Week 53 in 2025

Introduction

In a valid "Week 53" payroll employees are allocated one extra week of tax credits and PAYE/USC bands. All calculations are carried out on a "Week 1" basis. Essentially the employees are getting the benefit of 53 weeks or their tax credits which reduces their overall tax bill for the year.

However, there are some rules that you should be aware of;

Week 53 cannot be paid in advance

Week 53 only applies if you normally pay your wages on a Wednesday and are actually paying your employees on Wednesday 31st December. You cannot for example pay two weeks pay in Week 52 (Wednesday 24th December) and use the Week 53 credits.

If you pay an additional week of holiday pay in Week 52 in CollSoft Payroll then the calculations will only allocate 52 weeks of credits, not 53 as you might expect. This is to ensure that the calculations in the software match the correct Revenue calculations.

When Revenue prepare an employee's end of year "Statement Of Liability" they do not use the number of insurable weeks to determine if a Week 53 credit applies. So, even if the employee has 53 insurable weeks filed with Revenue, they will still only allocate 52 weeks of credits in their calculations.

Revenue will only allocate a "Week 53" credit to an employee if that employee has a filed payslip with a payment date of 31st December 2025.

Some employers will be tempted to process a Payroll for the 31st December, file it with Revenue, but then go ahead an pay the employee on 23rd/24th December - We strongly advise employers not to attempt this as they may be liable to sanction from Revenue if it is discovered.

Week 53 only applies in 2025 if Wednesday is your normal pay day

Employers are only entitled to use a Week 53 in 2024 if their normal pay day is Wednesday, and they are making a payment on Monday 30th or Tuesday 31st.

If your normal pay day is any other day of the week then you are not entitled to use a Week 53, even if you go ahead and make a payment on 31st

If your normal Pay Day is on a Monday, Tuesday, Thursday, Friday, Saturday or Sunday then you are not entitled to use Week 53 credits in 2025

What if I still need to process wages on 31st December but I don't qualify for Week 53?

There may be some circumstances where an employer will still need to process wages on Wednesday 31st of December even though they do not qualify for a Week 53.

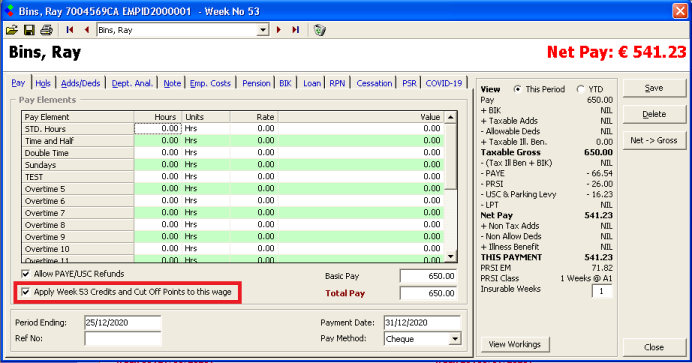

In CollSoft Payroll you can choose to run a Week 53, but not to allocate any additional credits to the employee's PAYE and USC calculations by unticking the box labelled "Apply Week 53 Credits and Cut Off Points to this wage" on the wage entry screen (shown below)

In 2025, any employer who normally pays their weekly wages on a Wednesday will have a Week 53.

If you pay fortnightly or 4-weekly you will have a "Week 53" if you normally pay your wages on a Wednesday, and you have a pay day that falls on Wednesday 31st December.

Employers who pay monthly wages never have a Week 53, even if they pay their wages on 31st December.

If you normally pay your wages on any other day of the week then you do not have a Week 53, and you should not attempt to process one as Revenue will not allow your employees to have the extra credits and allowances usually allocated in Week 53, and they will end up with an outstanding PAYE and USC liability.

Paying Wages over the Christmas Holidays - dealing with Bank Holidays.

Processing your Christmas holiday payroll can be a bit of a nightmare with all of the bank holidays.

Revenue have special rules that apply whenever your normal pay day falls on a non banking day.

We have prepared some specific guidance for employers based on the day of the week that they normally pay their wages.

How is PAYE/USC calculated in Week 53?

In a valid "Week 53" payroll employees are allocated one extra week of tax credits and PAYE/USC bands. All calculations are carried out on a "Week 1" basis. Essentially the employees are getting the benefit of 53 weeks or their tax credits which reduces their overall tax bill for the year.

However, there are some rules that you should be aware of;

Week 53 cannot be paid in advance

Week 53 only applies if you normally pay your wages on a Wednesday and are actually paying your employees on Wednesday 31st December. You cannot for example pay two weeks pay in Week 52 (Wednesday 24th December) and use the Week 53 credits.

If you pay an additional week of holiday pay in Week 52 in CollSoft Payroll then the calculations will only allocate 52 weeks of credits, not 53 as you might expect. This is to ensure that the calculations in the software match the correct Revenue calculations.

When Revenue prepare an employee's end of year "Statement Of Liability" they do not use the number of insurable weeks to determine if a Week 53 credit applies. So, even if the employee has 53 insurable weeks filed with Revenue, they will still only allocate 52 weeks of credits in their calculations.

Revenue will only allocate a "Week 53" credit to an employee if that employee has a filed payslip with a payment date of 31st December 2025.

Some employers will be tempted to process a Payroll for the 31st December, file it with Revenue, but then go ahead an pay the employee on 23rd/24th December - We strongly advise employers not to attempt this as they may be liable to sanction from Revenue if it is discovered.

Week 53 only applies in 2025 if Wednesday is your normal pay day

Employers are only entitled to use a Week 53 in 2024 if their normal pay day is Wednesday, and they are making a payment on Monday 30th or Tuesday 31st.

If your normal pay day is any other day of the week then you are not entitled to use a Week 53, even if you go ahead and make a payment on 31st

If your normal Pay Day is on a Monday, Tuesday, Thursday, Friday, Saturday or Sunday then you are not entitled to use Week 53 credits in 2025

What if I still need to process wages on 31st December but I don't qualify for Week 53?

There may be some circumstances where an employer will still need to process wages on Wednesday 31st of December even though they do not qualify for a Week 53.

In CollSoft Payroll you can choose to run a Week 53, but not to allocate any additional credits to the employee's PAYE and USC calculations by unticking the box labelled "Apply Week 53 Credits and Cut Off Points to this wage" on the wage entry screen (shown below)

| Files | ||

|---|---|---|

| W531.png | ||

Get help for this page

Get help for this page