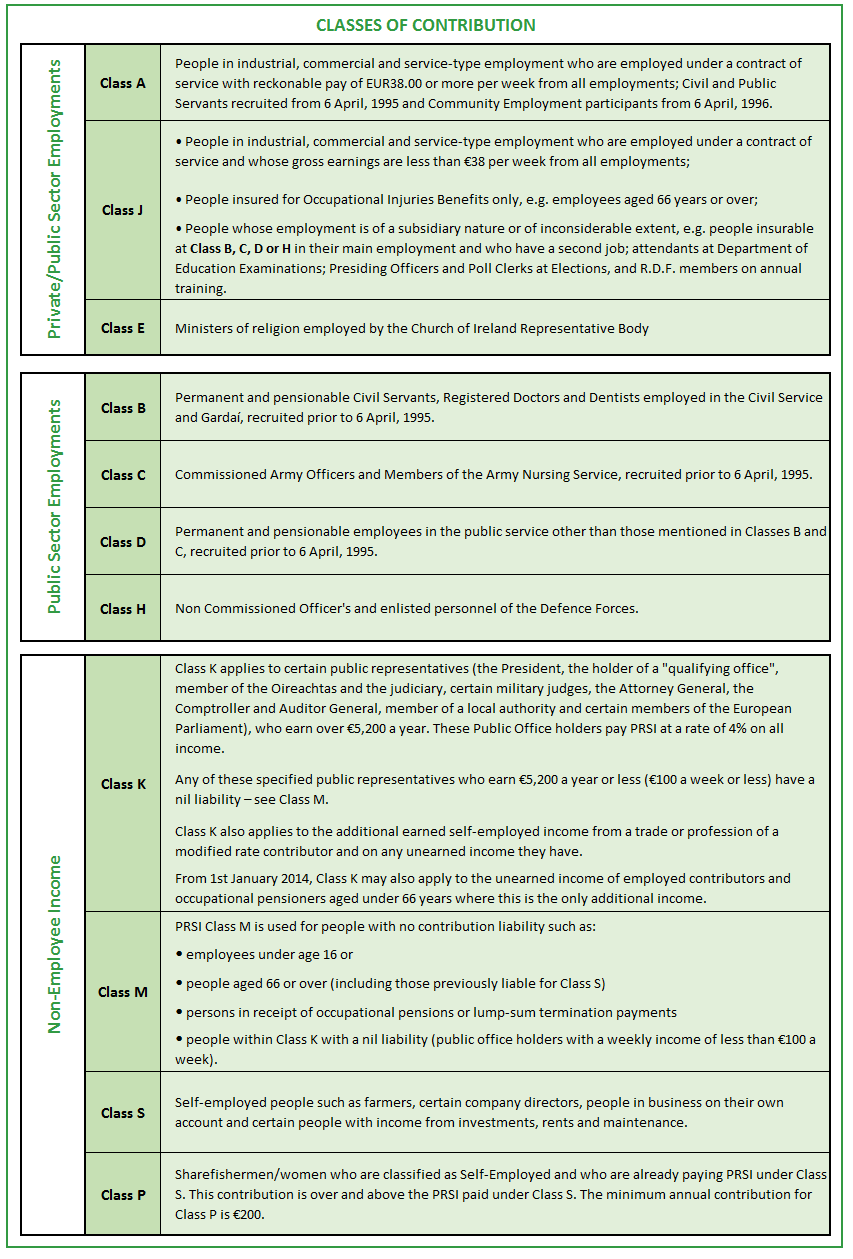

PRSI Classes of Contribution

In general, PRSI contribution classes are decided by the nature of a person's employment.

