TWSS Reversals

There are various reasons why some employers may wish to reverse out of the Temporary Wage Subsidy Scheme.

Sometimes this will be a voluntary decision made by the employer, other times it will follow a determination by Revenue that the employer was not eligible. If an employer has decided to exit the scheme voluntarily then they must make contact with Revenue via myEnquiries before undertaking any of the tasks below.

The reversal may be for the whole period in which the employer participated in the scheme, or it may be for a specific portion of time.

There are 3 distinct steps that must be taken in order for an employer to reverse out of TWSS.

Step 1 - Repay all TWSS received for the relevant period.

The employer must repay all of the TWSS received from Revenue during the relevant period. It is important to note that the employer must only pay back the TWSS amounts - they should not pay back any PAYE/USC refunds that were paid to employees.

The employer must repay the TWSS using the REVPAY function in ROS.

Step 2 - Submit a PRSI Calculation to Revenue

The employer must pay the Employers PSRI and the Employees PRSI that would have accrued to the exchequer had the employer not availed of TWSS for the specified period.

CollSoft Payroll has a recalculation wizard that will calculate the amount of PRSI that would have been deducted if the amount of TWSS was processed as Gross Pay.

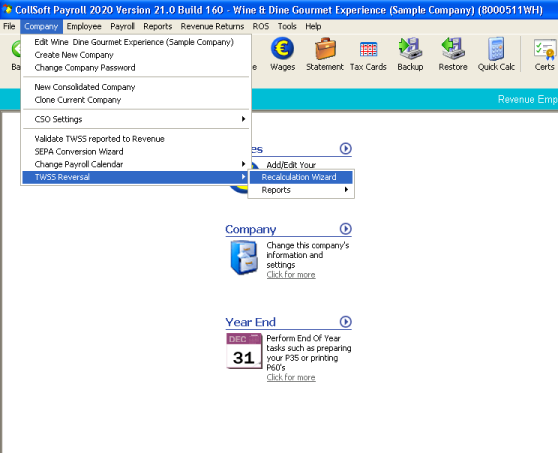

To run the wizard select the "TWSS Reversal > Recalculation Wizard" option in the "Company" menu as shown below;

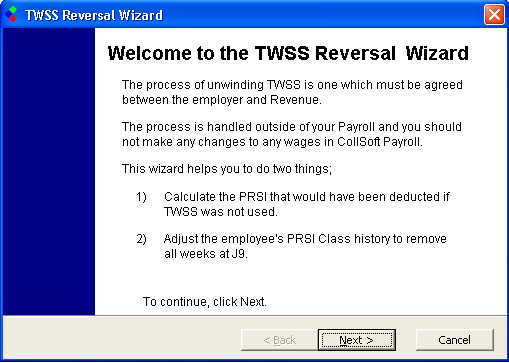

This will open the Recalculation Wizard

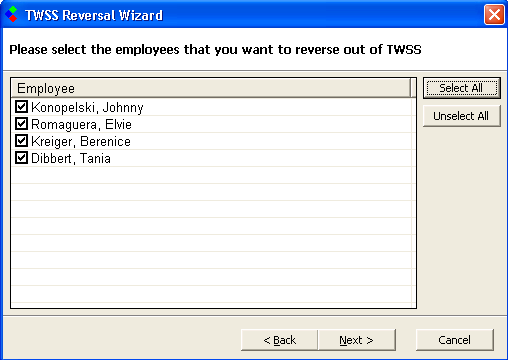

Press next to select the employee's that you want to reverse - generally speaking you will be selecting them all

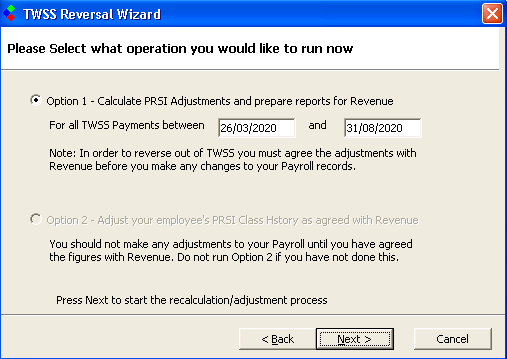

Press next to continue to the next step where you can specify a date range if you are only performing a partial reversal from a particular date;

Please Note: that at the moment this wizard can only calculate the PRSI that needs to be paid to Revenue, it does not as yet support the adjustment of Insurable Weeks and PRSI classes. This option will be added at a future date. For now this wizard will only calculate the PRSI due.

