Employees Commencing Employment

For PAYE purposes a new employee is one who takes up employment or resumes employment after a previous cessation of employment. It also includes a company director who may previously have been self-employed.

If the employer is aware that the new employee was not previously employed (for example a school-leaver), the employee should be advised to enter the details of the job online through the Jobs and Pensions service in myAccount. The employee will need to register for myAccount to use the Jobs and Pensions service. Shortly afterwards a tax credit certificate will be made available to the employer.

Registering a new Employee on ROS

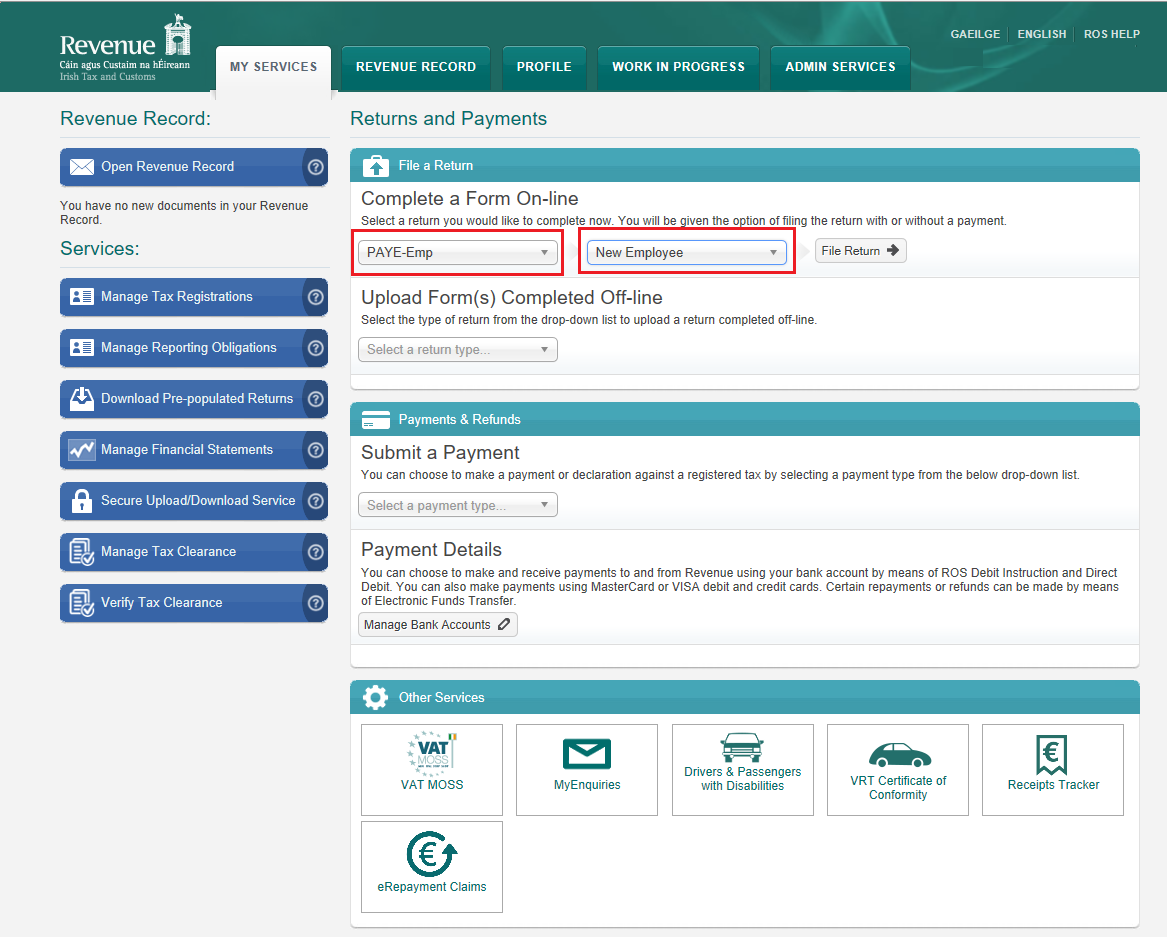

ROS - Select to register new employee

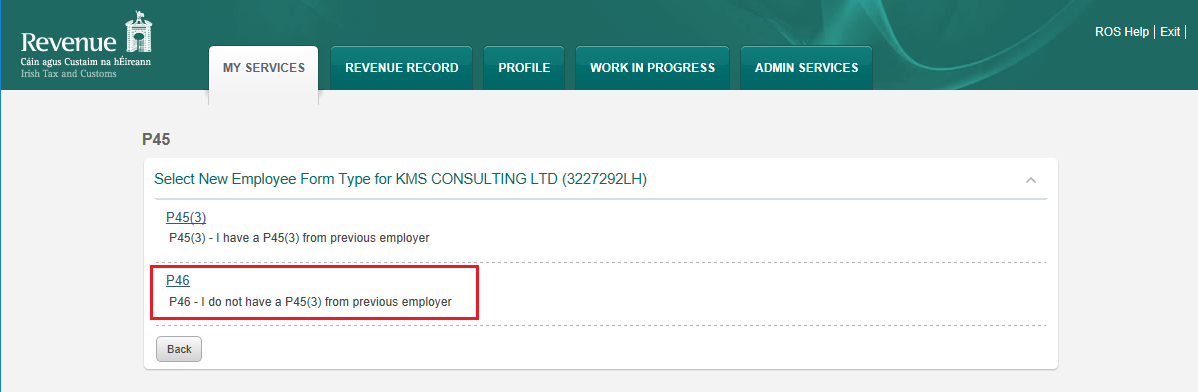

On the subsequent ROS screen, you will be given two options, either P45(3) and P46.

