Changes to BIK rules in 2023 for company cars and vans

Summary of changes that apply from 1st

January 2023

1. The calculation of the BIK due on a company car (Petrol/Diesel/Hybrid) will now take account of the

vehicles CO2 emissions.

Basically vehicles with higher emissions will attract a higher rate of BIK.

2. For company vans where the employee has private use of the van, the rate of BIK is increasing from

5% to 8%.

3. The relief allowed for fully Electric Vehicles is being reduced from €50,000 to €35,000 in 2023 followed

by a further reduction to €20,000 in 2024 and finally in 2025 to a reduction of €10,000.

In order to ensure that BIK is calculated correctly in 2023 many employers will be required to gather information

on their vehicles CO2 emissions and enter it into CollSoft Payroll.

If you do not enter this information then CollSoft Payroll will automatically default to the most expensive rates

of BIK in 2023, so it is very important for employers to ensure that the correct CO2 data is held and that the

correct rate of BIK can be applied in payroll calculations.

The following section explains how this data can be entered into your 2022 Payroll Software, so that it can be

carried forward and used from the beginning of 2023.

Further information can be found on the Revenue website at

https://www.revenue.ie/en/tax-professionals/tdm/income-tax-capital-gains-tax-corporation-tax/part-05/05-

01-01b.pdf

In particular refer to Appendix C on page 3

New CO2 based method of calculating BIK on company car

The Finance Act 2019 introduced a new method of calculating the BIK due on a company car that is based both

on the car’s CO2 emissions as well as the annual mileage.

This new method applies to all petrol, diesel and hybrid cars from the 1st January 2023.

It also applies to Fully Electric vehicles (EV), which are typically Category A (zero emissions), but there is an

allowed reduction of €35,000 on the Original Market Value (OMV) of the EV in 2023 (previously €50,000).

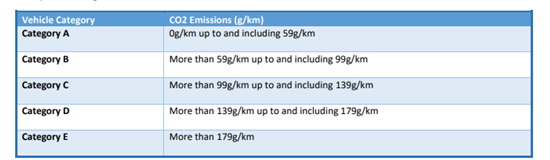

Each vehicle will belong to one of five new categories (A to E) depending on their CO2 emissions, with Category

A having the lowest set of rates, and Category E having the highest set of rates.

The specific categories are as follows:

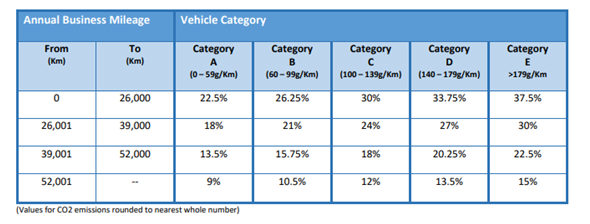

When you have determined which category that the vehicle belongs to, the annual mileage is then used to select

the relevant rate of BIK based on the following table of rates;

Once you have established which category of rates apply to the vehicle then the calculation of BIK follows the

normal calculation based on the Original Market Value and the annual business mileage.

Payroll 2023 will

automatically calculate the Vehicle Category and BIK based on the CO2 emissions recorded for vehicle in Payroll.

Updating Payroll with CO2 Emissions Data

The new CO2 based calculation of BIK will apply to all relevant company vehicles from 1

st January 2023 – it does

not apply to any 2022 BIK calculations.

In order to be prepared in advance of running your first 2023 payrolls we have updated our 2022 Payroll software

so that users can start gathering the required information, and we would strongly advise users to update their

vehicle data.

Please Note: If you do not enter any CO2 emissions data for a vehicle, then CollSoft Payroll will automatically

apply the highest Category E rates.

