Redundancy Payments

For any taxable portion of Redundancy payments, these should be set up as a 'Taxable Addition'. Where Statutory Redundancy is paid which satisfies eligibility to be tax free then this should be set up as a 'Non-Taxable Addition'

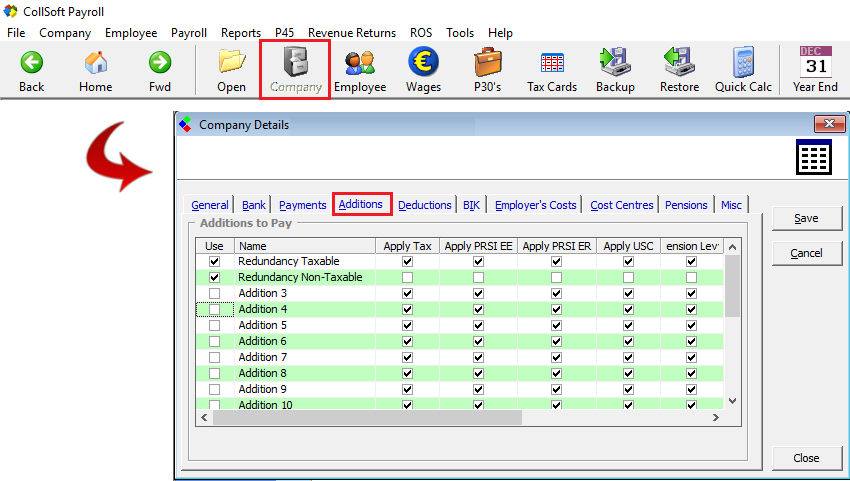

Set up an Addition at Company Level

Choose to edit the company details by either selecting Company> Edit Company> from the menu bar or by selecting the Company quick access icon.

Click on the Additions Tab on the Company Details screen to access the Additions section.

CollSoft Payroll allows you to create up to twenty custom payment categories (in addition to the standard types of pay) called Additions. Each addition can be pre-set to be taxable or non-taxable (i.e. tax free).

You must create these Addition categories for the company before you can use them in your wages.

To create a new Addition or edit those supplied already, simply follow the instructions below:

Taxable: simply flag each tax to apply it to the Addition. (Taxable Redundancy Payments)

Non-Taxable: unflag each tax that is not applicable to the Addition (Non-Taxable Redundancy Payments)

Redundancy Payments: Company Level Addition

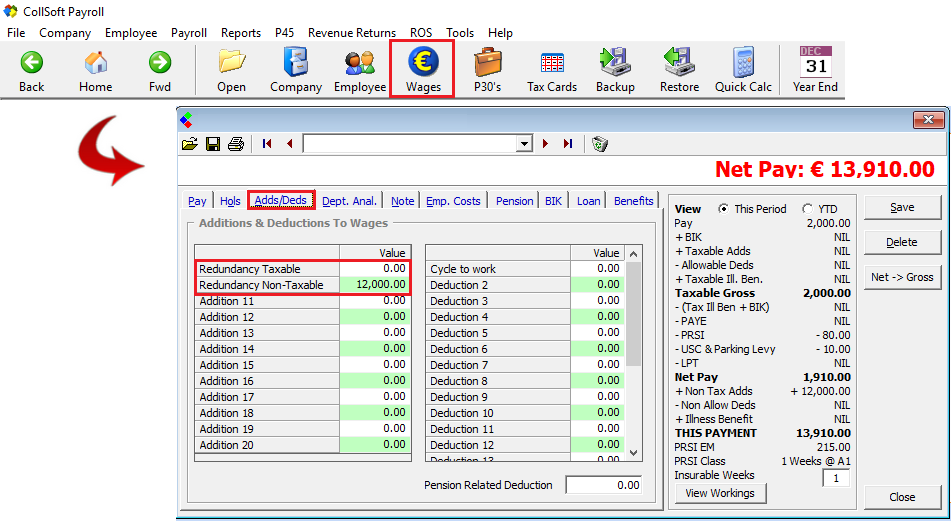

Entering an Addition at Wage Entry Level

When running the next Wage period simply choose the employee for whom you are required to add a Redundancy payment.

Redundancy Payments: Wage Entry Addition

Set up an Addition at Company Level

Choose to edit the company details by either selecting Company> Edit Company> from the menu bar or by selecting the Company quick access icon.

Click on the Additions Tab on the Company Details screen to access the Additions section.

CollSoft Payroll allows you to create up to twenty custom payment categories (in addition to the standard types of pay) called Additions. Each addition can be pre-set to be taxable or non-taxable (i.e. tax free).

You must create these Addition categories for the company before you can use them in your wages.

To create a new Addition or edit those supplied already, simply follow the instructions below:

- Select an Addition to use.

- Flag the Use tick box to make it available to view within the wages entry function.

- Highlight the Default name of the Addition (e.g. Addition 4) and enter the preferred name for the Addition (e.g. Redundancy Payment). The preferred name that is entered will appear in all wage entry screens and on the employee payslip once an amount is entered against it. N.B. Additions only appear on employee payslips when there is a monetary entry against it in a particular pay period.

- Set the Addition’s tax status. Each statutory taxation (PAYE, USC) and contribution (PRSI, PENSION LEVY) is listed against each Addition. The deduction to be applied to each Addition can be tailored for the correct tax treatment applicable.

Taxable: simply flag each tax to apply it to the Addition. (Taxable Redundancy Payments)

Non-Taxable: unflag each tax that is not applicable to the Addition (Non-Taxable Redundancy Payments)

Redundancy Payments: Company Level Addition

Entering an Addition at Wage Entry Level

When running the next Wage period simply choose the employee for whom you are required to add a Redundancy payment.

- Enter the salary payments due to the employee in the Pay tab

- To enter the additional Redundancy Payments select the Adds/Deds tab

- Enter the monetary value of each Redundancy payment type as applicable

- Save the entry

- The entries will be detailed on the employees payslip as set up by you.

Redundancy Payments: Wage Entry Addition

| Files | ||

|---|---|---|

| Company Level Addition.png | ||

| Wage Level Addition.png | ||

Get help for this page

Get help for this page