PHI / Income Protection Policies - Employer Contributions

In relation to the Income Protection Payments, if these are to be recorded as a Benefit in Kind then they must follow the Benefit in Kind rules as set out in Revenue's guidelines, which states to deduct PAYE, USC and PRSI.

Further information can be found on the Revenue website to determine the correct treatment at Permanent Health Benefit Contributions

Excerpt from this section of the Revenue website states the following:

Employer Contribution

Your employer may contribute to an approved scheme on your behalf. You must pay USC on these contributions.

PAYE and PRSI does not need to be paid on a Revenue approved policy or scheme unless the combined contribution (employee and employer) does not exceed the 10% of the employee's income. Any excess over 10% should be put through the payroll and PAYE and PRSI paid in that amount.

Where the premiums are for an unapproved policy or scheme, the premiums paid by the employer are taxable as Benefit in Kind

Your accountant/financial advisor will guide you to the best treatment, based on this professional guidance the three options to record the employer contribution:

Based on which of the above the Employers Income Protection Contribution falls into, I have set-out how to setup each of the above within CollSoft Payroll.

1. APPROVED SCHEME - DEDUCT USC CONTRIBUTIONS (not Benefit in Kind)

You must set up a Company Addition to be used at Employee level which will a) increase the wages subject to USC and b) back it out so that there is no additional payment to the employee. To do this:

Company Setup

Employee Setup

Wage Entry

2. APPROVED SCHEME; EXCEEDS 10% OF EMPLOYEES INCOME - DEDUCT PAYE, PRSI AND USC (not Benefit in Kind)

You must set up a Company Addition to be used at Employee level which will a) increase the wages subject to PAYE, PRSI and USC and b) back it out so that there is no additional payment to the employee. To do this:

Company Setup

Follow the steps from number one above to enter the contribution against the employee set-up and wage entry.

3. UNAPPROVED SCHEME - DEDUCT PAYE, PRSI AND USC (Benefit in Kind)

In the circumstance where the contribution is actually categorised as a Benefit In Kind, then the PHI/Income Protection Contribution can be set up in the dedicated Benefit in Kind section. To do this:

Company BIK Setup

Employee Setup

Wage Entry

This BIK item will be identified at the end of year return as a BIK item and reported in the BIK reporting fields at both company and employee level.

It is important that an item is only recorded as Benefit in Kind if it is actually Benefit in Kind, as Benefit in Kind is reported on, at year end.

Your accountant/financial advisor is best placed to determine the correct method from the above to adopt.

Further information can be found on the Revenue website to determine the correct treatment at Permanent Health Benefit Contributions

Excerpt from this section of the Revenue website states the following:

Employer Contribution

Your employer may contribute to an approved scheme on your behalf. You must pay USC on these contributions.

PAYE and PRSI does not need to be paid on a Revenue approved policy or scheme unless the combined contribution (employee and employer) does not exceed the 10% of the employee's income. Any excess over 10% should be put through the payroll and PAYE and PRSI paid in that amount.

Where the premiums are for an unapproved policy or scheme, the premiums paid by the employer are taxable as Benefit in Kind

Your accountant/financial advisor will guide you to the best treatment, based on this professional guidance the three options to record the employer contribution:

- Approved Scheme - Pay USC Contributions (not Benefit in Kind)

- Approved Scheme, exceeds 10% of employees income - Pay PAYE, PRSI and USC (not Benefit in Kind)

- Unapproved Scheme - Pay PAYE, PRSI and USC (Benefit in Kind)

Based on which of the above the Employers Income Protection Contribution falls into, I have set-out how to setup each of the above within CollSoft Payroll.

1. APPROVED SCHEME - DEDUCT USC CONTRIBUTIONS (not Benefit in Kind)

You must set up a Company Addition to be used at Employee level which will a) increase the wages subject to USC and b) back it out so that there is no additional payment to the employee. To do this:

