Share Based Remuneration - Setting up the Benefit in Kind

The net value of Share Based Remuneration (i.e. the gain or benefit arising for an employee on the acquisition of the shares) is to be treated as notional pay for the purposes of calculating employee PRSI only. Employer PRSI is not chargeable on gains from Share Based Remuneration.

The net value means the difference between the market value of the shares awarded and the amount paid by the employee for the shares, where this results in a discount price on the shares, it is this 'discount' which is deemed to give rise to a benefit to the employee. Revenue has issued a specific Tax Manual in relation to Share Based Remuneration.

Any gains arising from the disposal of the shares (proceeds less cost & qualifying expenses) is within the scope of Capital Gains Tax and is not relevant in the context of Share Based Remuneration.

PROCESSING SHARE BASED REMUNERATION IN COLLSOFT

Once an employee and employer enter into a shares agreement, the employer must establish which if the categories the share falls into; Share Based Remuneration or a Share option. Once confirmed the employer will identify if it falls into the PAYE collection system and their obligations to deduct and remit the necessary PAYE, USC and PRSI derived from the resulting gains on exercise/vesting.

Recording share gains in CollSoft in order to make the necessary deduction the gains would be treated as a Benefit in Kind.

To apply the correct treatment of PAYE, USC, and EmployEE PRSI (but not EmployER PRSI) CollSoft offers a specific Share Based Remuneration flag within Benefit settings.

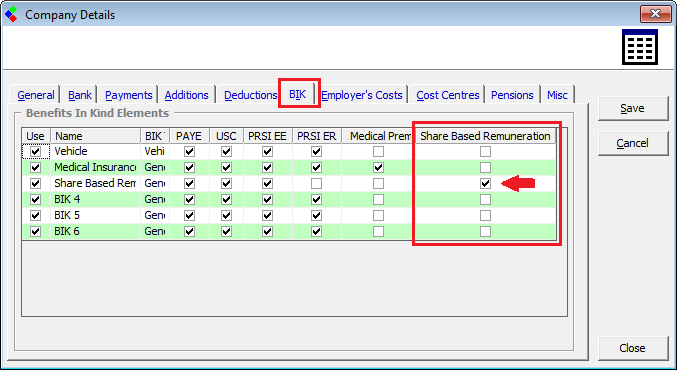

The first step is to assign a Benefit in Kind setting to 'Share Based Remuneration' at the Company level.

ASSIGN A BIK ELEMENT TO TREAT SHARE BASED REMUNERATION

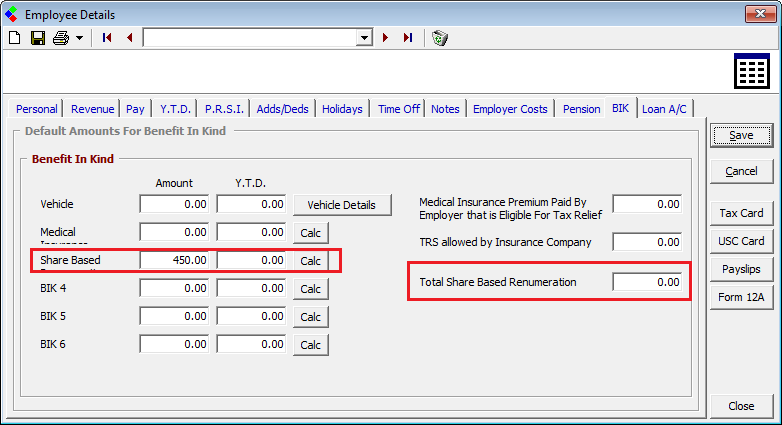

Share Based Remuneration: Enter the periodical amount to the Employee Record

NOTE: It is important to flag the specific 'Share Based Remuneration' indicator in order to a) apply the correct PRSI treatment and b) to fulfill your obligations to correctly report Share Based Remuneration. If this indicator is not Flagged your P35 may fail validation.

UPDATE THE EMPLOYEE RECORD WITH THE PERIODICAL VALUE

Now that there is a dedicated BIK element, the notional value of the associated share remuneration should be captured within the employees periodical payroll to which it relates (the appropriate date to make the deductions should be decided on based on the circumstance in compliance with the Revenue rules for remittance).

