Company Cars

Information relating to the principles of Benefit in Kind can be found in the Introduction to Benefit in Kind article.

COMPANY CARS

When an employee receives a company car, which they normally keep overnight and which the employee has private use of, then a Benefit in Kind arises for the employee.

Benefit in Kind is treated like all other pay-in-the-hands of the employee and so, is a taxable prerequisite of employment. For each non-cash benefit, the employee receives a 'cash equivalent' value of that benefit, which is calculated in order to be able to deduct the appropriate level of tax from the employee. The 'cash equivalent' value is referred to as 'notional pay'

WHAT IS WITHIN THE SCOPE OF A 'CAR'

For the purposes of the PAYE, USC and PRSI charges, a car means any mechanically propelled road vehicle designed, constructed or adapted for the carriage of the driver or the driver and one or more other persons. This excludes the average motorcycle, van, truck, bus, limousine, hearse, emergency response vehicle, but includes 4 wheel drive vehicles (i.e. jeeps and crew cabs).

These are not considered cars:

This includes all cars within the ordinary meaning of the word, crew cabs and jeeps but excludes hearses and lorries.

CAR-POOLS

A car in a 'car-pool' will not be treated as a benefit in kind ONLY if it fulfills the following criteria;

CALCULATING THE VALUE OF THE BENEFIT IN KIND (NOTIONAL PAY)

In order to tax the employee on the provision of a company car a cash equivalent value must be ascertained. This cash equivalent value becomes the notional pay item on the payroll for that employee, i.e. a value on which tax is be deducted but the benefit of which has already been received in the form of the company car.

The level of business kilometers travelled by the employee in the car determines how integral a part of employment the car is. The greater the level of business use the lower the personal benefit derived and therefore the lower the level of notional pay to be taxed. The Department of Finance set out the percentage to be applied to the Opening Market Value (OMV) within each band of kilometres travelled. The results arise at a notional value (cash equivalent) on which the employee will be taxed.

1. Ascertain the Opening Market Value

For the purposes of Benefit in Kind, the Opening Market Value (OMV) of a car is the original value the car would have been sold for pre-registration in the state. The OMV is the list price of the car, INCLUDING custom duty, VAT and VRT, which is the price it would have been reasonable for it to be sold for PRE-REGISTRATION, i.e. new.

The only adjustment that can be made to reduce the OMV of a car is when the employer receives a discount, then the list price may be adjusted.

Any discount received is restricted to a maximum of 10% reduction to the OMV as it is a reasonable discount that a purchaser may receive for a single purchase on the open market. However, to apply a discount you must:

2. Ascertain the level of kilometres travelled.

The employee submits a periodical record of kilometers travelled. The annualised business kilometres will fall into a specific band from which the corresponding percentage rate will be assigned to the OMV of the car.

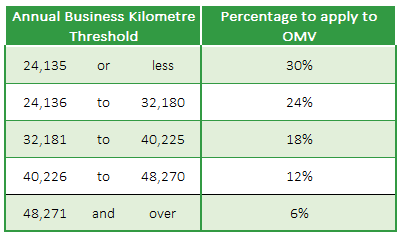

Company Car: Kilomteric Table

Remember it is only business kilometres to be used. Any private mileage should be disregarded, therefore it is not best practice to simply use kilometre readings from the car. However, it is good practice to take a record of kilometre readings from the car at regular intervals throughout the year to ascertain if these readings are in line with records of kilometres travelled.

Private Kilometres

In the event that the employee is not submitting records of business kilometres travelled then a record of private kilometres travelled must be submitted by the employee to the employer. An adjustment to the total kilometres travelled (if taken from the car) is required in respect of private travel.

Where an employee is unable to submit a record of private kilometres travelled then a minimum adjustment of 8,047 kilometres per annum (155 kilometres per week: 670 kilometres per month) must be made.

