Your first 2020 Payment Date

Determining the correct Payment Date for your first Payroll in 2020 is something that you should give serious consideration to in order to avoid any issues later in the year.

Many employers will be returning from their Christmas Holidays on Monday 6th January and will want to process their first 2020 payroll for either Thursday 9th or Friday 10th January.

From a Revenue perspective Payroll Week 1 covers payment dates from 1st January to 7th January, so if your first payment is on the 8th, 9th or 10th of January then technically this is Week 2.

Under the PAYE Regulations employees are actually entitled to the tax credits up to the date of payment, so, in this case such employees would be entitled to two weeks tax credits.

Employers may be tempted to ignore this and try to process these payrolls as a Week 1, but we would strongly advise against this.

Revenue have made a change to the 2020 submissions so that they now include both the payment date and the week number (in 2019 only the payment date was submitted).

Therefore if you send a submission to Revenue that states Week 1 with a Payment Date of 10th January it is likely that Revenue will follow this up with you and force you to change your submissions. This will not be an easy task to perform and it is quite likely that by the time Revenue get in contact you will be well through the 2020 tax year. This could result in you having to completely re-run your entire Payroll for 2020. There is no way that this can be automated in Payroll software - you will simply have to re-run your entire 2020 Payroll to match Revenue's requirements. Please be under no illusion - Revenue will not show any flexibility in this regard, and CollSoft will not be in a position to undertake this work for you. It will be up to you to correct.

Furthermore, Revenue may choose to look at your payments around the end of 2018 / beginning of 2019. If they find that you processed a Week 52 in 2018 but actually paid your staff in January 2019 they will make you amend your 2018 P35 and file a 2019 submission for the relevant payments. We would advise you that it is a complicated process.

Revenue have published a document outlining these particular requirements at

https://www.revenue.ie/en/employing-people/documents/pmod-topics/payment-date-alignment-and-general-issues.pdf

How To Start Your Payroll With a Week 2 Payment Date

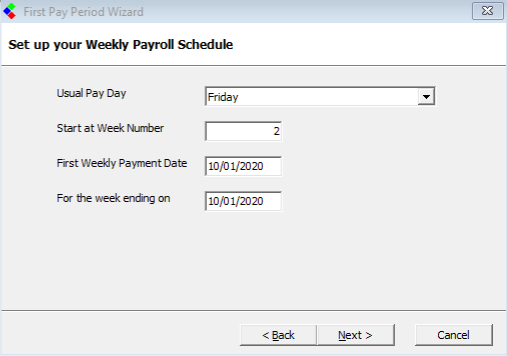

When you run your first Payroll in the software you will be shown the "First Pay Period" wizard where you will be able to specify the starting Week Number, the first Payment Date and the Period Ending Date.

To use the 10th January as your first Payment Date in 2020 you should do the following;

You are now ready to run your first 2020 Payroll.

What about Insurable Weeks?

In terms of PRSI, as the employee will not be paid in Week 1 of 2020 (3 January 2020), one of the following options should be used to correctly record the insurable weeks for PRSI purposes:

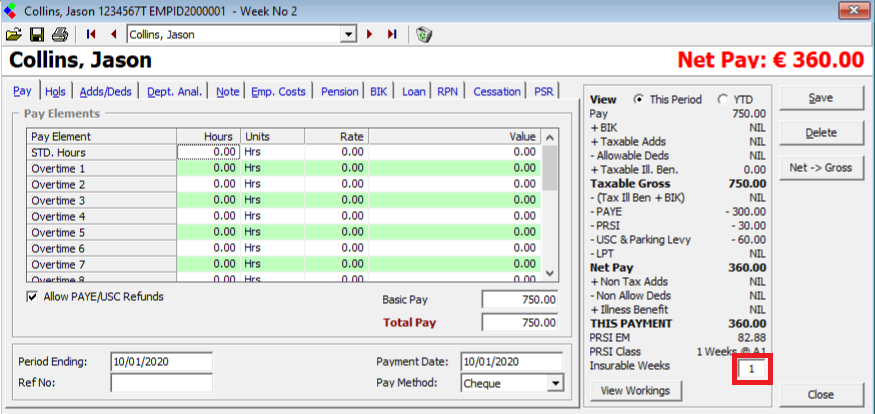

We would suggest that you take the second option and allocate 2 Insurable weeks for your wages on 10th December by editing each payroll entry and setting the "Insurable Weeks" to two as shown below;

What if you have already processed your first Period Incorrectly?