Share Based Remuneration: Enter the periodical amount to the Employee Record

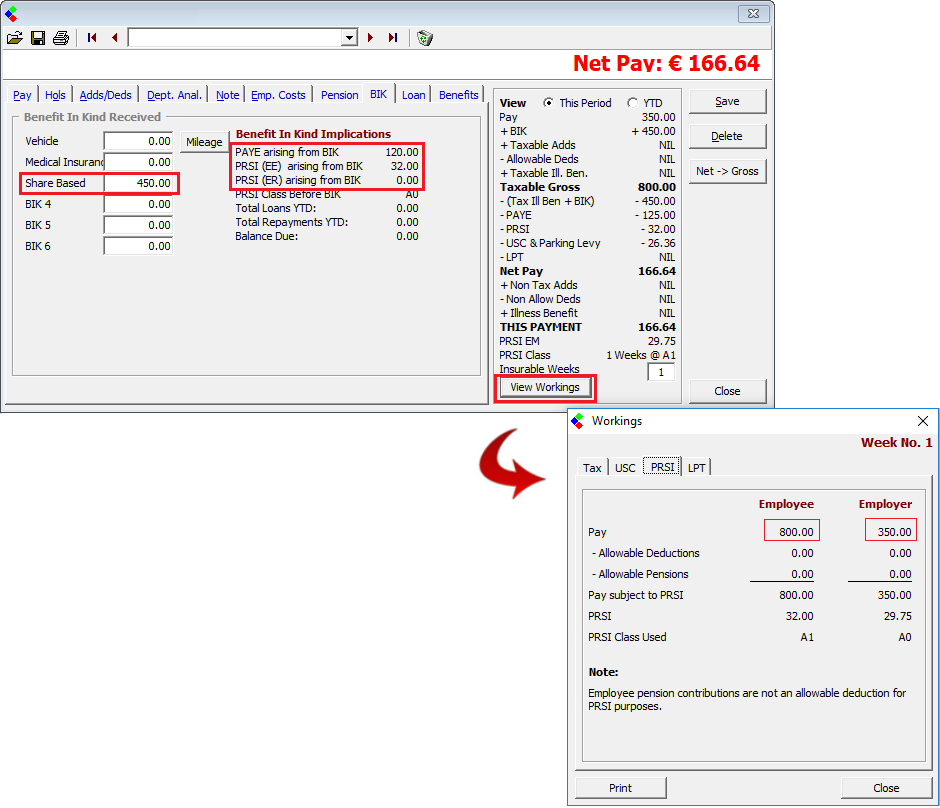

PAYSLIP PROCESSING WITH SHARE BASED REMUNERATION

From the above settings, the Share Based Remuneration benefit value will be included in each periodical payroll.

As explained earlier, the Employee PRSI subclass may differ to the Employer PRSI subclass as the amounts subject to employee and employer PRSI now differ.

Share Based Remuneration: Enter a value to the employees payroll

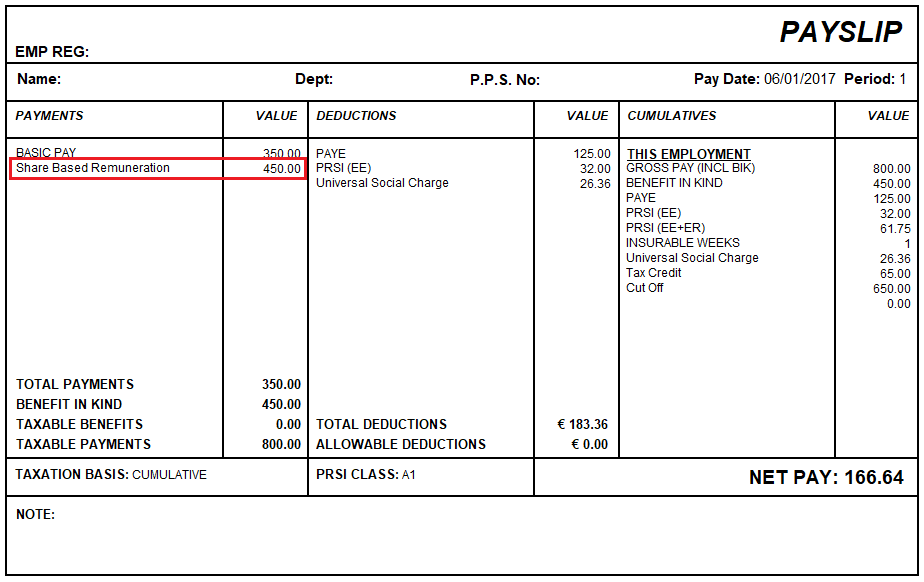

The Benefit captured will be itemised on the employees payslip, as shown below.

