Share Based Remuneration - P35 Reporting

Below you will find information specific to the reporting of Share Based Remuneration on the 2018 P35.

2018 P35 Reporting of Share Based Remuneration

The 2018 P35 has been updated to include the reporting of Share Based Remuneration on an employee by employee basis, and in total, for the company. In order to correctly itemise this Benefit at each employee level, an indicator is required to identify the Benefit used to record this item.

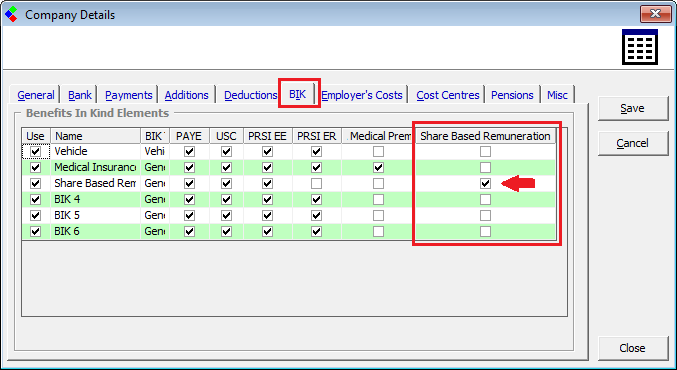

A new indicator has been added to the Company Benefit Settings, similar to the Medical Insurance indicator, in order to identify the required Share Based benefit.

For historical and future periods, indicators must be flagged, as appropriate, against associated benefits.

Advanced notice was issued by Revenue in relation to the new reporting requirement, Revenue have also published a tax manual in relation to the tax treatment of Share Based Remuneration.

P35 not completing due to a Share Based Remuneration warning

If a Benefit has been setup with an instruction not to charge Employer PRSI (i.e. Employer PRSI is unflagged in Company Benefits setup) AND without the Share based Remuneration flag then CollSoft will automatically prevent the completion of the P35 routine.

The only Benefit in Kind which is not subject to Employer PRSI is Share Based Remuneration, in order to report it correctly on the P35 then you must also flag the BIK item as Share Based Remuneration.

Flagging the Benefit as Share Based Remuneration:

Share Based Remuneration - P35 Reporting: Flagging the Benefit Item as Share Based

Note : If you are looking for more information on what is deemed to fulfil the necessary criteria of for more detailed information please refer to the CollSoft Knowledgebase article 'Share Based Remuneration'

2018 P35 Reporting of Share Based Remuneration

The 2018 P35 has been updated to include the reporting of Share Based Remuneration on an employee by employee basis, and in total, for the company. In order to correctly itemise this Benefit at each employee level, an indicator is required to identify the Benefit used to record this item.

A new indicator has been added to the Company Benefit Settings, similar to the Medical Insurance indicator, in order to identify the required Share Based benefit.

For historical and future periods, indicators must be flagged, as appropriate, against associated benefits.

Advanced notice was issued by Revenue in relation to the new reporting requirement, Revenue have also published a tax manual in relation to the tax treatment of Share Based Remuneration.

P35 not completing due to a Share Based Remuneration warning

If a Benefit has been setup with an instruction not to charge Employer PRSI (i.e. Employer PRSI is unflagged in Company Benefits setup) AND without the Share based Remuneration flag then CollSoft will automatically prevent the completion of the P35 routine.

The only Benefit in Kind which is not subject to Employer PRSI is Share Based Remuneration, in order to report it correctly on the P35 then you must also flag the BIK item as Share Based Remuneration.

Flagging the Benefit as Share Based Remuneration:

- Select Company> Edit Company>

- Select the BIK (Benefit in Kind) tab from this Company screen

- Identify the benefit which has been used to record Share Based Remuneration.

- Flag the dedicated Share Based Remuneration indicator against the identified Benefit.

- Select Save to update your amendment.

Share Based Remuneration - P35 Reporting: Flagging the Benefit Item as Share Based

Note : If you are looking for more information on what is deemed to fulfil the necessary criteria of for more detailed information please refer to the CollSoft Knowledgebase article 'Share Based Remuneration'

| Files | ||

|---|---|---|

| Assign BIK at Company Level.png | ||

Get help for this page

Get help for this page