An adjustment lower than this can only be made with supporting documentary evidence of the actual private kilometres travelled (i.e. a travel record; submission of business journeys and distance)

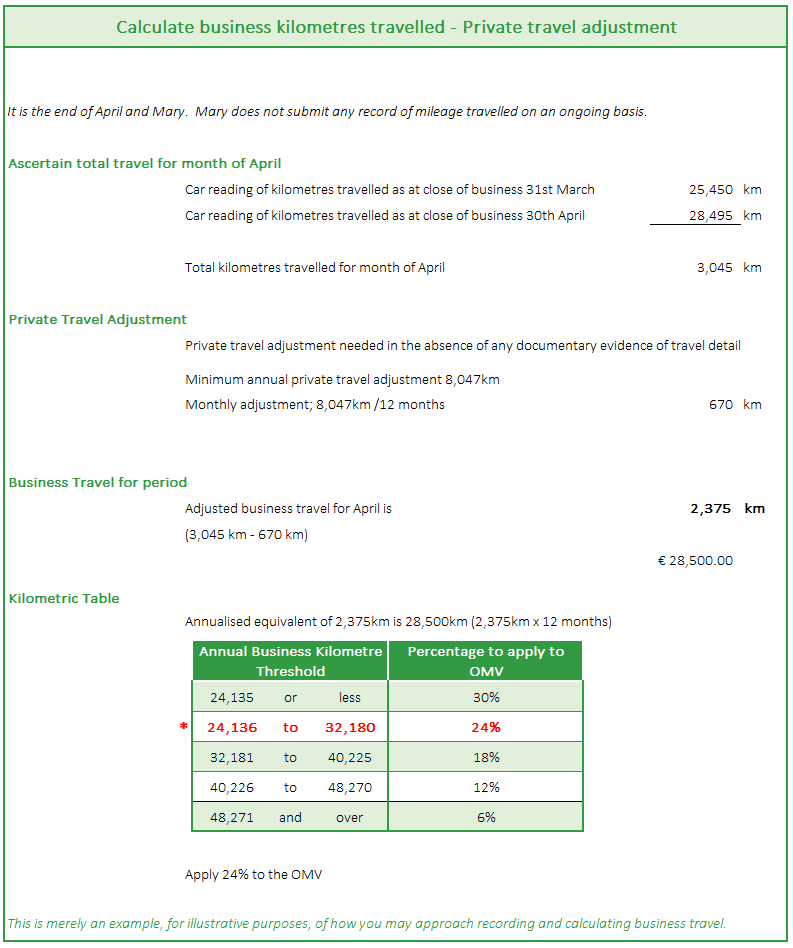

Company Cars: Business travel and a private travel adjustment

3. Calculate the Cash Equivalent

Using the percentage determined from Step 2 apply this percentage to the OMV of the vehicle from Step 1.

The result of this is the cash equivalent of the benefit derived from having the use of a company car.

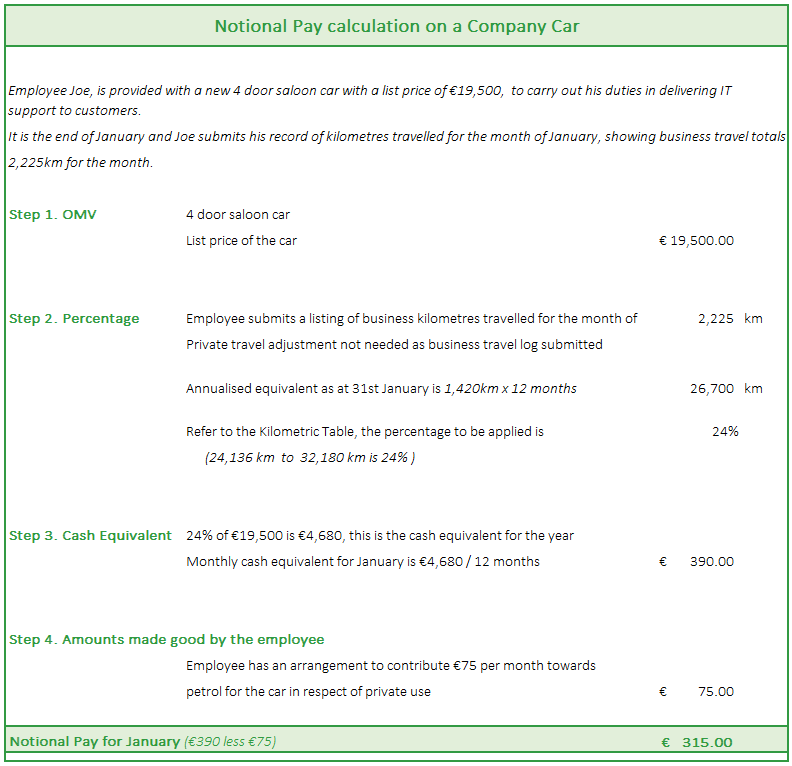

Company Cars: Cash Equivalent / Notional Pay Calculation

In all circumstances, all documentary evidence must be retained.

