Payroll 2018 - Importing from a Payroll 2017 Backup

CollSoft facilitates the option to import from a 2017 company backup. This is relevant when:

HOW TO IMPORT FROM COLLSOFT PAYROLL 2017 BACKUP

1. TAKE A BACKUP IN COLLSOFT PAYROLL 2017

2. OPEN COLLSOFT PAYROLL 2018

2. SELECT 2017 COMPANIES FOR IMPORT

3. Import of Tax Credits from CollSoft 2017

Once the Import option is selected you must confirm if you wish to import the 2017 Tax Credits and Cut Off Points from 2017 for each employee.

If you have not received a 2018 tax credit certificate for an Employee, then the Revenue instruction is to continue using their 2017 USC COPs but to apply the 2018 USC rates (i.e. 0.5%, 2%, 4.75%, 8%). If you have imported employees from CollSoft Payroll 2017 along with their 2017 tax details, then CollSoft Payroll 2018 will automatically apply this rule.

Yes - each employee will import with their 2017 Revenue Record which is their PAYE Tax Credits and SRCOP AND USC COP into 2018.

No - each employee will import and their Revenue Record for 2018, PAYE Tax Credit and SRCOP AND USC COP will be set to zero.

Once the tax credit import is decided (Yes/No), 2018 will Import each selected company.

4. COMPLETE THE IMPORT

The progress of the import will display on screen.

On completion the total number of companies imported from the backup will confirm on screen.

All companies imported from the backup will now be listed in CollSoft Payroll 2018.

IMPORTANT NOTE : 2018 P2C IMPORT

Revenue issued 2018 P2Cs (electronic tax credit certificates) to Employers from the 05th December 2017.

It is important that, if you have received the 2018 P2C, that it is imported to update each Employees Revenue details with their 2018 Tax Credit Certificate prior to processing payroll for the 2018 tax year.

Please retrieve your 2018 P2C from your ROS account and import it to CollSoft Payroll 2018 to update each Employees 2018 Revenue details.2017 to update each Employees 2017 Revenue details.

Click here to view our Knowledgebase articles for guidance on the P2C:

- 2018 is installed to a new PC

- the 2017 data is located on a different PC or in a different location

- access issues to the 2017 database occur

- adding a new company from a client CollSoft backup

HOW TO IMPORT FROM COLLSOFT PAYROLL 2017 BACKUP

1. TAKE A BACKUP IN COLLSOFT PAYROLL 2017

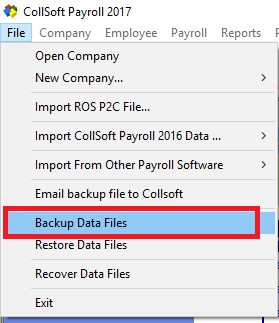

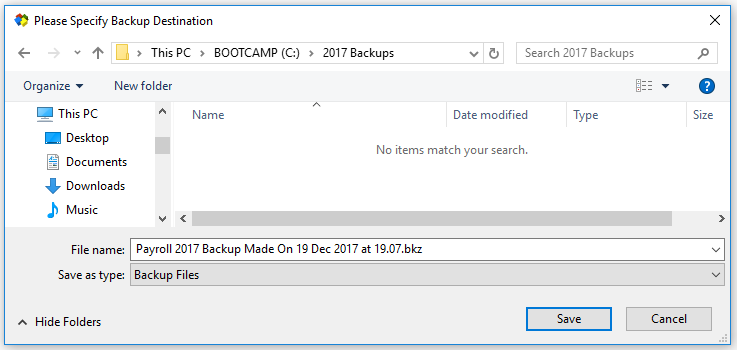

- Choose the File menu

- Select 'Backup Data Files'

- Choose a backup location; e.g. memory key, shared network location etc.

- Select 'Save'

- Select the Company/Companies to backup.

- Select 'Backup'

- The backup will complete and save.

2. OPEN COLLSOFT PAYROLL 2018

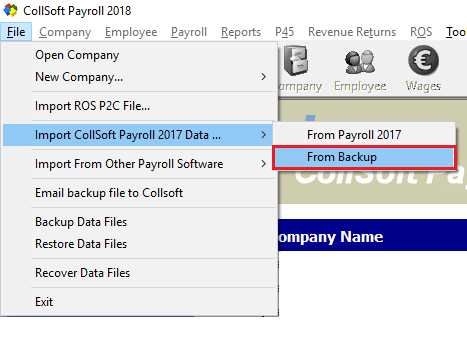

- Choose the File menu

- Select 'Import from CollSoft Payroll 2017 Data file'

- Select 'From Backup'

- Browse to the location of the backup file.

- Select the backup file, it will be named 'Payroll 2017 Backup Made on ........bkz'

- Once the backup file is located and selected choose to 'Open' the backup file.

