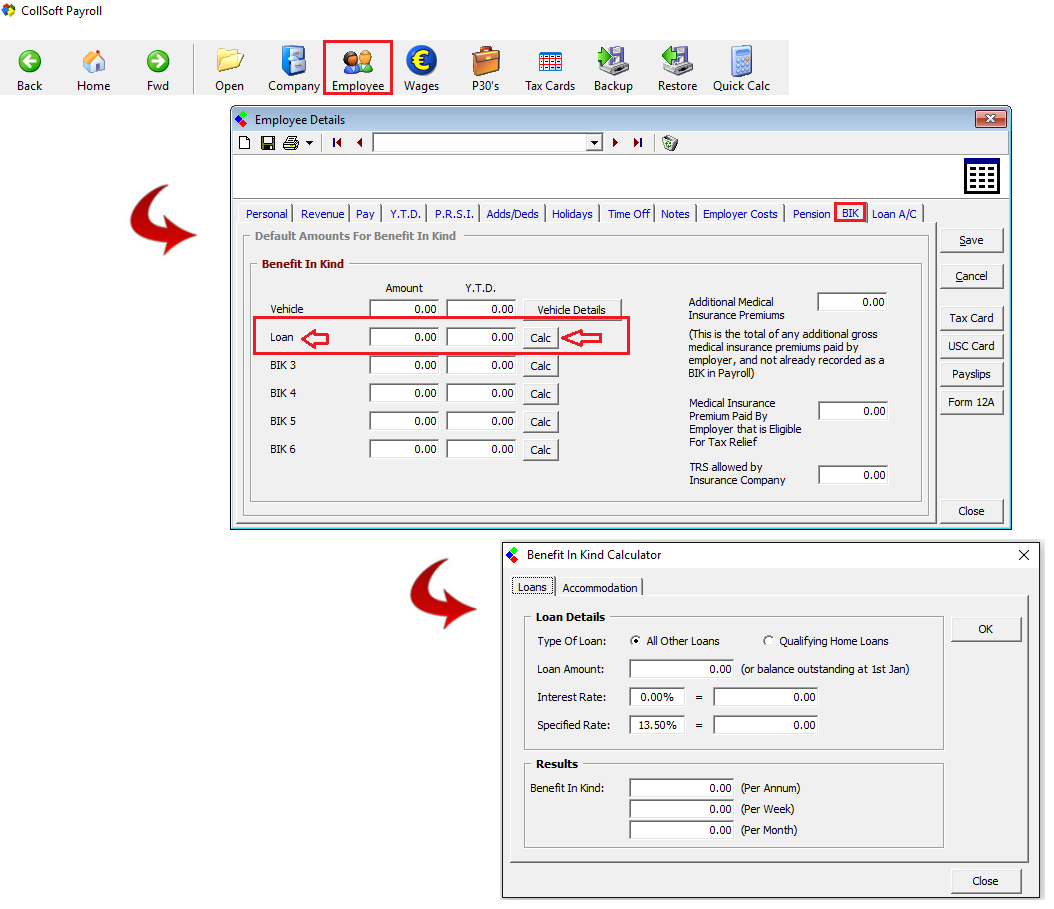

Accessing the BIK function at employee level

Preferential Loans: Accessing the BIK loan at employee level

It is important the Loan details entered are correct. BIK operates on a cumulative basis, therefore, errors can be corrected in a subsequent payroll period within the tax year, however, this may result in excessive tax deductions for an employee in one particular payroll period.

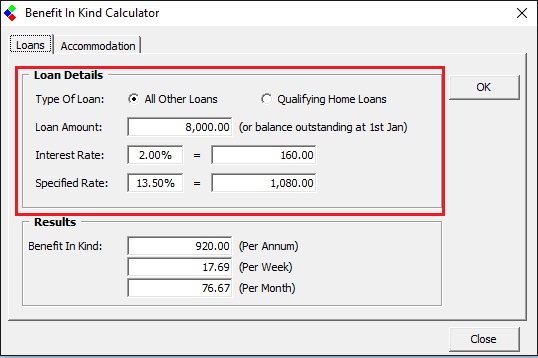

Set up the loan details

Preferential Loans: set up loan detail

Select OK to save the loan detail and to attach the loan to the employees payroll.

