P35 - Pension Tracing Number

Employers who are operating sponsored pension schemes must provide a Pension Tracing Number which the trustees of the scheme will acquire when they meet their obligation in registering the scheme with The Pensions Authority.

The registration process generates a Pension Board (PB) reference number. This number should be quoted in the "Pension Tracing" number field on the P35L. This will be used to trace pension entitlements for employees from various employments during their careers.

The capture of The Pensions Authority issued pension tracing number on the P35L will facilitate a prospective retiree trace the pension schemes of which he/she was a member during his/her employment career.

The Pension Tracing Number will be in the format of PBXXXXXX, where XXXXXX is a number with up to 6 digits, e.g. PB123456

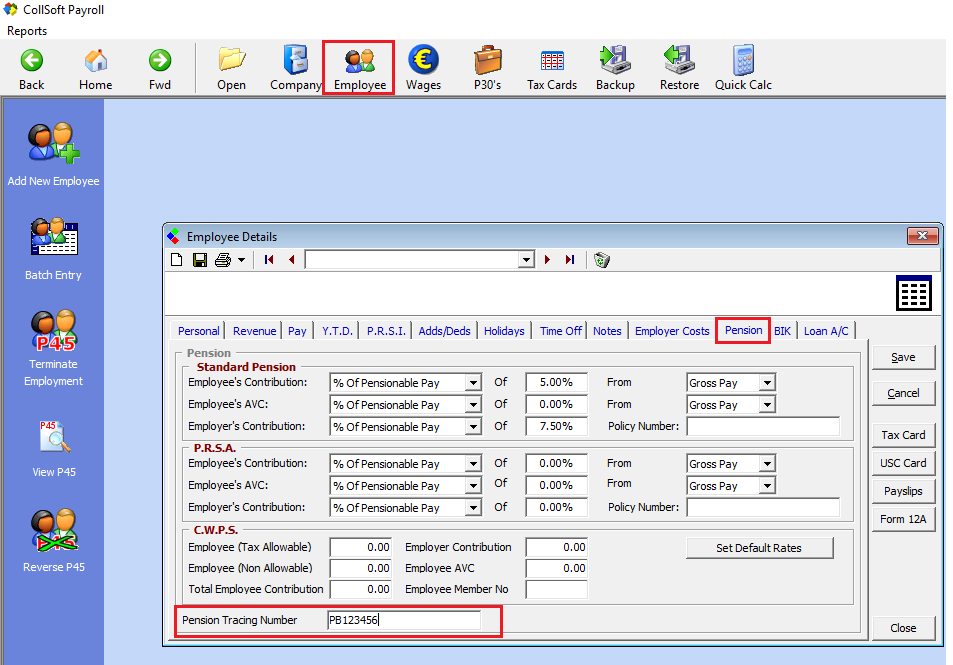

ENTERING THE PENSION TRACING NUMBER IN COLLSOFT PAYROLL

The payroll operative must know the pension arrangement of each employee, i.e. if the pension set-up within the employee record is an employee sponsored pension scheme (generally occupational pension schemes) or a private pension arrangement (PRSA).

For each employer sponsored pension the pension tracing number should be entered within the pension record at employee level.

To enter the Pension Tracing Number;

Pension Tracing Number - Entering the number in CollSoft Payroll

Employers generally only operate one sponsored scheme. As the Pension Tracing Number is issued to the employer sponsored pension scheme, and not by employee, the Pension Tracing Number will be the same for all employees contributing to the scheme. It would be unusual for employer to operate numerous separate schemes.

CWPS

For Employers operating the CWPS pension, CWPS is the trustee company for all registered employers as CWPS is the Master Trust. The CWPS registered number with the Pensions Authority can be obtained from CWPS and will be the one number for all employees within the scheme.

The registration process generates a Pension Board (PB) reference number. This number should be quoted in the "Pension Tracing" number field on the P35L. This will be used to trace pension entitlements for employees from various employments during their careers.

The capture of The Pensions Authority issued pension tracing number on the P35L will facilitate a prospective retiree trace the pension schemes of which he/she was a member during his/her employment career.

The Pension Tracing Number will be in the format of PBXXXXXX, where XXXXXX is a number with up to 6 digits, e.g. PB123456

ENTERING THE PENSION TRACING NUMBER IN COLLSOFT PAYROLL

The payroll operative must know the pension arrangement of each employee, i.e. if the pension set-up within the employee record is an employee sponsored pension scheme (generally occupational pension schemes) or a private pension arrangement (PRSA).

For each employer sponsored pension the pension tracing number should be entered within the pension record at employee level.

To enter the Pension Tracing Number;

- Select Employees from the menu/toolbar

- Select the relevant employee

- Choose the Pension menu option within the employee record

- Enter the Pension Tracing Number associated with the pension setup for this employee

Pension Tracing Number - Entering the number in CollSoft Payroll

Employers generally only operate one sponsored scheme. As the Pension Tracing Number is issued to the employer sponsored pension scheme, and not by employee, the Pension Tracing Number will be the same for all employees contributing to the scheme. It would be unusual for employer to operate numerous separate schemes.

CWPS

For Employers operating the CWPS pension, CWPS is the trustee company for all registered employers as CWPS is the Master Trust. The CWPS registered number with the Pensions Authority can be obtained from CWPS and will be the one number for all employees within the scheme.

| Files | ||

|---|---|---|

| Pension Tracing Number.png | ||

Get help for this page

Get help for this page