How to Change the PPSN for a wage entry

From time to time you may find that you have created an employee but used the wrong PPS number for that Employee, and indeed you may have even made Payroll Submissions to Revenue using the wrong PPSN.

Obviously, it is very important that this error is corrected both in your Payroll Software and on Revenue's records.

This article explains the procedure for changing a PPSN for a particular wage entry.

The steps in this procedure are to correct the PPSN on the Employee's record in CollSoft or update the wage with a PPSN to submit to Revenue.

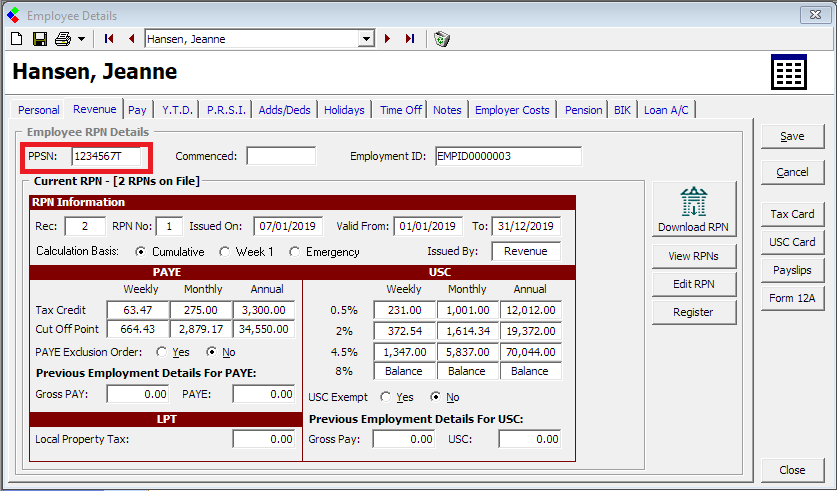

Open the "Employee Details" screen for the relevant employee.

You will see that in this case, the Employee has a PPSN of "1234567T" which was incorrect. However, this was not picked up until after wages had been run (and perhaps submitted to Revenue)

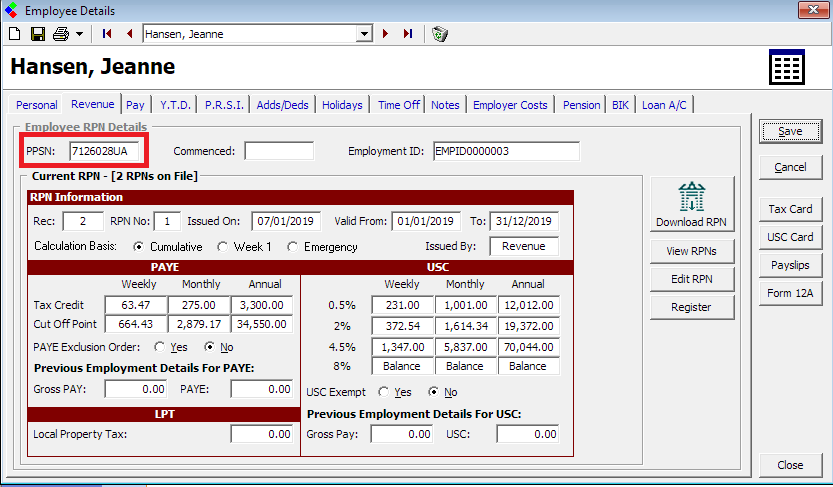

So the first thing that we need to do is to enter the correct PPSN on the Employee file and save the changes as shown below.