PRSI Classes of Contribution

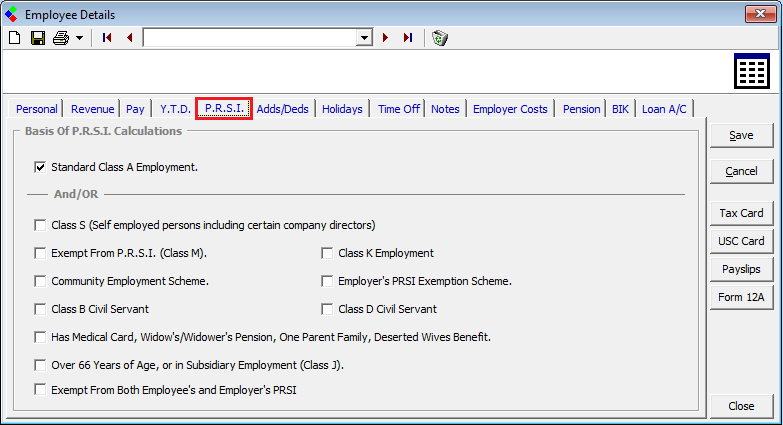

ASSIGNING PRSI CLASSES

When setting up employees within CollSoft, you must assign the correct PRSI Class as appropriate for each individual employee. If, for any reason, you cannot establish the correct class, you should contact the Scope section in the DEASP.

By default, CollSoft assigns the most common category of Class A, however, you can amend the class as is appropriate to each individual employee/Director.

PRSI Classes of Contribution: Assign the appropriate PRSI class to the employee

If the employee ends up paying more PRSI than he or she owes, their employer must repay him or her the difference. If the employee ends up paying less than he or she owes, the employer is liable to pay the difference. So, it is important that the employer establish and apply the correct class from the outset.

PRSI SUBCLASSES

The PRSI contribution classes are further divided into subclasses attached to which there is a rate of contribution – the subclass is determined by the amount of employee's weekly gross reckonable earnings*. The class of PRSI you pay determines the social welfare payments for which an employee may qualify.

*Reckonable earnings for PRSI purposes are gross pay including notional pay (benefit in kind) plus superannuation and permanent health insurance contributions made by an employee. In determining an employees pay subject to PRSI the same rules as applied for determining pay subject to income tax and/or USC DO NOT apply.

Each subclass is dictated by the weekly rate of pay. Each subclass has an employee rate of contribution and an employers rate of contribution which is applied to the weekly wages. A breakdown of these subclasses is available from the Department of Social Protection in leaflet SW14 (click here to download).

PRSI Classes of Contribution

ASSIGNING PRSI CLASSES

When setting up employees within CollSoft, you must assign the correct PRSI Class as appropriate for each individual employee. If, for any reason, you cannot establish the correct class, you should contact the Scope section in the DEASP.

By default, CollSoft assigns the most common category of Class A, however, you can amend the class as is appropriate to each individual employee/Director.

PRSI Classes of Contribution: Assign the appropriate PRSI class to the employee

If the employee ends up paying more PRSI than he or she owes, their employer must repay him or her the difference. If the employee ends up paying less than he or she owes, the employer is liable to pay the difference. So, it is important that the employer establish and apply the correct class from the outset.

PRSI SUBCLASSES

The PRSI contribution classes are further divided into subclasses attached to which there is a rate of contribution – the subclass is determined by the amount of employee's weekly gross reckonable earnings*. The class of PRSI you pay determines the social welfare payments for which an employee may qualify.

*Reckonable earnings for PRSI purposes are gross pay including notional pay (benefit in kind) plus superannuation and permanent health insurance contributions made by an employee. In determining an employees pay subject to PRSI the same rules as applied for determining pay subject to income tax and/or USC DO NOT apply.

Each subclass is dictated by the weekly rate of pay. Each subclass has an employee rate of contribution and an employers rate of contribution which is applied to the weekly wages. A breakdown of these subclasses is available from the Department of Social Protection in leaflet SW14 (click here to download).

| Files | ||

|---|---|---|

| Employees - Assigning the PRSI Class.png | ||

| PRSI - Classes of Contribution.png | ||

Get help for this page

Get help for this page