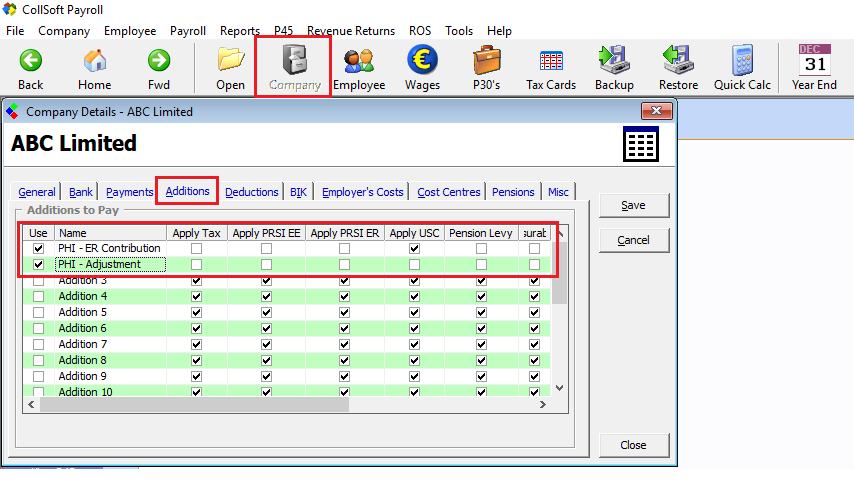

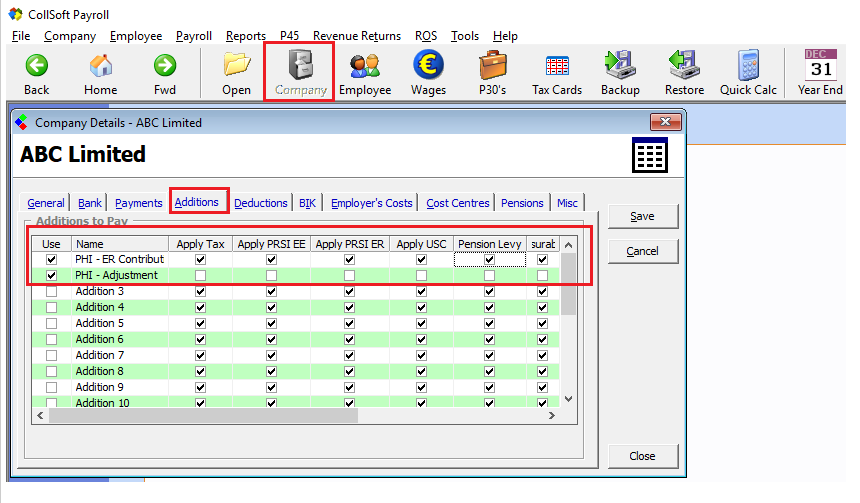

Company Setup

- Open the Company Details screen.

- Select the Additions tab so that two Additions can be customised for this specific item.

- Setup the first addition entering a name which will make it easily identifiable, e.g. PHI - ER Contribution. Ensure all items are unflagged EXCEPT USC so that USC will be deducted on it.

- Setup a second addition which will back out the original addition to ensure that it is not included in the Net Pay without affecting the USC calculation, customise it to make it easily identifiable e.g. PHI - Adjustment. Ensure ALL PAYE, PRSI AND USC items are unflagged.

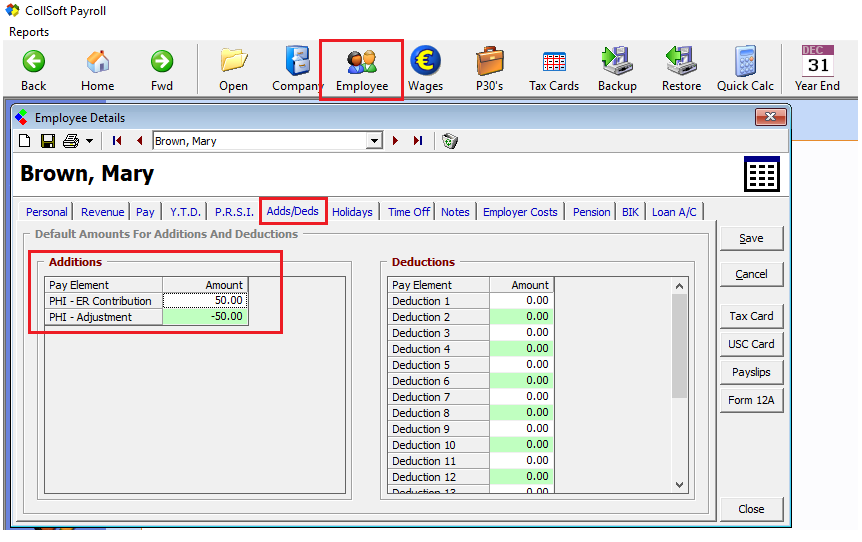

Employee Setup

- Open the Employee record

- Select the Employees Additions tab. You will see the two additions setup at Company level.