The employer should maintain concise records of business kilometers, in addition to applying best practice procedures for complete and accurate records in this area. These records should be available in the event of a Revenue Audit.

ADJUSTMENT FOR LOW MILEAGE EMPLOYEES

There is an adjustment available for a certain category of employees fulfilling certain criteria whose business travel does not exceed 24,140km in the year.

Per the kilometric table, employees with less than 24,135km of business travel would normally apply a rate of 30% to the OMV to calculate the cash equivalent of the benefit derived from the company car. However, employees fulfilling ALL of the following criteria qualify for a reduction from 30% to 24%:

SETTING UP COMPANY CARS IN COLLSOFT PAYROLL

BIK must be set up at company level prior to entering specific benefits at employee level. See Benefit in Kind Settings at Company Level.

The specific detail relevant to each employees individual employment are then entered against the employee record so that the notional pay will flow through to the payroll for tax purposes. This will be itemised on the employee payslip also.

Accessing the BIK function at employee level

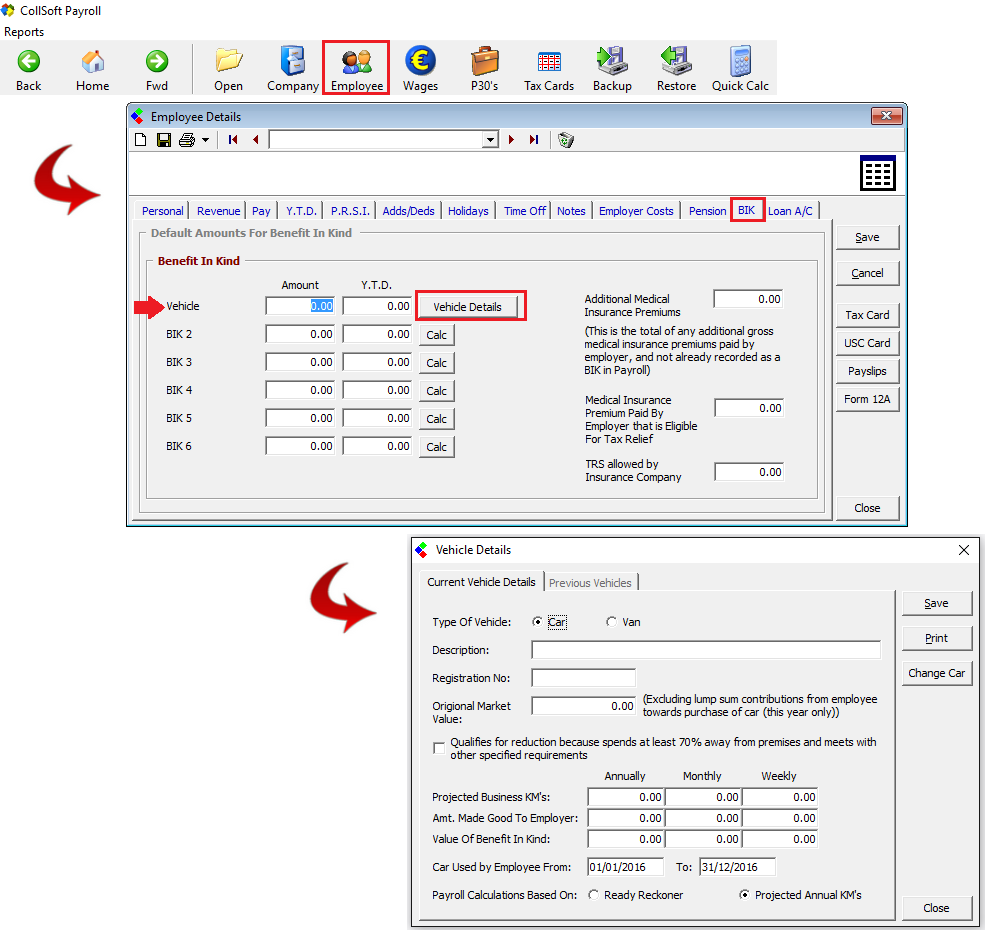

Company Car: Employee Level, BIK entry

It is important the Vehicle details entered are correct. BIK operates on a cumulative basis, therefore, errors can be corrected in a subsequent payroll period within the tax year, however, this may result in an excessive tax bill for the employee in one particular payroll period.