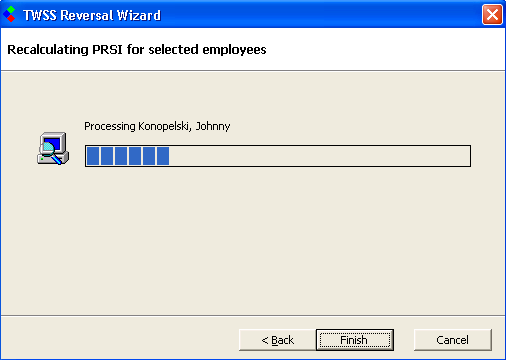

Press next to begin the recalculation. This recalculation does not actually change any of your Payrolls, it simply calculates the additional amounts of PRSI that would have applied if the TWSS payment was treated as Gross Pay, and the new values of PRSI are stored separately from your payslips.

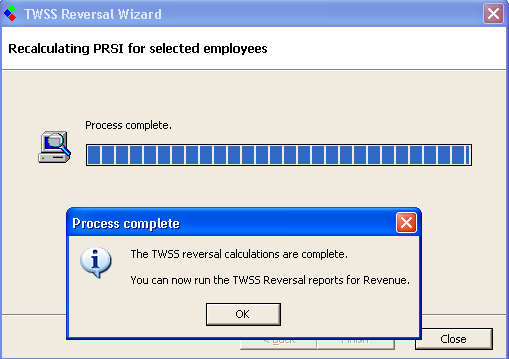

You will be advised when the Wizard has completed the task;

So now that the calculations have been completed you can run the report to send to Revenue showing the details of your calculations.

There are three versions of this report;

At this stage we suggest that you submit the first detailed report to revenue for their approval. Once they have accepted the calculations they will raise an assessment for the total amount of PRSI due.

Step 3 - Adjusting your employees PRSI Classes and insurable weeks.

The purpose of this step is to change all of your employee's J9 PRSI contributions over to whatever normal PRSI Class would have applied if TWSS was not run (usually Class A).

The second report mentioned above gives you the information needed to perform this adjustment, and they could be entered manually on ROS.

But, we are working on an update to enable you to file this adjustments through CollSoft Payroll automatically, this will be part of our Year End update which will be available early in December.

Sometimes this will be a voluntary decision made by the employer, other times it will follow a determination by Revenue that the employer was not eligible. If an employer has decided to exit the scheme voluntarily then they must make contact with Revenue via myEnquiries before undertaking any of the tasks below.

The reversal may be for the whole period in which the employer participated in the scheme, or it may be for a specific portion of time.

There are 3 distinct steps that must be taken in order for an employer to reverse out of TWSS.

Step 1 - Repay all TWSS received for the relevant period.

The employer must repay all of the TWSS received from Revenue during the relevant period. It is important to note that the employer must only pay back the TWSS amounts - they should not pay back any PAYE/USC refunds that were paid to employees.

The employer must repay the TWSS using the REVPAY function in ROS.

Step 2 - Submit a PRSI Calculation to Revenue

The employer must pay the Employers PSRI and the Employees PRSI that would have accrued to the exchequer had the employer not availed of TWSS for the specified period.

CollSoft Payroll has a recalculation wizard that will calculate the amount of PRSI that would have been deducted if the amount of TWSS was processed as Gross Pay.

To run the wizard select the "TWSS Reversal > Recalculation Wizard" option in the "Company" menu as shown below;

This will open the Recalculation Wizard

Press next to select the employee's that you want to reverse - generally speaking you will be selecting them all

Press next to continue to the next step where you can specify a date range if you are only performing a partial reversal from a particular date;

Please Note: that at the moment this wizard can only calculate the PRSI that needs to be paid to Revenue, it does not as yet support the adjustment of Insurable Weeks and PRSI classes. This option will be added at a future date. For now this wizard will only calculate the PRSI due.

Press next to begin the recalculation. This recalculation does not actually change any of your Payrolls, it simply calculates the additional amounts of PRSI that would have applied if the TWSS payment was treated as Gross Pay, and the new values of PRSI are stored separately from your payslips.

You will be advised when the Wizard has completed the task;

So now that the calculations have been completed you can run the report to send to Revenue showing the details of your calculations.

There are three versions of this report;

- A detailed line by line report showing the calculations for each payslip

- A monthly report where the totals have been calculated by calendar month.

- A detail by employee where each employee is analysed separately. This shows the changes required by PRSI class also.

At this stage we suggest that you submit the first detailed report to revenue for their approval. Once they have accepted the calculations they will raise an assessment for the total amount of PRSI due.

Step 3 - Adjusting your employees PRSI Classes and insurable weeks.

The purpose of this step is to change all of your employee's J9 PRSI contributions over to whatever normal PRSI Class would have applied if TWSS was not run (usually Class A).

The second report mentioned above gives you the information needed to perform this adjustment, and they could be entered manually on ROS.

But, we are working on an update to enable you to file this adjustments through CollSoft Payroll automatically, this will be part of our Year End update which will be available early in December.

| Files | ||

|---|---|---|

| Step1.png | ||

| Step2.PNG | ||

| Step3.PNG | ||

| Step4.PNG | ||

| Step5.PNG | ||

| Step6.PNG | ||

Get help for this page

Get help for this page