Choose the relevant return type based on the information to hand;

P46: ROS - Select P46 submission

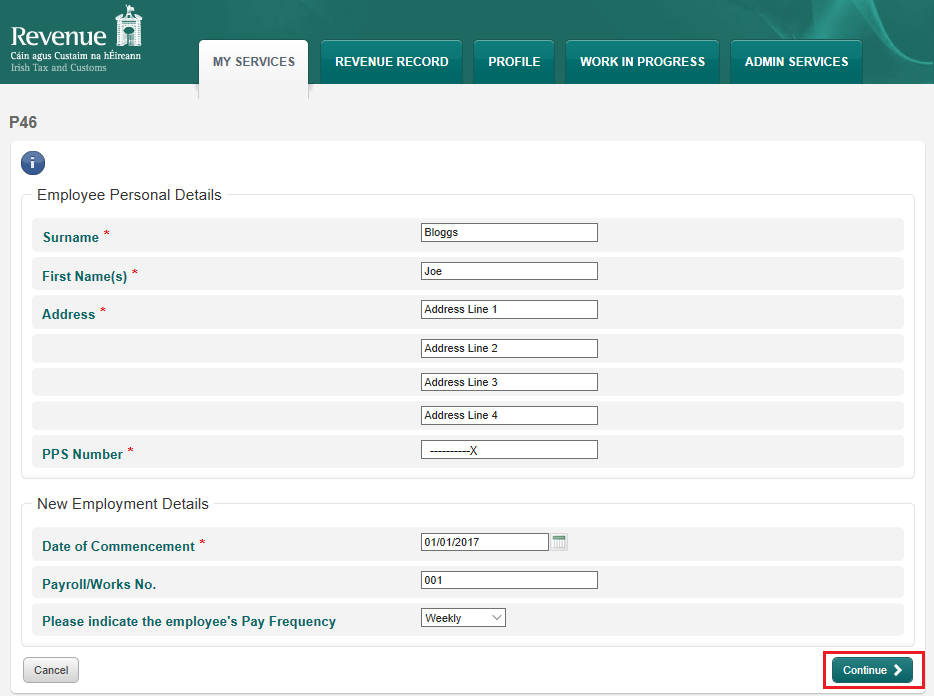

P46: ROS - Submit the P46

NEW EMPLOYEES ON THE P35

Where an employer includes a new employee on the P35, without previous notification (i.e. a P46 or P45P3) to Revenue, the employer is still required to submit the commencement notification to Revenue.

The Revenue do not record the commencement of the employment from the P35, therefore a tax credit certificate (P2C) will not issue for the employee in question for the new tax year.

The employer must make a P46 submission on the 01st January of the new tax year for all such employees.

If the employer is aware that the new employee was not previously employed (for example a school-leaver), the employee should be advised to enter the details of the job online through the Jobs and Pensions service in myAccount. The employee will need to register for myAccount to use the Jobs and Pensions service. Shortly afterwards a tax credit certificate will be made available to the employer.

Registering a new Employee on ROS

- Log on to your ROS Secure Account.

- On the main 'My Services' section of your ROS Account, from the 'File a Return' section choose to 'Complete a Form On-line'

- From the drop down menu choose the tax type 'PAYE-Emp', select 'New Employee'

- Choose 'File Return'

ROS - Select to register new employee

On the subsequent ROS screen, you will be given two options, either P45(3) and P46.

Choose the relevant return type based on the information to hand;

- P45P3 - if you have a P45 from the previous employer

- P46 - where you do not have a P45 from the previous employer or the employee was not previously employed.

P46: ROS - Select P46 submission

- Enter the new employee details, you must include the employees PPSN.

- Once complete select 'Continue' to complete the registration submission.

P46: ROS - Submit the P46

NEW EMPLOYEES ON THE P35

Where an employer includes a new employee on the P35, without previous notification (i.e. a P46 or P45P3) to Revenue, the employer is still required to submit the commencement notification to Revenue.

The Revenue do not record the commencement of the employment from the P35, therefore a tax credit certificate (P2C) will not issue for the employee in question for the new tax year.

The employer must make a P46 submission on the 01st January of the new tax year for all such employees.

| Files | ||

|---|---|---|

| 1. Select to register new employee.png | ||

| 2. Select P46.png | ||

| 3. Complete Online form and submit.png | ||

Get help for this page

Get help for this page