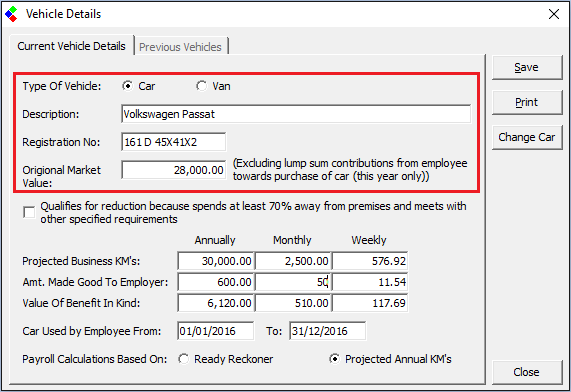

Set-up the car details

Company Car: Specific detail to car

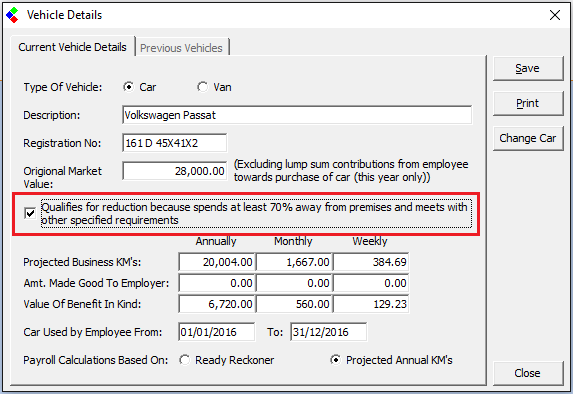

Apply the reduced rate (where applicable)

If the employee fulfills the criteria (as set out above) to qualify for the reduction of the 30% to the 24% against the OMV then tick the box 'Qualifies for reduction' to state that the employee works away from the business premises for 70% of the time.

You must still enter the business kilometres travelled from the records maintained. If the business kilometres entered is less than 24,140km then CollSoft will automatically reduce the applicable 30% rate to 24%.

If the business travel exceeds 32,180 km then, as per the kilometric table (see above), the rate lower than 24% will be applied, however, the kilometres must be entered to ensure this happens.

Company Car: Applying the reduction

Only flag this box for the 30% rate adjustment if the employees qualifies and if it is applicable.

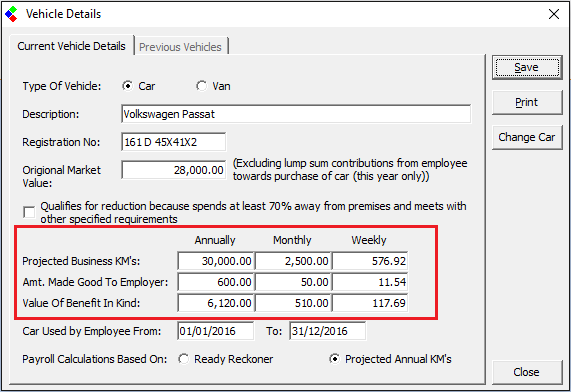

Enter business kilometres travelled

Enter the business kilometres travelled. From a travel log submitted by the employee the average monthly kilometres can be entered.

Alternatively a best guess of the projected kilometres can be entered, however, this requires an adjustment to the figures, prior to the end of year to affect any adjustment necessary in the subsequent pay period. If using a projection, it may be advisable to adjust quarterly based on actual kilometres travelled to avoid an under-deduction of tax accumulating and also to show accurate workings.

Company Car: Enter projected business kilometres

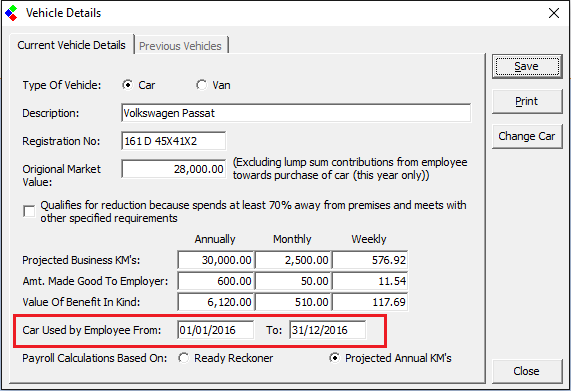

Date range of use

Enter the date range for which the employee has use of the car for the current tax year.