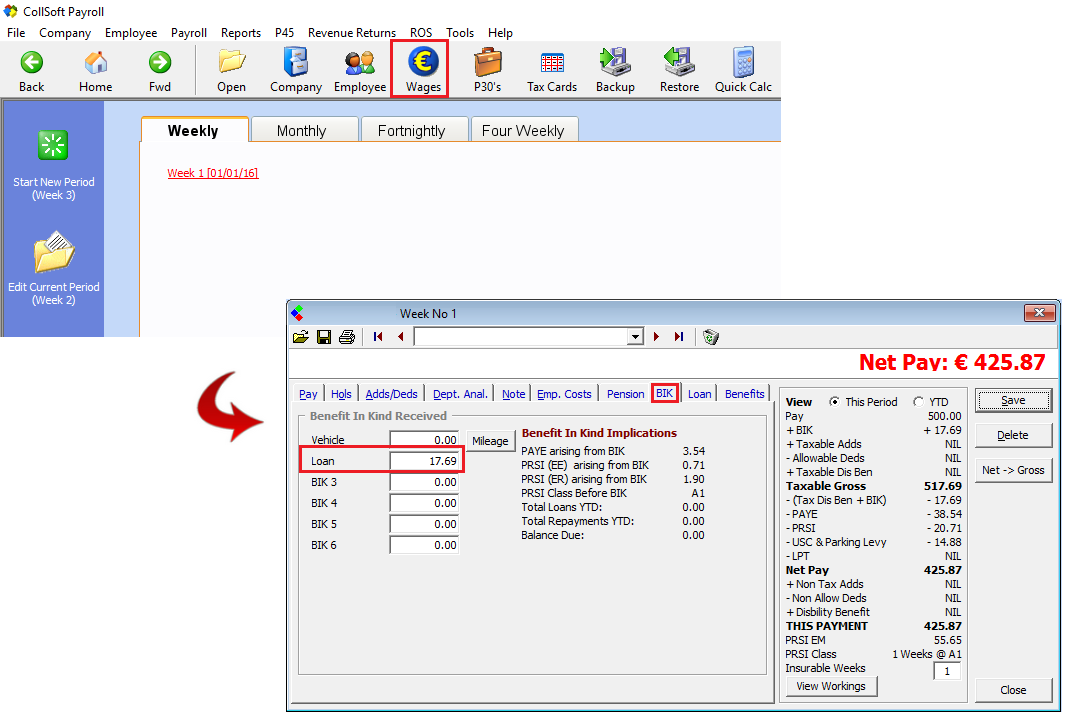

NOTIONAL PAY ON LOANS IN THE WAGES

Now that the loan detail has been set up against the employee record the notional pay (i.e. cash equivalent) will flow through to the employee's payroll.

The loan will display the current period notional pay as calculated by CollSoft Payroll based on the loan details entered on the employee record (as explained above).

Preferential Loans: Notional Pay of the loan in the wages

As explained earlier the notional pay is the cash equivalent benefit of the reduced interest rate extended to the employee by the employer on providing the loan. Based on the loan detail entered, each pay period will reflect a pro-rata element of the notional pay appropriate to the length of the pay period.

The notional pay will be added to the payroll for the period in order to calculate the PAYE, USC and PRSI attributable to this payment in kind, in addition to the wages/salary. The notional pay is merely added to the payroll in order to make the correct deductions based on total pay, it is then deducted so that the net effect does not have a payment element within the net pay figure as the employee has already received it in the form of the reduced interest rate.