- In the first Addition, enter the periodical amount from which USC is to be deducted (i.e. if weekly payroll, enter the weekly equivalent contribution).

- In the second Addition, enter the same value as a negative value.

- This will have the effect of increasing the amount subject to USC but then backing out the amount so that it is not in NET pay but without reversing the USC charge.

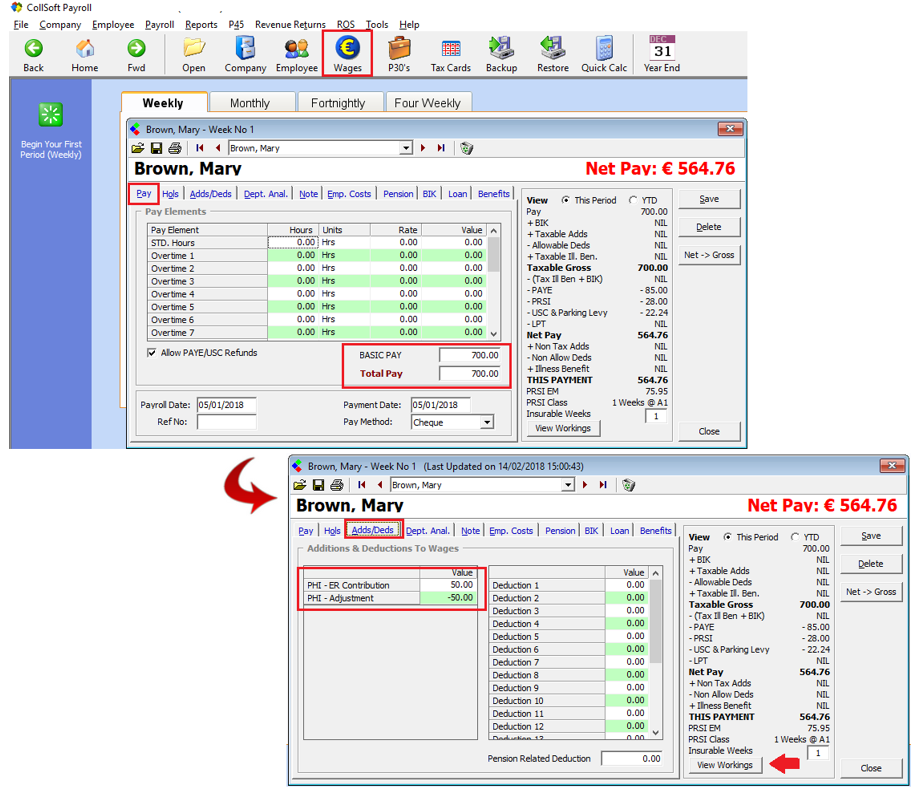

Wage Entry

- Open the Wage Entry by clicking on the Wage icon.

- View the Pay tab which will display the normal periodical wage entry (either as Basic Pay or hours worked)

- Select the Additions tab. You will see the periodical PHI/Income Protection Contribution.

- Open the View Workings.