If the employee has a change of role, for which they will no longer have a company car, it is very important to enter the end date as the last day they had use of the car.

Where an employee only has use of a car for part of the tax year, it is important to set up the car as a benefit in kind and use the dates to indicate the length of use. Remember once an employee no longer has use of the car (or changes to a new car) DO NOT DELETE the car detail simply enter the end date for use of the car.

Where a new car is given to the employee, the original car will have a mid-year end date and the new car will be set up with a mid-year start date.

Benefit in Kind is operated on a cumulative basis, therefore any changes made to a benefit creates an adjustment in the subsequent pay period to take account of the previous notional pay accounted for in the payroll.

Company Car: date range the employee has use of the car

Select 'Save' to attach the company car detail to the employee file.

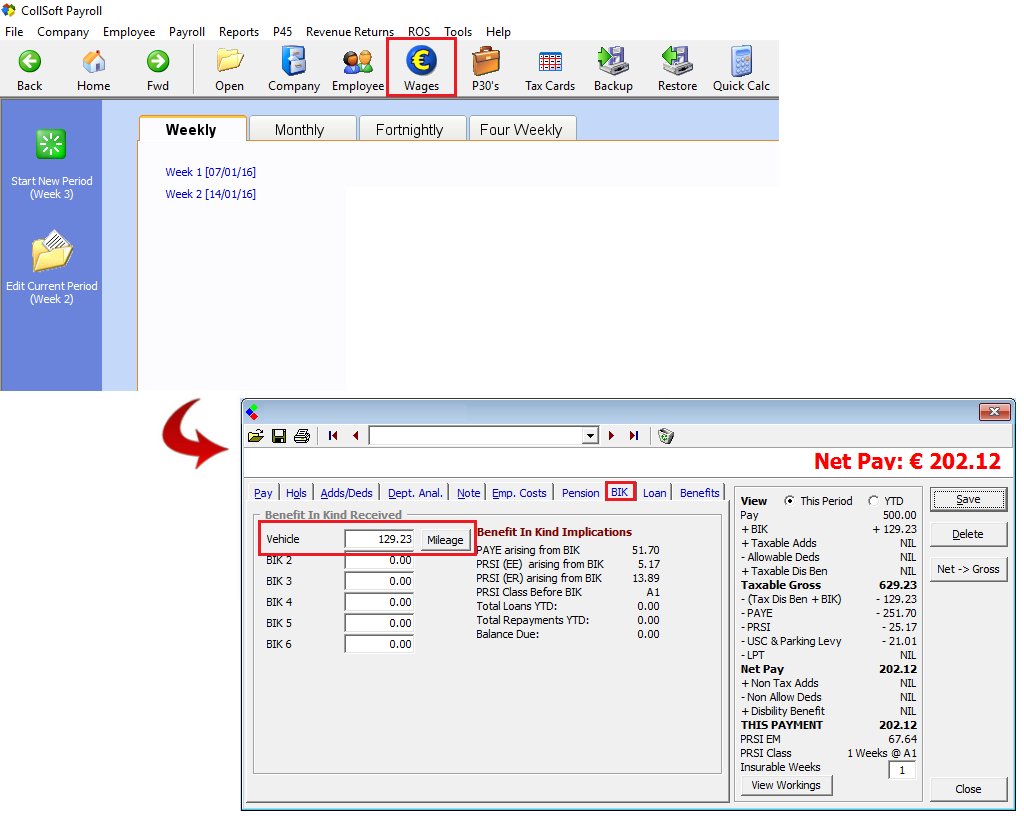

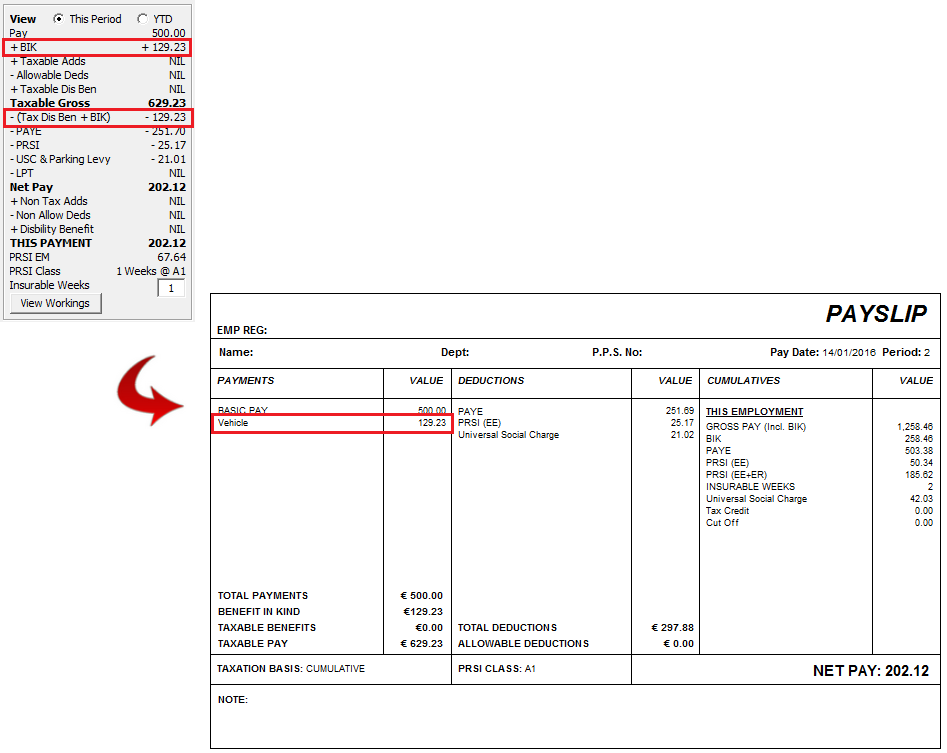

Notional Pay in the Wages

Now that the company car details are set up against the employee record the notional pay (cash equivalent) will flow through to the employee's payroll.

The first default benefit of Vehicle will display the current period notional pay (cash equivalent) as calculated by CollSoft payroll based on the car details entered on the employee record (as explained above).

Company Car: Notional Pay

As explained earlier the notional pay is the cash equivalent value of the use of the company car for the payroll period in question. Based on the date range entered when setting up the company car, each pay period, within that date range, will reflect a pro-rata element appropriate to the length of the pay period.

The notional pay will be added to the payroll for the period in order to calculate the PAYE, USC and PRSI attributable to this payment in kind in addition to the wages/salary. The notional pay is merely added in order to make the correct deductions based on total pay, it is then deducted so that the net effect does not have a pay element within the net payment figure as the employee has already received it (i.e. in kind) in the form of the company car.

Company Car: Notional Pay in the payroll & on the payslip