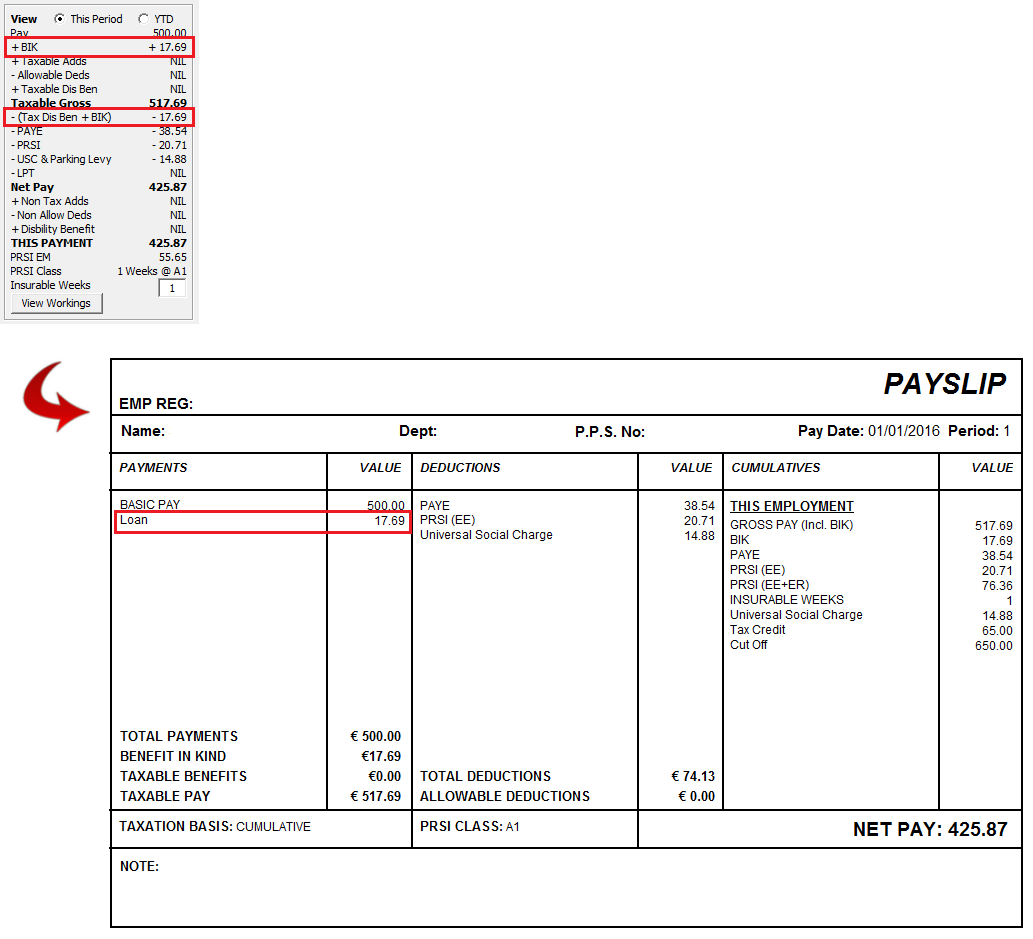

Preferential Loan: Notional Pay in the payroll and on the payslip

PREFERENTIAL LOANS

A Benefit In Kind arises where an employer extends certain types of loans to an employee at preferential rates of interest.

WHAT IS A PREFERENTIAL LOAN

A "preferential loan" means a loan, made by an employer to an employee or former employee, the spouse of an employee or former employee in respect of which no interest is payable, or interest is payable at a rate lower than the normal commercial rate of loan interest. In order to benchmark what the commercial rate of interest is, it is specified annually by the Department of Finance as a "specified rate".

WHEN IS A LOAN NOT A PREFERENTIAL LOAN (NON-TAXABLE)

Where an employer extends a loan to an employee where the rate of interest is NOT less than the rate of interest at which the employer, in the course of the employer's trade, makes equivalent loans for similar purposes at arm's length to persons other than employees or their spouses or civil partners, then these loans are not preferential loans and so are non-taxable.