Share Based Remuneration: Employee payslip itemising the gain

The deductions made from the gain in this manner will flow through to the P30 for inclusion in the subsequent P30 return to be made to Revenue.

The net value means the difference between the market value of the shares awarded and the amount paid by the employee for the shares, where this results in a discount price on the shares, it is this 'discount' which is deemed to give rise to a benefit to the employee. Revenue has issued a specific Tax Manual in relation to Share Based Remuneration.

Any gains arising from the disposal of the shares (proceeds less cost & qualifying expenses) is within the scope of Capital Gains Tax and is not relevant in the context of Share Based Remuneration.

PROCESSING SHARE BASED REMUNERATION IN COLLSOFT

Once an employee and employer enter into a shares agreement, the employer must establish which if the categories the share falls into; Share Based Remuneration or a Share option. Once confirmed the employer will identify if it falls into the PAYE collection system and their obligations to deduct and remit the necessary PAYE, USC and PRSI derived from the resulting gains on exercise/vesting.

Recording share gains in CollSoft in order to make the necessary deduction the gains would be treated as a Benefit in Kind.

To apply the correct treatment of PAYE, USC, and EmployEE PRSI (but not EmployER PRSI) CollSoft offers a specific Share Based Remuneration flag within Benefit settings.

The first step is to assign a Benefit in Kind setting to 'Share Based Remuneration' at the Company level.

ASSIGN A BIK ELEMENT TO TREAT SHARE BASED REMUNERATION

- Select Company> Edit Company>

- Select the BIK (Benefit in Kind) tab from this Company screen

- Rename a BIK element to easily identify it's purpose, e.g. Share Based Remuneration, this will also display on the employee's payslip

- Flag the dedicated Share Based Remuneration flag against the Benefit item you have assigned for this purpose

- The benefit will automatically unflag Employer PRSI as this particular benefit type is not subject to Employer PRSI (refer to article Share Based Remuneration for further information)

Share Based Remuneration: Enter the periodical amount to the Employee Record

NOTE: It is important to flag the specific 'Share Based Remuneration' indicator in order to a) apply the correct PRSI treatment and b) to fulfill your obligations to correctly report Share Based Remuneration. If this indicator is not Flagged your P35 may fail validation.

UPDATE THE EMPLOYEE RECORD WITH THE PERIODICAL VALUE

Now that there is a dedicated BIK element, the notional value of the associated share remuneration should be captured within the employees periodical payroll to which it relates (the appropriate date to make the deductions should be decided on based on the circumstance in compliance with the Revenue rules for remittance).

- Select the Employee record

- Select the BIK tab

- The previously assigned BIK element will be displayed by the name allocated at Company level

- Enter the periodical value as appropriate to the pay frequency

- The 'Total Share Based Remuneration' field will automate the year to date total as each wage period is processed.

Share Based Remuneration: Enter the periodical amount to the Employee Record

PAYSLIP PROCESSING WITH SHARE BASED REMUNERATION

From the above settings, the Share Based Remuneration benefit value will be included in each periodical payroll.

- Select the Employees periodical payslip

- Select the BIK tab

- The previously assigned BIK element will be displayed by the name allocated at Company level

- The periodical value added to the Employee record will display.

- A summary of the Benefit PAYE and PRSI implications will be calculated on screen

- The calculation of the PRSI can be further viewed by choosing to 'View Workings'

As explained earlier, the Employee PRSI subclass may differ to the Employer PRSI subclass as the amounts subject to employee and employer PRSI now differ.

Share Based Remuneration: Enter a value to the employees payroll

The Benefit captured will be itemised on the employees payslip, as shown below.

Share Based Remuneration: Employee payslip itemising the gain

The deductions made from the gain in this manner will flow through to the P30 for inclusion in the subsequent P30 return to be made to Revenue.

| Files | ||

|---|---|---|

| Assign BIK at Company Level.png | ||

| Final Payslips.png | ||

| Payslip Working.png | ||

| Setting up periodical amount.png | ||

Get help for this page

Get help for this page