Revenue states that prior to the end of the tax year, having regard to the known business kilometres covered in the tax year up to that date, the best estimate should be reviewed to determine its accuracy. Any adjustments necessary to the cumulative notional pay charged to date should be incorporated in the remaining pay periods for the year thus resulting in the notional pay calculating on actual travel.

It is best practice to maintain logs or to request employees to submit travel logs on a continual basis to ensure the accuracy of this calculation.

COMPANY CARS

When an employee receives a company car, which they normally keep overnight and which the employee has private use of, then a Benefit in Kind arises for the employee.

Benefit in Kind is treated like all other pay-in-the-hands of the employee and so, is a taxable prerequisite of employment. For each non-cash benefit, the employee receives a 'cash equivalent' value of that benefit, which is calculated in order to be able to deduct the appropriate level of tax from the employee. The 'cash equivalent' value is referred to as 'notional pay'

WHAT IS WITHIN THE SCOPE OF A 'CAR'

For the purposes of the PAYE, USC and PRSI charges, a car means any mechanically propelled road vehicle designed, constructed or adapted for the carriage of the driver or the driver and one or more other persons. This excludes the average motorcycle, van, truck, bus, limousine, hearse, emergency response vehicle, but includes 4 wheel drive vehicles (i.e. jeeps and crew cabs).

These are not considered cars:

- a motor-cycle the weight of which is less than 410 kilograms

- a van or

- a vehicle not commonly used as a private vehicle and unsuitable to be used as so.

This includes all cars within the ordinary meaning of the word, crew cabs and jeeps but excludes hearses and lorries.

CAR-POOLS

A car in a 'car-pool' will not be treated as a benefit in kind ONLY if it fulfills the following criteria;

- the car is made available to AND IS ACTUALLY USED by MORE THAN ONE employee and is not used by one employee with the exclusion of others

- private use of the car is merely incidental to business use

- the car is not kept in the vicinity of an employee's home, with the exception that the car is provided to an employee who is an officer of the state to fulfill their 'on-call' duties to respond to illegal activities, and if the employee did not require the use of the car for these circumstances, then it would be a pooled car.

