Adjusting Year to Date Kilometres

Revenue states that prior to the end of the tax year, having regard to the known business kilometres covered in the tax year up to that date, the best estimate should be reviewed to determine its accuracy. Any adjustments necessary to the cumulative notional pay charged to date, should be incorporated in the remaining pay periods for the year thus resulting in the notional pay calculating on actual travel.

It is best practice to maintain logs or to request employee's to submit travel logs on a continual basis to ensure the accuracy of this calculation.

In processing the final payroll for the current year, review the Benefit in Kind of each employee and amend accordingly to reflect the actual benefit received.

Adjusting the year to date business kilometres

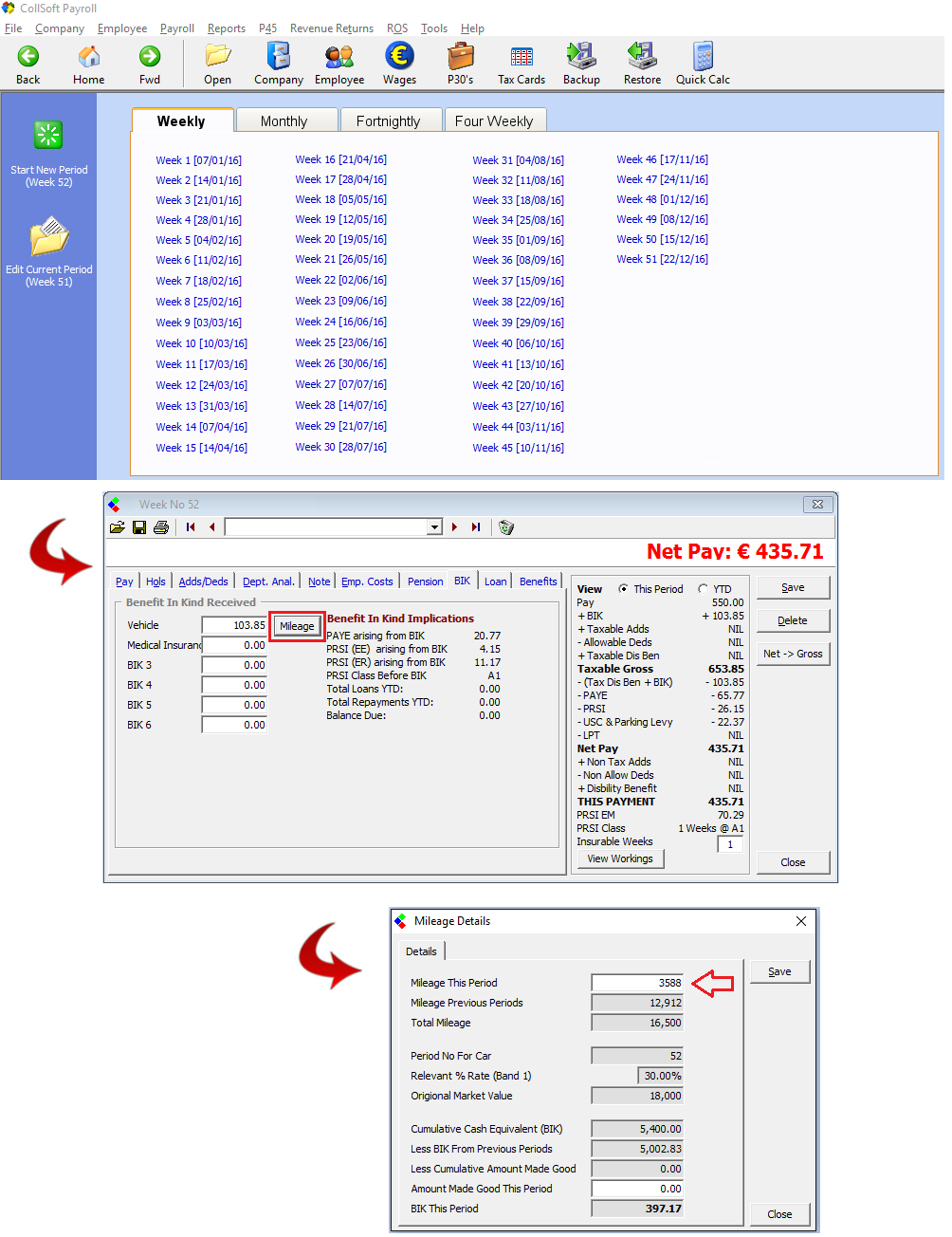

Once 'Mileage' is selected in the current period increment along with the year to date business kilometres will be shown.

Change the current period increment, shown as 'Mileage this period' to the total adjustment required.

The 'Total Mileage' figure will change taking account of the adjusted 'Mileage this period' entry.

The object is to ensure that the adjustment entered results in the actual 'Total Mileage' adjusting to reflect the total actual business kilometres travelled for the tax year.

The notional pay will reflect the necessary adjustment which will also flow through to the payroll calculations.

The employee's final payroll will deduct any underpayment or refund any over payment of PAYE/USC/PRSI accordingly.

It is best practice to maintain logs or to request employee's to submit travel logs on a continual basis to ensure the accuracy of this calculation.

In processing the final payroll for the current year, review the Benefit in Kind of each employee and amend accordingly to reflect the actual benefit received.

Adjusting the year to date business kilometres

- Choose Wages from the Toolbar or Select the Wages Icon.

- Open the final pay period, as appropriate.

- Choose the Employee for whom the BIK must be updated.

- Select the BIK tab.

Once 'Mileage' is selected in the current period increment along with the year to date business kilometres will be shown.

Change the current period increment, shown as 'Mileage this period' to the total adjustment required.

The 'Total Mileage' figure will change taking account of the adjusted 'Mileage this period' entry.

The object is to ensure that the adjustment entered results in the actual 'Total Mileage' adjusting to reflect the total actual business kilometres travelled for the tax year.

The notional pay will reflect the necessary adjustment which will also flow through to the payroll calculations.

The employee's final payroll will deduct any underpayment or refund any over payment of PAYE/USC/PRSI accordingly.

| Files | ||

|---|---|---|

| BIK Vehicles - Amend Year to Date Kilometres.png | ||

Get help for this page

Get help for this page