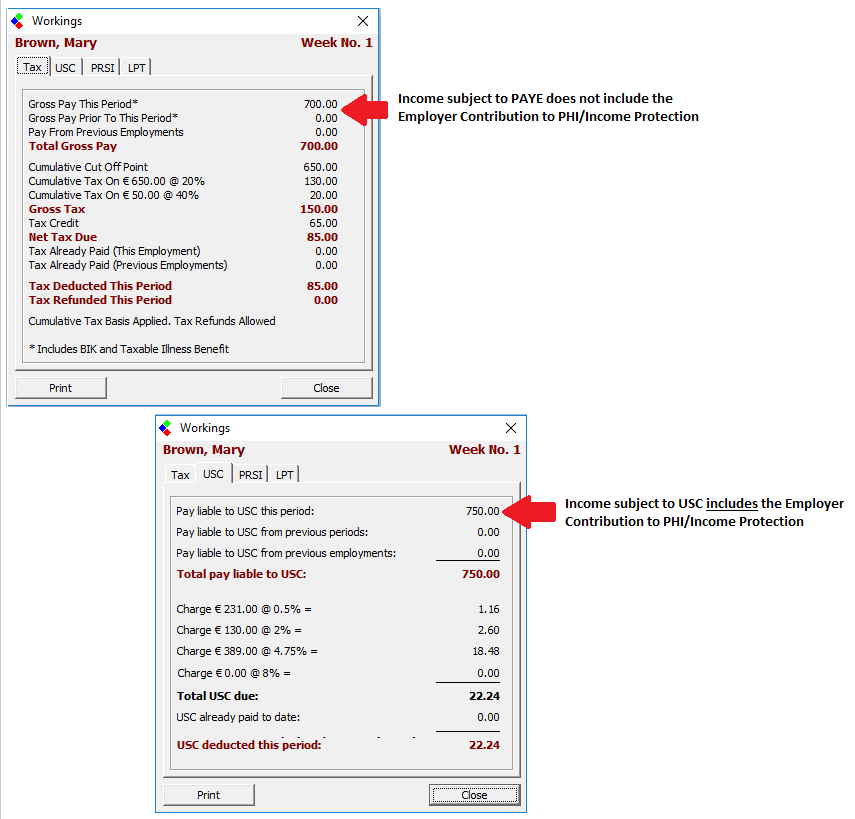

- The Income subject to PAYE and PRSI for the period will reflect the Basic Wage

- The Income subject to USC for the period will reflect the Basic Wage + PHI/Income Protection contribution

2. APPROVED SCHEME; EXCEEDS 10% OF EMPLOYEES INCOME - DEDUCT PAYE, PRSI AND USC (not Benefit in Kind)

You must set up a Company Addition to be used at Employee level which will a) increase the wages subject to PAYE, PRSI and USC and b) back it out so that there is no additional payment to the employee. To do this:

Company Setup

- Open the Company Details screen.

- Select Additions so that two Additions can be customised for this specific item.

- Setup the first addition entering a name which will make it easily identifiable, e.g. PHI - ER Contribution. Ensure all items are flagged; PAYE, PRSI and USC

- Setup a second addition which will back out the original addition to ensure that it is not included in the Net Pay without affecting the PAYE, PRSI and USC calculation, customise it to make it easily identifiable e.g. PHI - Adjustment. Ensure ALL PAYE, PRSI AND USC items are unflagged.

Follow the steps from number one above to enter the contribution against the employee set-up and wage entry.

3. UNAPPROVED SCHEME - DEDUCT PAYE, PRSI AND USC (Benefit in Kind)

In the circumstance where the contribution is actually categorised as a Benefit In Kind, then the PHI/Income Protection Contribution can be set up in the dedicated Benefit in Kind section. To do this:

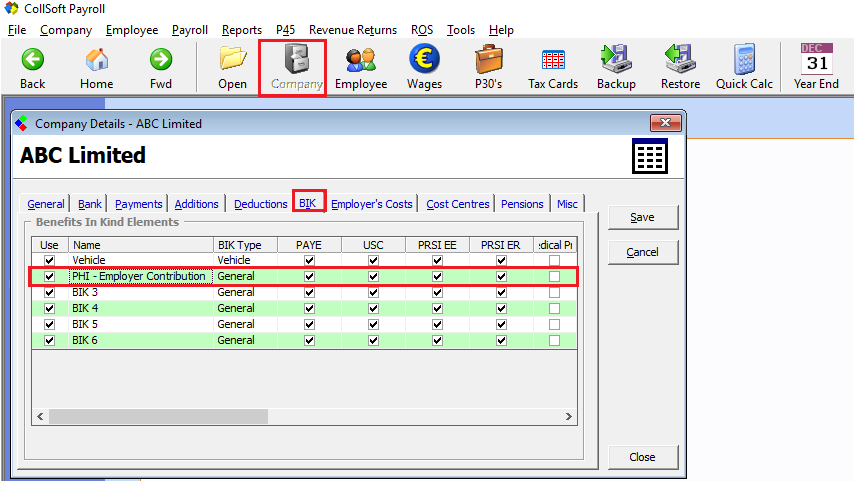

Company BIK Setup

- Open the Company Details screen.

- Select BIK section.