CALCULATING THE VALUE OF THE BENEFIT IN KIND (NOTIONAL PAY)

In order to tax the employee on the provision of a company car a cash equivalent value must be ascertained. This cash equivalent value becomes the notional pay item on the payroll for that employee, i.e. a value on which tax is be deducted but the benefit of which has already been received in the form of the company car.

The level of business kilometers travelled by the employee in the car determines how integral a part of employment the car is. The greater the level of business use the lower the personal benefit derived and therefore the lower the level of notional pay to be taxed. The Department of Finance set out the percentage to be applied to the Opening Market Value (OMV) within each band of kilometres travelled. The results arise at a notional value (cash equivalent) on which the employee will be taxed.

1. Ascertain the Opening Market Value

For the purposes of Benefit in Kind, the Opening Market Value (OMV) of a car is the original value the car would have been sold for pre-registration in the state. The OMV is the list price of the car, INCLUDING custom duty, VAT and VRT, which is the price it would have been reasonable for it to be sold for PRE-REGISTRATION, i.e. new.

The only adjustment that can be made to reduce the OMV of a car is when the employer receives a discount, then the list price may be adjusted.

Any discount received is restricted to a maximum of 10% reduction to the OMV as it is a reasonable discount that a purchaser may receive for a single purchase on the open market. However, to apply a discount you must:

- have documentary evidence of discounts received

- if the discount exceeded 10% you do not apply this- you must restrict the OMV adjustment to 10%

- discount is applied to the VAT and VRT inclusive price

- the discount would be achievable in a single purchase transaction

2. Ascertain the level of kilometres travelled.

The employee submits a periodical record of kilometers travelled. The annualised business kilometres will fall into a specific band from which the corresponding percentage rate will be assigned to the OMV of the car.

Company Car: Kilomteric Table

Remember it is only business kilometres to be used. Any private mileage should be disregarded, therefore it is not best practice to simply use kilometre readings from the car. However, it is good practice to take a record of kilometre readings from the car at regular intervals throughout the year to ascertain if these readings are in line with records of kilometres travelled.

Private Kilometres

In the event that the employee is not submitting records of business kilometres travelled then a record of private kilometres travelled must be submitted by the employee to the employer. An adjustment to the total kilometres travelled (if taken from the car) is required in respect of private travel.

Where an employee is unable to submit a record of private kilometres travelled then a minimum adjustment of 8,047 kilometres per annum (155 kilometres per week: 670 kilometres per month) must be made.

An adjustment lower than this can only be made with supporting documentary evidence of the actual private kilometres travelled (i.e. a travel record; submission of business journeys and distance)

Company Cars: Business travel and a private travel adjustment

3. Calculate the Cash Equivalent

Using the percentage determined from Step 2 apply this percentage to the OMV of the vehicle from Step 1.

The result of this is the cash equivalent of the benefit derived from having the use of a company car.

Company Cars: Cash Equivalent / Notional Pay Calculation

In all circumstances, all documentary evidence must be retained.

The employer should maintain concise records of business kilometers, in addition to applying best practice procedures for complete and accurate records in this area. These records should be available in the event of a Revenue Audit.

ADJUSTMENT FOR LOW MILEAGE EMPLOYEES

There is an adjustment available for a certain category of employees fulfilling certain criteria whose business travel does not exceed 24,140km in the year.

Per the kilometric table, employees with less than 24,135km of business travel would normally apply a rate of 30% to the OMV to calculate the cash equivalent of the benefit derived from the company car. However, employees fulfilling ALL of the following criteria qualify for a reduction from 30% to 24%:

- work an average of not less than 20 hours per week

- travel at least 8,047km per annum on the employer's business

- spends at least 70% of their working time away from the employer's premises

- retains proper records pertaining to business travel, these include; log book detailing business kilometers, business transacted, business time travelled and date of journey, all of which must be certified to be true and accurate by the employer

SETTING UP COMPANY CARS IN COLLSOFT PAYROLL

BIK must be set up at company level prior to entering specific benefits at employee level. See Benefit in Kind Settings at Company Level.

The specific detail relevant to each employees individual employment are then entered against the employee record so that the notional pay will flow through to the payroll for tax purposes. This will be itemised on the employee payslip also.

