Medical Insurance Premiums and TRS

Revenue requires that employers itemize medical insurance premiums by employee for whom:

For more information in relation to entering medical insurance premiums as a Benefit in Kind at employee level refer to article Medical Insurance.

Additional reporting requirements specify that for each medical insurance premium the amount of that medical insurance premium which is eligible for Tax Relief must be itemised by employee also.

In order to comply with these reporting requirements employers must enter the amount of the medical insurance premium which is eligible for Tax Relief by employee.

To report TRS on Medical Insurance Premiums

P35 Medical Insurance - flag the benefit as medical insurance

Enter Premium value eligible for TRS by employee

Medical Insurance - amount eligible for TRS

P35 Medical Insurance - automated TRS calculation

Note: while an individual may be entitled to tax relief up to a €1,000, the amount eligible cannot exceed the premium amount. If you enter an eligible amount, which is greater than the premium year to date total, ROS will reject the submission.

- the medical insurance premium is paid by the employer

- and where this medical insurance premium had been treated as a benefit in kind and taxed accordingly

For more information in relation to entering medical insurance premiums as a Benefit in Kind at employee level refer to article Medical Insurance.

Additional reporting requirements specify that for each medical insurance premium the amount of that medical insurance premium which is eligible for Tax Relief must be itemised by employee also.

In order to comply with these reporting requirements employers must enter the amount of the medical insurance premium which is eligible for Tax Relief by employee.

To report TRS on Medical Insurance Premiums

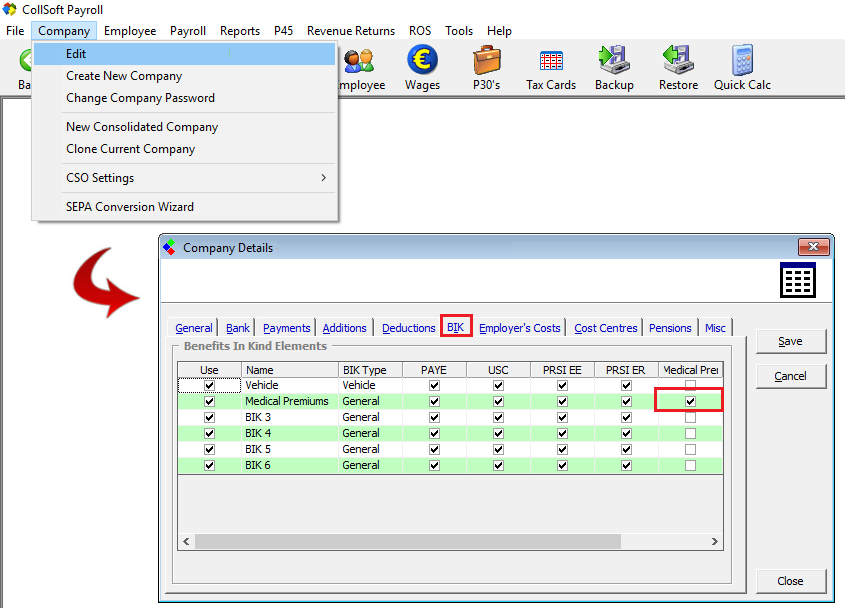

- Open the Company within CollSoft Payroll.

- Choose to Edit the Company Settings

- Choose the BIK option

- Ensure that the Benefit allocated to be used for the recording of Medical Insurance premiums is indicated as Medical Insurance