TWO TYPES OF LOANS

The specified rate is dependent on the category (purpose) of the loan:

- Qualifying home loan

- Ordinary loan (i.e. loan for other purposes)

The specified rate is set by the Department of Finance in the annual budget and changes in line with commercial rates. Click here for the latest rates as per Revenue.

The benefit arises from the employee receiving a loan from the employer at a rate lower than would be payable commercially (i.e. at the specified rate). It is the difference in these rates which is the actual benefit.

CALCULATING THE NOTIONAL PAY

The interest that would have been payable at the specified rate less the actual interest paid is the monetary value of the benefit. This monetary difference, i.e. the notional pay, is taxable.

QUALIFYING LOANS - NOTIONAL PAY

A qualifying home loan is a loan which qualifies for mortgage interest relief.

Preferential Loan: Notional Pay calculation on a qualifying home loan

Reset the Loan at the start of each tax year

Where a loan is repayable over a number of tax years, the opening balance should be reduced at the start of each new tax year.

Preferential Loan: Notional Pay calculation on a qualifying loan repayable over 2 years

ORDINARY LOANS

Ordinary loans are all loans that do not qualify for mortgage interest relief.

Preferential Loan: Notional Pay calculation on an ordinary loan

Reset the Loan at the start of each tax year

Where a loan is repayable over a number of tax years, the opening balance should be reduced at the start of each new tax year.

Preferential Loan: Notional Pay calculation on a qualifying loan repayable over 2 years

SETTING UP PREFERENTIAL LOANS IN COLLSOFT PAYROLL

BIK must be set up at company level prior to entering specific benefits at employee level. See Benefit in Kind Settings at Company Level.

The specific detail relevant to each employees individual employment are then entered against the employee record so that the notional pay will flow through to the payroll for tax purposes. This will be itemised on the employee payslip as well.

Accessing the BIK function at employee level

- Choose Employee via the toolbar icon.

- Select the employee to whom the loan has been provided.

- Select the BIK tab.

- The first benefit defaults to Vehicle, choose the benefit that has been renamed to identify that it is a loan. Choose Calc to enter the loan detail applicable to this particular employee.

Preferential Loans: Accessing the BIK loan at employee level

It is important the Loan details entered are correct. BIK operates on a cumulative basis, therefore, errors can be corrected in a subsequent payroll period within the tax year, however, this may result in excessive tax deductions for an employee in one particular payroll period.

Set up the loan details

- Choose the type of loan-ordinary or qualifying home loan.

- Enter the amount of the loan given (or if in a subsequent year the opening balance outstanding as at the start of the year)

- Enter the rate of interest being charged by the employer (enter zero if there is no interest charge applied by the employer.

Preferential Loans: set up loan detail

Select OK to save the loan detail and to attach the loan to the employees payroll.

NOTIONAL PAY ON LOANS IN THE WAGES

Now that the loan detail has been set up against the employee record the notional pay (i.e. cash equivalent) will flow through to the employee's payroll.

- Choose Wages from the toolbar

- Start the next payroll period or choose the current period, as appropriate.

- Choose the Employee

- Choose the BIK tab.

The loan will display the current period notional pay as calculated by CollSoft Payroll based on the loan details entered on the employee record (as explained above).

Preferential Loans: Notional Pay of the loan in the wages

As explained earlier the notional pay is the cash equivalent benefit of the reduced interest rate extended to the employee by the employer on providing the loan. Based on the loan detail entered, each pay period will reflect a pro-rata element of the notional pay appropriate to the length of the pay period.

The notional pay will be added to the payroll for the period in order to calculate the PAYE, USC and PRSI attributable to this payment in kind, in addition to the wages/salary. The notional pay is merely added to the payroll in order to make the correct deductions based on total pay, it is then deducted so that the net effect does not have a payment element within the net pay figure as the employee has already received it in the form of the reduced interest rate.

Preferential Loan: Notional Pay in the payroll and on the payslip

Get help for this page

Get help for this page