Accessing the BIK function at employee level

- Choose Employee from the toolbar.

- Select the Employee to whom the company car has been provided.

- Choose BIK

- The first benefit defaults to Vehicle by default, beside this you will see Vehicle Details. Choose Vehicle Details, an input screen will display to allow you to enter all the relevant vehicle details from which the notional pay will be calculated (as explained above).

Company Car: Employee Level, BIK entry

It is important the Vehicle details entered are correct. BIK operates on a cumulative basis, therefore, errors can be corrected in a subsequent payroll period within the tax year, however, this may result in an excessive tax bill for the employee in one particular payroll period.

Set-up the car details

- Choose the type of vehicle; Car

- Enter a description which will identify the particular vehicle in use at the moment.

- Enter the vehicle registration.

- Enter the Opening Market Value (OMV)

Company Car: Specific detail to car

Apply the reduced rate (where applicable)

If the employee fulfills the criteria (as set out above) to qualify for the reduction of the 30% to the 24% against the OMV then tick the box 'Qualifies for reduction' to state that the employee works away from the business premises for 70% of the time.

You must still enter the business kilometres travelled from the records maintained. If the business kilometres entered is less than 24,140km then CollSoft will automatically reduce the applicable 30% rate to 24%.

If the business travel exceeds 32,180 km then, as per the kilometric table (see above), the rate lower than 24% will be applied, however, the kilometres must be entered to ensure this happens.

Company Car: Applying the reduction

Only flag this box for the 30% rate adjustment if the employees qualifies and if it is applicable.

Enter business kilometres travelled

Enter the business kilometres travelled. From a travel log submitted by the employee the average monthly kilometres can be entered.

Alternatively a best guess of the projected kilometres can be entered, however, this requires an adjustment to the figures, prior to the end of year to affect any adjustment necessary in the subsequent pay period. If using a projection, it may be advisable to adjust quarterly based on actual kilometres travelled to avoid an under-deduction of tax accumulating and also to show accurate workings.

Company Car: Enter projected business kilometres

Date range of use

Enter the date range for which the employee has use of the car for the current tax year.

If the employee has a change of role, for which they will no longer have a company car, it is very important to enter the end date as the last day they had use of the car.

Where an employee only has use of a car for part of the tax year, it is important to set up the car as a benefit in kind and use the dates to indicate the length of use. Remember once an employee no longer has use of the car (or changes to a new car) DO NOT DELETE the car detail simply enter the end date for use of the car.

Where a new car is given to the employee, the original car will have a mid-year end date and the new car will be set up with a mid-year start date.

Benefit in Kind is operated on a cumulative basis, therefore any changes made to a benefit creates an adjustment in the subsequent pay period to take account of the previous notional pay accounted for in the payroll.

Company Car: date range the employee has use of the car

Select 'Save' to attach the company car detail to the employee file.

Notional Pay in the Wages

Now that the company car details are set up against the employee record the notional pay (cash equivalent) will flow through to the employee's payroll.

- Choose Wages from the toolbar.

- Start the next payroll period or choose the current period, as appropriate.

- Choose the Employee

- Choose BIK

The first default benefit of Vehicle will display the current period notional pay (cash equivalent) as calculated by CollSoft payroll based on the car details entered on the employee record (as explained above).

Company Car: Notional Pay

As explained earlier the notional pay is the cash equivalent value of the use of the company car for the payroll period in question. Based on the date range entered when setting up the company car, each pay period, within that date range, will reflect a pro-rata element appropriate to the length of the pay period.

The notional pay will be added to the payroll for the period in order to calculate the PAYE, USC and PRSI attributable to this payment in kind in addition to the wages/salary. The notional pay is merely added in order to make the correct deductions based on total pay, it is then deducted so that the net effect does not have a pay element within the net payment figure as the employee has already received it (i.e. in kind) in the form of the company car.

Company Car: Notional Pay in the payroll & on the payslip

Revenue states that prior to the end of the tax year, having regard to the known business kilometres covered in the tax year up to that date, the best estimate should be reviewed to determine its accuracy. Any adjustments necessary to the cumulative notional pay charged to date should be incorporated in the remaining pay periods for the year thus resulting in the notional pay calculating on actual travel.

It is best practice to maintain logs or to request employees to submit travel logs on a continual basis to ensure the accuracy of this calculation.

Get help for this page

Get help for this page