P35 Medical Insurance - flag the benefit as medical insurance

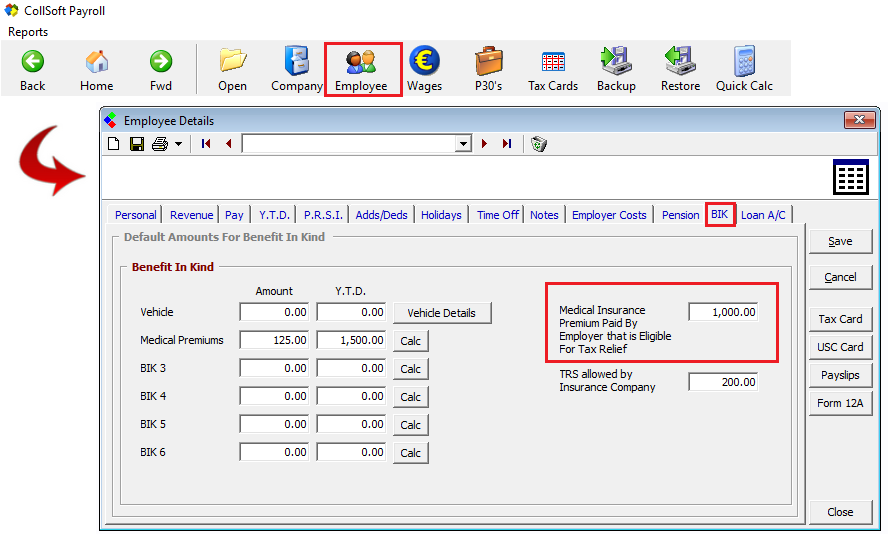

Enter Premium value eligible for TRS by employee

- Choose the relevant employee record for whom medical insurance has been processed as a BIK

- Select the BIK option

- Enter the amount of the medical insurance premium paid that is eligible for tax relief. This cannot exceed the total premium value.

Medical Insurance - amount eligible for TRS

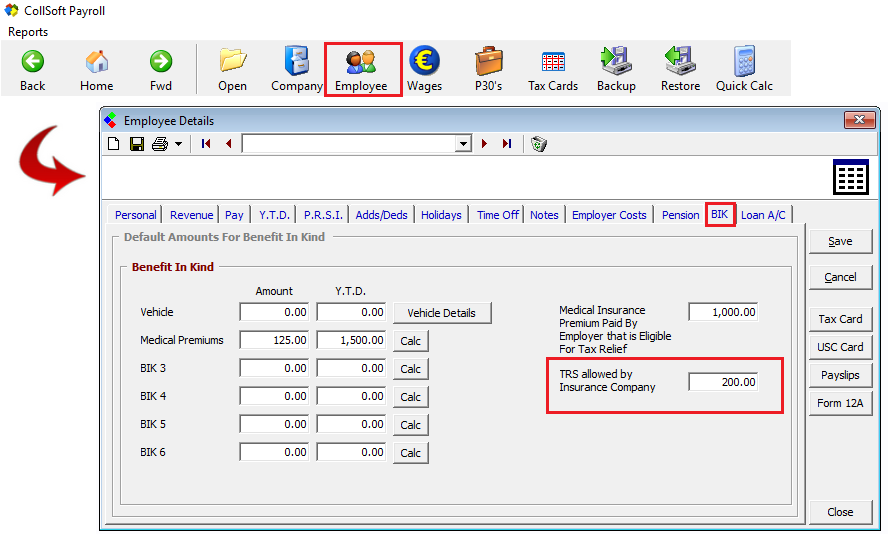

- CollSoft Payroll will automatically calculate the tax relief based on the eligible amount entered, i.e. applying 20%

P35 Medical Insurance - automated TRS calculation

- Repeat this process for each employee for whom Medical Insurance has been included as a BIK item within the tax year.

Note: while an individual may be entitled to tax relief up to a €1,000, the amount eligible cannot exceed the premium amount. If you enter an eligible amount, which is greater than the premium year to date total, ROS will reject the submission.

| Files | ||

|---|---|---|

| 1. Medical Insurance Premiums - Enter the Premium eligible for TRS.png | ||

| 2. Medical Insurance Premiums - Automated TRS.png | ||

| Employer level - Setting up BIK for Medical Insurance.png | ||

Get help for this page

Get help for this page