You have two options here;

The option that you choose is entirely up to you.

Option 1 requires more work on your part, but it completely corrects your Payroll record on Revenue, and leaves you in the best overall position.

Option 2 is the easier to carry out, and it will fix your Payroll records going forward. However, there is the chance that at some point Revenue will ask you to correct your Week 1 Payroll which will require some work.

We would strongly urge you to take this time now to correct your Payroll if you find yourself in this situation. Revenue will eventually catch up with you and they will make you correct your Payroll when they do. If this happens you will a lot more to do so you are not helping yourself by ignoring this issue. CollSoft will not be in a position to re-run your payrolls for you when this occurs - you will have to do it yourself.

Running a Week 53 in 2019

The only way that you can legitimately run a Week 53 in 2019 is if your normal payment date happens to fall on Tuesday 31st December. As you may be aware most employers do not pay on a Tuesday so the number of employers who can legitimately process a Week 53 in 2019 is very low.

Revenue are likely to pay very close attention to all payroll submissions that are dated the 31st December because such Payrolls are allocated an extra weeks tax credit and result in a loss of tax revenue to the state.

Remember, you have been making submissions to Revenue all year, so if your normal pay day is a Friday and you then submit a Week 53 then Revenue are going to know and they will likely be in touch.

We have also seen many customer who have processed a Week 53 in 2019 but paid their employees on 2nd or 3rd January. If you have done this then please be aware that you are in breach of the PAYE regulations and we would urge you to correct your Payroll records to correct this.

Revenue Data Quality Teams

In the middle of 2019 Revenue established a central "Data Quality Team" which was responsible for monitoring the submissions that Employers were making.

Initially they developed a set of almost 24 rules that were applied to your submissions designed to identify potential issues. The number of rules was finally reduced to 13 because some were giving false positives.

CollSoft responded with our "Data Quality Update" in November where we implemented the same rules in our software so that you could check the quality of your submissions and correct any mistakes as required.

Revenue have been following all employers whom they have identified as needing to make corrective submissions, and as anybody involved will tell you, they don't go away. Indeed, Revenue have actually gone out and visited employers to see how they run their payrolls.

In 2020 Revenue are expanding this Data Quality teams and rolling them out to all the district offices. In 2019 Revenue have put a lot of effort into trying to assists Employers with PAYE Modernisation, and in 2020 we expect that Revenue will start to shift from assistance mode to compliance mode.

Many employers will be returning from their Christmas Holidays on Monday 6th January and will want to process their first 2020 payroll for either Thursday 9th or Friday 10th January.

From a Revenue perspective Payroll Week 1 covers payment dates from 1st January to 7th January, so if your first payment is on the 8th, 9th or 10th of January then technically this is Week 2.

Under the PAYE Regulations employees are actually entitled to the tax credits up to the date of payment, so, in this case such employees would be entitled to two weeks tax credits.

Employers may be tempted to ignore this and try to process these payrolls as a Week 1, but we would strongly advise against this.

Revenue have made a change to the 2020 submissions so that they now include both the payment date and the week number (in 2019 only the payment date was submitted).

Therefore if you send a submission to Revenue that states Week 1 with a Payment Date of 10th January it is likely that Revenue will follow this up with you and force you to change your submissions. This will not be an easy task to perform and it is quite likely that by the time Revenue get in contact you will be well through the 2020 tax year. This could result in you having to completely re-run your entire Payroll for 2020. There is no way that this can be automated in Payroll software - you will simply have to re-run your entire 2020 Payroll to match Revenue's requirements. Please be under no illusion - Revenue will not show any flexibility in this regard, and CollSoft will not be in a position to undertake this work for you. It will be up to you to correct.

Furthermore, Revenue may choose to look at your payments around the end of 2018 / beginning of 2019. If they find that you processed a Week 52 in 2018 but actually paid your staff in January 2019 they will make you amend your 2018 P35 and file a 2019 submission for the relevant payments. We would advise you that it is a complicated process.