- Select an available Benefit item and rename it which will make it easily identifiable, e.g. PHI - ER Contribution. Ensure all items are flagged PAYE, PRSI, USC

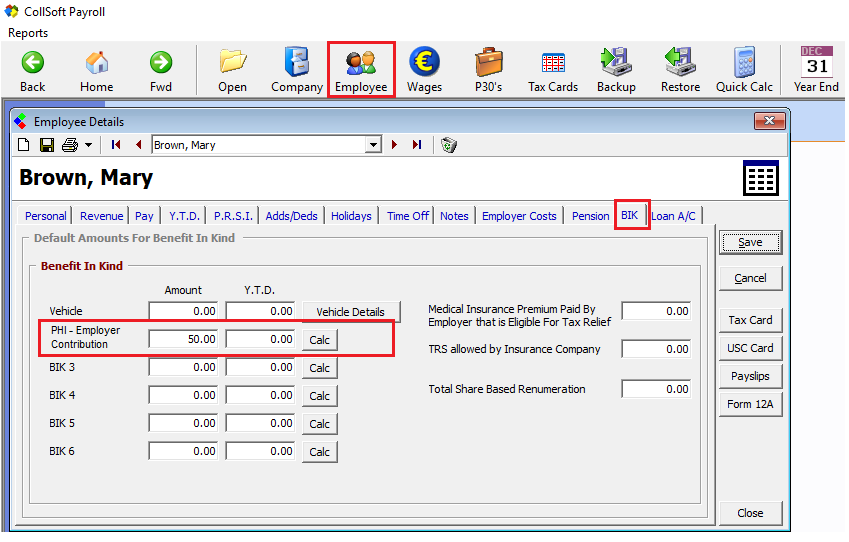

Employee Setup

- Open the Employee record

- Select the Employees BIK.

- Enter the periodical amount (in line with the pay frequency) which is to be treated as BIK and included in each wage entry hereafter.

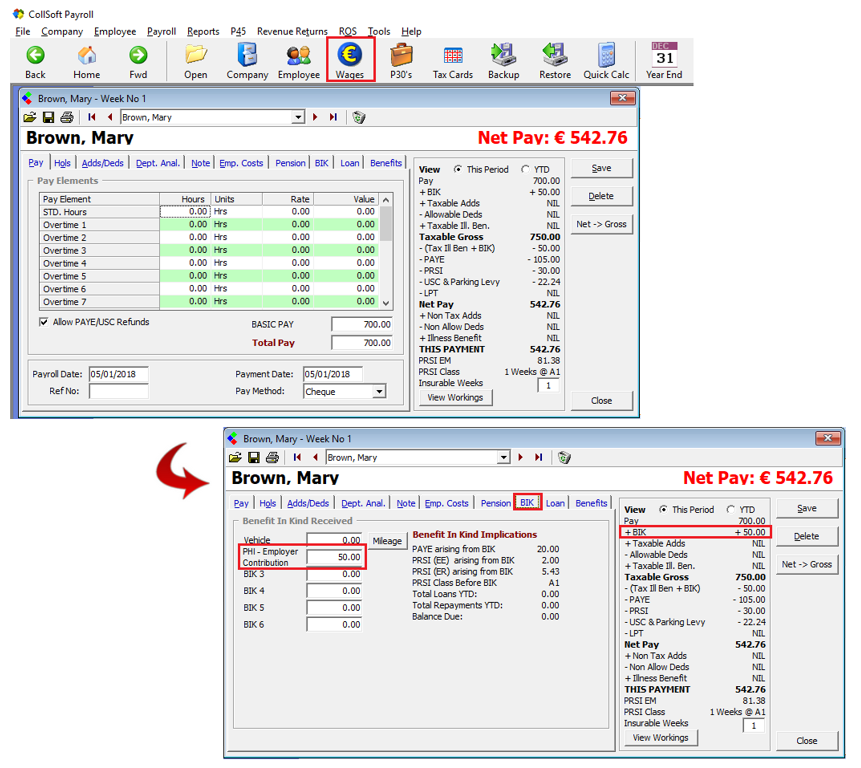

Wage Entry

- Open the Wage Entry

- View the Pay tab which will display the normal periodical wage entry (either as Basic Pay or hours worked)

- Select the BIK tab. You will see the periodical PHI/Income Protection Contribution.

- The Wage calculation will include the BIK amount in order to deduct PAYE, PRSI and USC on the contribution.

This BIK item will be identified at the end of year return as a BIK item and reported in the BIK reporting fields at both company and employee level.

It is important that an item is only recorded as Benefit in Kind if it is actually Benefit in Kind, as Benefit in Kind is reported on, at year end.

Your accountant/financial advisor is best placed to determine the correct method from the above to adopt.

Get help for this page

Get help for this page