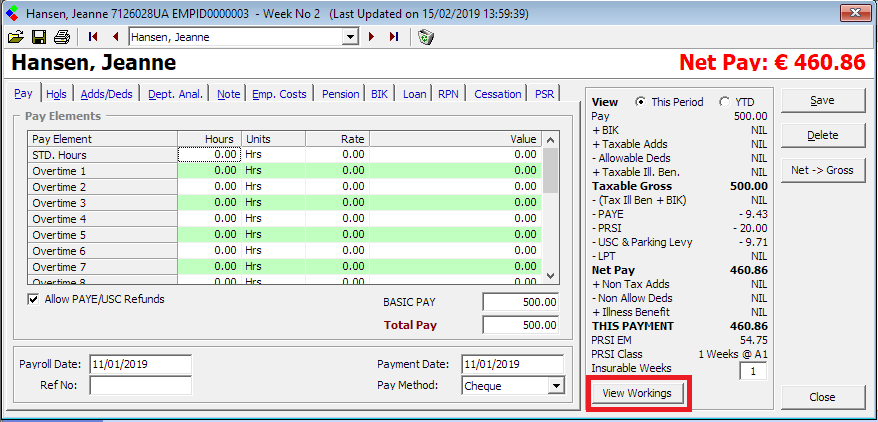

Then you will need to open any relevant wage entries and press the "View Workings" button

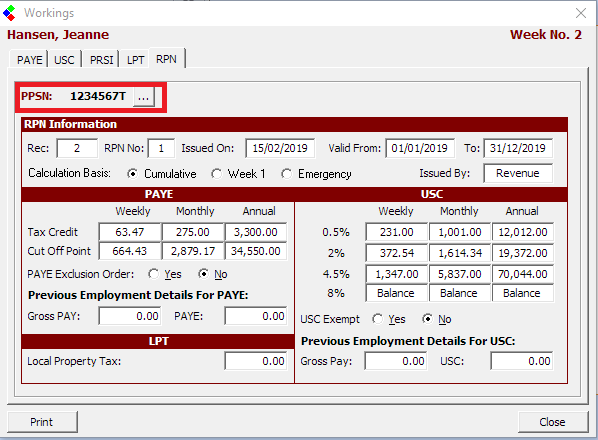

On the "View Workings" screen click into the "RPN" tab.

You will see the PPSN shown at the top of the screen, and if the PPSN saved for the wage is different from the PPSN on the Employee file you will see a small button beside it.

Pressing this button will update the PPSN on the wage to be the same as the PPSN on the Employee file.

When you press this button you will be asked if you are sure that you want to update the PPSN. Select YES to complete the process.

The PPSN stored on the wage will now be the same as the Employee file.

If you had previously submitted this wage to Revenue you will need to make another submission to reflect this correction, simply follow the PSR wizard for the payroll period as per normal.

You will need to repeat this process for all wage entries that have the incorrect PPSN.

Obviously, it is very important that this error is corrected both in your Payroll Software and on Revenue's records.

This article explains the procedure for changing a PPSN for a particular wage entry.

The steps in this procedure are to correct the PPSN on the Employee's record in CollSoft or update the wage with a PPSN to submit to Revenue.

Open the "Employee Details" screen for the relevant employee.

You will see that in this case, the Employee has a PPSN of "1234567T" which was incorrect. However, this was not picked up until after wages had been run (and perhaps submitted to Revenue)

So the first thing that we need to do is to enter the correct PPSN on the Employee file and save the changes as shown below.

Then you will need to open any relevant wage entries and press the "View Workings" button

On the "View Workings" screen click into the "RPN" tab.

You will see the PPSN shown at the top of the screen, and if the PPSN saved for the wage is different from the PPSN on the Employee file you will see a small button beside it.

Pressing this button will update the PPSN on the wage to be the same as the PPSN on the Employee file.

When you press this button you will be asked if you are sure that you want to update the PPSN. Select YES to complete the process.

The PPSN stored on the wage will now be the same as the Employee file.

If you had previously submitted this wage to Revenue you will need to make another submission to reflect this correction, simply follow the PSR wizard for the payroll period as per normal.

You will need to repeat this process for all wage entries that have the incorrect PPSN.

| Files | ||

|---|---|---|

| Image1.png | ||

| Image2.png | ||

| Image3.png | ||

| Image4.png | ||

Get help for this page

Get help for this page