Revenue have published a document outlining these particular requirements at

https://www.revenue.ie/en/employing-people/documents/pmod-topics/payment-date-alignment-and-general-issues.pdf

How To Start Your Payroll With a Week 2 Payment Date

When you run your first Payroll in the software you will be shown the "First Pay Period" wizard where you will be able to specify the starting Week Number, the first Payment Date and the Period Ending Date.

To use the 10th January as your first Payment Date in 2020 you should do the following;

- Select the Day of the week that your employees are paid - in this example we a using Friday.

- Change the starting Week Number to 2 - you will be warned about skipping Week 1, but you can ignore this.

- The Payment Date will be automatically set to 10th January 2020 - the Friday in Week 2.

- Change the Period Ending Date to reflect the period up to which this payroll relates. This date will determine how these payrolls are reported in the various management reports within Payroll.

You are now ready to run your first 2020 Payroll.

What about Insurable Weeks?

In terms of PRSI, as the employee will not be paid in Week 1 of 2020 (3 January 2020), one of the following options should be used to correctly record the insurable weeks for PRSI purposes:

- The employer can submit a “NIL” pay value payroll submission in Week 1 (3 January 2020)showing 1 insurable week

- The employer can report 2 insurable weeks (PRSI) on the payroll submission for the Week 2 pay date (10 January 2020).

We would suggest that you take the second option and allocate 2 Insurable weeks for your wages on 10th December by editing each payroll entry and setting the "Insurable Weeks" to two as shown below;

What if you have already processed your first Period Incorrectly?

You have two options here;

- Delete your existing first Payroll run and start again. This will likely result in a different Net Pay for each employee as they will be allocated two weeks of credits when you reprocess the wages.

- Leave your first period alone, but when you run your second period skip Week 2 and process it as Week 3.

The option that you choose is entirely up to you.

Option 1 requires more work on your part, but it completely corrects your Payroll record on Revenue, and leaves you in the best overall position.

Option 2 is the easier to carry out, and it will fix your Payroll records going forward. However, there is the chance that at some point Revenue will ask you to correct your Week 1 Payroll which will require some work.

We would strongly urge you to take this time now to correct your Payroll if you find yourself in this situation. Revenue will eventually catch up with you and they will make you correct your Payroll when they do. If this happens you will a lot more to do so you are not helping yourself by ignoring this issue. CollSoft will not be in a position to re-run your payrolls for you when this occurs - you will have to do it yourself.

Running a Week 53 in 2019

The only way that you can legitimately run a Week 53 in 2019 is if your normal payment date happens to fall on Tuesday 31st December. As you may be aware most employers do not pay on a Tuesday so the number of employers who can legitimately process a Week 53 in 2019 is very low.

Revenue are likely to pay very close attention to all payroll submissions that are dated the 31st December because such Payrolls are allocated an extra weeks tax credit and result in a loss of tax revenue to the state.

Remember, you have been making submissions to Revenue all year, so if your normal pay day is a Friday and you then submit a Week 53 then Revenue are going to know and they will likely be in touch.

We have also seen many customer who have processed a Week 53 in 2019 but paid their employees on 2nd or 3rd January. If you have done this then please be aware that you are in breach of the PAYE regulations and we would urge you to correct your Payroll records to correct this.

Revenue Data Quality Teams

In the middle of 2019 Revenue established a central "Data Quality Team" which was responsible for monitoring the submissions that Employers were making.

Initially they developed a set of almost 24 rules that were applied to your submissions designed to identify potential issues. The number of rules was finally reduced to 13 because some were giving false positives.

CollSoft responded with our "Data Quality Update" in November where we implemented the same rules in our software so that you could check the quality of your submissions and correct any mistakes as required.

Revenue have been following all employers whom they have identified as needing to make corrective submissions, and as anybody involved will tell you, they don't go away. Indeed, Revenue have actually gone out and visited employers to see how they run their payrolls.

In 2020 Revenue are expanding this Data Quality teams and rolling them out to all the district offices. In 2019 Revenue have put a lot of effort into trying to assists Employers with PAYE Modernisation, and in 2020 we expect that Revenue will start to shift from assistance mode to compliance mode.

| Files | ||

|---|---|---|

| FirstPayrollPeriodA.png | ||

| InsurableWeeks.png | ||

Get help for this page

Get help for this page