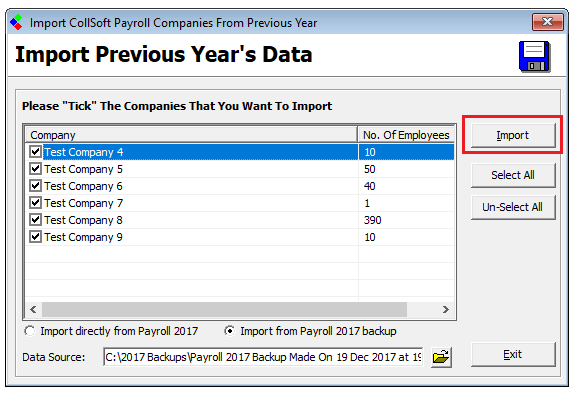

2. SELECT 2017 COMPANIES FOR IMPORT

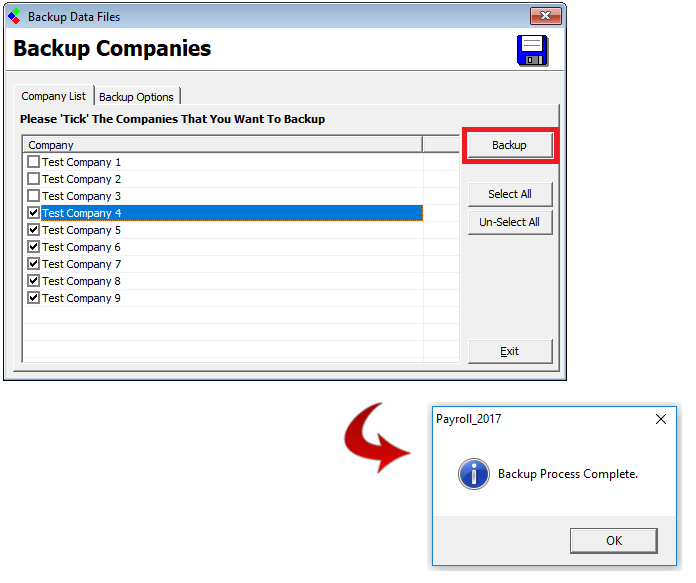

- CollSoft Payroll 2018 will read the Company data from the Payroll 2017 backup file

- All Companies contained within the backup will be listed

- By default all Companies are flagged for import.

- Modify the selection of Companies for import as required.

- Select 'Import'

- All the companies can be imported at once or by specific selection.

- Select 'Un-Select All' to clear the flag and select the companies you wish to import.

3. Import of Tax Credits from CollSoft 2017

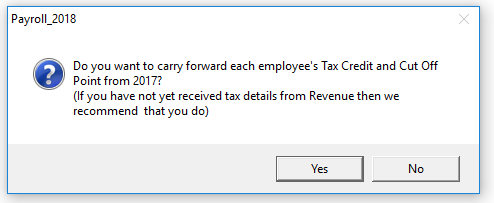

Once the Import option is selected you must confirm if you wish to import the 2017 Tax Credits and Cut Off Points from 2017 for each employee.

If you have not received a 2018 tax credit certificate for an Employee, then the Revenue instruction is to continue using their 2017 USC COPs but to apply the 2018 USC rates (i.e. 0.5%, 2%, 4.75%, 8%). If you have imported employees from CollSoft Payroll 2017 along with their 2017 tax details, then CollSoft Payroll 2018 will automatically apply this rule.

Yes - each employee will import with their 2017 Revenue Record which is their PAYE Tax Credits and SRCOP AND USC COP into 2018.

No - each employee will import and their Revenue Record for 2018, PAYE Tax Credit and SRCOP AND USC COP will be set to zero.

Once the tax credit import is decided (Yes/No), 2018 will Import each selected company.

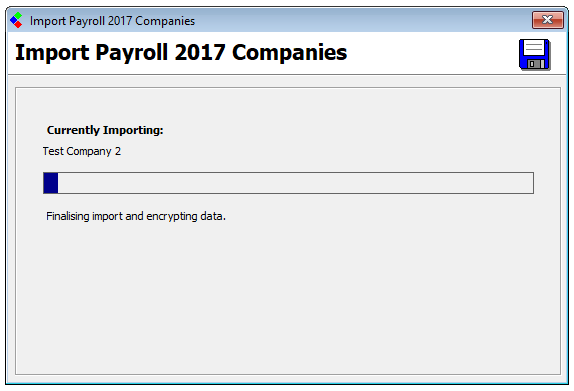

4. COMPLETE THE IMPORT

The progress of the import will display on screen.

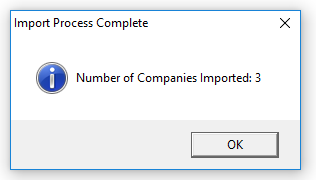

On completion the total number of companies imported from the backup will confirm on screen.

All companies imported from the backup will now be listed in CollSoft Payroll 2018.

IMPORTANT NOTE : 2018 P2C IMPORT

Revenue issued 2018 P2Cs (electronic tax credit certificates) to Employers from the 05th December 2017.

It is important that, if you have received the 2018 P2C, that it is imported to update each Employees Revenue details with their 2018 Tax Credit Certificate prior to processing payroll for the 2018 tax year.

Please retrieve your 2018 P2C from your ROS account and import it to CollSoft Payroll 2018 to update each Employees 2018 Revenue details.2017 to update each Employees 2017 Revenue details.

Click here to view our Knowledgebase articles for guidance on the P2C:

Get help for this page

Get help for this page