Benefit in Kind Settings at Company Level

Information relating to the principles of Benefit in Kind can be found in the Introduction to Benefit in Kind article.

COLLSOFT PAYROLL AND BENEFIT IN KIND

CollSoft Payroll has a Benefit in Kind (BIK) feature for the addition of taxable benefits to employee records. This specific feature must be used in all taxable benefit cases in order to correctly calculate and apply the benefit as 'notional pay' within the employee's periodical payroll.

SETTING UP BENEFITS AT EMPLOYER LEVEL

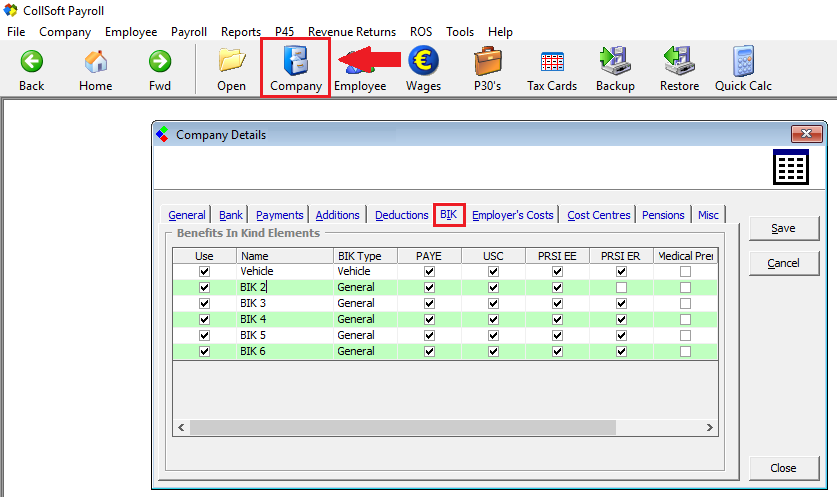

Open the Company record.

Select the specific BIK section for setting up benefit types.

Setting up BIK: BIK at Company Level

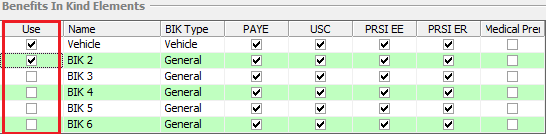

Use

Indicate which benefits to make available at the employee level. Benefits unflagged will not show at the employee level.

Setting up BIK: Company Level - flagging which benefits to show

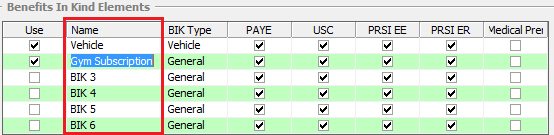

Name

Each benefit listed can be renamed by simply clicking into the 'Name' field and overwriting the default label. The new 'Name' will show at the employee level.

Setting up BIK: Company Level - renaming benefits

The first benefit is named 'Vehicle' by default, this should be left as "Vehicle" and used for this purpose. It is this first vehicle benefit and ONLY this one which facilitates the entry of the vehicle details, business kilometers etc., at the employee level.

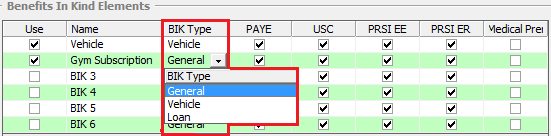

BIK Type

Select the BIK Type to correspond with the newly named benefit.

The first benefit, which is named vehicle by default, is also set as the BIK Type vehicle by default. All other benefits should be categorized as either General benefit, e.g. medical insurance premiums, gym memberships etc. or a Loan made by the employer to the employee.

All vehicles should be recorded against the first benefit, employee level offers the functionality to record multiple cars against this first benefit.

The benefits listed, with the exception of the first, do not allow the recording of business kilometers, therefore the BIK Type selected should either General or Loan only.

Setting up BIK: Company Level - assigning BIK Type

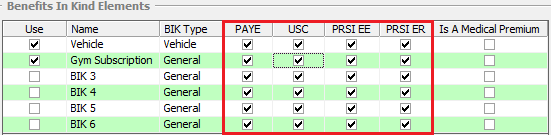

Tax Elements

Set which statutory deductions the benefit is subject to; PAYE, USC, PRSI Employee, PRSI Employer. By default all deductions are flagged, simply unflag each deduction that the benefit is not subject to.

Almost all benefits are subject to all statutory deductions, however, there are some exceptions, for example, Share Based Remuneration is not subject to PRSI Employer.

Setting up BIK: Company Level - statutory deductions

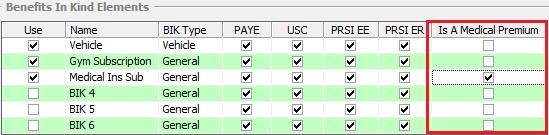

Medical Premiums

Medical Insurance Premiums paid by employers are a benefit in kind, in addition to being taxed these premiums must be identified on the year-end returns.

Therefore when setting up the benefit, flag if the benefit entered is a medical insurance premium, this will ensure the correct treatment of such benefits on the year-end returns.

Setting up BIK: Company Level - medical insurance premiums

Select 'Save' to save the new settings.

COLLSOFT PAYROLL AND BENEFIT IN KIND

CollSoft Payroll has a Benefit in Kind (BIK) feature for the addition of taxable benefits to employee records. This specific feature must be used in all taxable benefit cases in order to correctly calculate and apply the benefit as 'notional pay' within the employee's periodical payroll.

SETTING UP BENEFITS AT EMPLOYER LEVEL

Open the Company record.

Select the specific BIK section for setting up benefit types.

Setting up BIK: BIK at Company Level

Use

Indicate which benefits to make available at the employee level. Benefits unflagged will not show at the employee level.

Setting up BIK: Company Level - flagging which benefits to show

Name

Each benefit listed can be renamed by simply clicking into the 'Name' field and overwriting the default label. The new 'Name' will show at the employee level.

Setting up BIK: Company Level - renaming benefits

The first benefit is named 'Vehicle' by default, this should be left as "Vehicle" and used for this purpose. It is this first vehicle benefit and ONLY this one which facilitates the entry of the vehicle details, business kilometers etc., at the employee level.

BIK Type

Select the BIK Type to correspond with the newly named benefit.

The first benefit, which is named vehicle by default, is also set as the BIK Type vehicle by default. All other benefits should be categorized as either General benefit, e.g. medical insurance premiums, gym memberships etc. or a Loan made by the employer to the employee.

All vehicles should be recorded against the first benefit, employee level offers the functionality to record multiple cars against this first benefit.

The benefits listed, with the exception of the first, do not allow the recording of business kilometers, therefore the BIK Type selected should either General or Loan only.

Setting up BIK: Company Level - assigning BIK Type

Tax Elements

Set which statutory deductions the benefit is subject to; PAYE, USC, PRSI Employee, PRSI Employer. By default all deductions are flagged, simply unflag each deduction that the benefit is not subject to.

Almost all benefits are subject to all statutory deductions, however, there are some exceptions, for example, Share Based Remuneration is not subject to PRSI Employer.

Setting up BIK: Company Level - statutory deductions

Medical Premiums

Medical Insurance Premiums paid by employers are a benefit in kind, in addition to being taxed these premiums must be identified on the year-end returns.

Therefore when setting up the benefit, flag if the benefit entered is a medical insurance premium, this will ensure the correct treatment of such benefits on the year-end returns.

Setting up BIK: Company Level - medical insurance premiums

Select 'Save' to save the new settings.

Get help for this page

Get help for this page