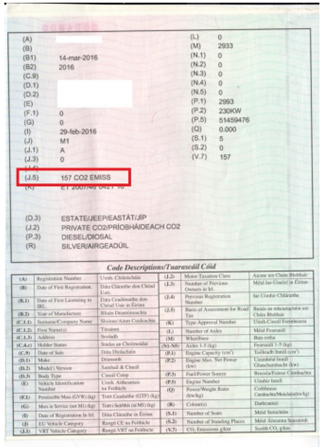

For vehicles that are taxed on a CO2 basis, your Vehicle Licensing Certificate (VLC) will show the CO2 emissions

on line J5.

The following is an example of a certificate which shows a vehicle with emissions of 157g/Km:

For vehicles which are taxed on the basis of their engine size (such as commercial jeeps etc) you may have to

refer back to the manufacturers specifications to establish what the WLTP CO2 emissions are.

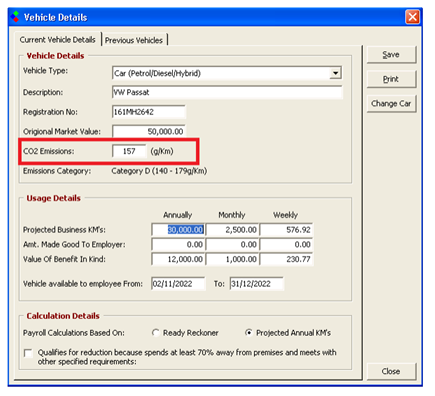

Once you have established what the CO2 emissions are for your vehicle you can enter them on the “Vehicle

Details” screen via the BIK section of the employee’s file.

Once this data has been entered into Payroll 2022 it will transfer over automatically to Payroll 2023 where it will

be used in the new BIK calculations from 1st January 2023.

Electric Vehicles (EVs)

The treatment of Electric Vehicles for BIK purposes has varied over the years, and currently only EV’s with an

Original Market Value (OMV) over €50,000 are chargeable to BIK, and then only on the excess amount over the

€50,000 threshold.

In 2023 this threshold is being reduced to €35,000 such that any EV with an OMV in excess of €35,000 will now

be subject to BIK on the excess amount over the €35,000 threshold.

So, for example an entry level Nissan Leaf XE, with an OMV of €30,345 will continue to be exempt, whereas the

62KWH SVE model of the same car valued at €42,510 would now be subject to BIK on the €7,510 excess above

the €35,000 threshold.

In this case the lowest Category A rates would apply based on the annual business

mileage.

In Payroll 2023, you must ensure that the correct (and full) OMV is entered on the Vehicle Details screen – Payroll

will automatically take account of the €35,000 exemption threshold and calculate any BIK accordingly.

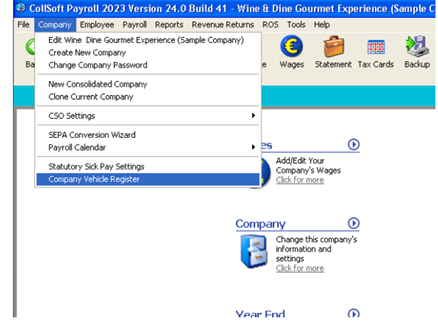

Company Vehicle Register

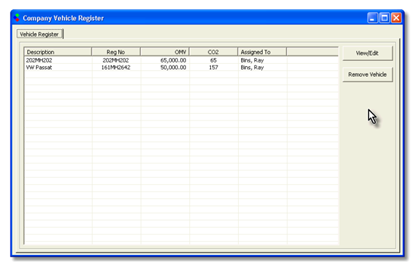

In Payroll 2023 we have added a new Company Vehicle Register screen which enables you to view all of your

company vehicles in one convenient place.

To view the new screen simply click into the Company menu and select the Company Vehicle Register option.

This will open your Company Vehicle Register, and from here you can edit the settings for each individual

vehicle (such as the CO2 emissions), or you can remove any vehicle that is no longer being used by your

employees.

| Files | ||

|---|---|---|

| DataImage11.png | ||

| DataImage11.png | ||

| DataImage11.png | ||

| DataImage47.png | ||

| DataImage47.png | ||

| DataImage75.png | ||

Get help for this page

Get help for this page