Medical Insurance Premiums

Information relating to the principles of Benefit in Kind can be found in the Introduction to Benefit in Kind article.

MEDICAL INSURANCE PREMIUMS

Where an employer pays medical insurance premiums on behalf of an employee and/or their dependents, a Benefit in Kind charge will arise.

PAYE, USC and PRSI will be deducted by the employer in respect of the value of the benefit provided.

Benefit in Kind is treated like all other pay-in-the-hand of the employee's and so, is a taxable prerequisite of employment. Each benefit is given a 'cash equivalent' value so that tax and PRSI can be calculated and deducted, The 'cash equivalent' value is referred to as 'notional pay'.

CALCULATING THE VALUE OF THE BENEFIT IN KIND (NOTIONAL PAY)

Where the employer pays the employee's medical insurance notional pay is calculated as the gross amount of the medical insurance premium less amounts contributed to the cost of the premium by the employee (sometimes referred to as 'amounts made good' by the employee).

It is important that the GROSS medical insurance premium (i.e. before tax relief) as paid by the employer is entered as the amount for notional pay purposes.

For more information about tax relief on medical insurance premiums refer to our article Medical Insurance Premiums - Tax Relief.

See BENEFIT IN KIND SETTINGS AT COMPANY LEVEL for guidance prior to setting up the medical insurance at the employee level.

SETTING UP MEDICAL INSURANCE PREMIUM BENEFITS AT EMPLOYEE LEVEL IN COLLSOFT

The specific detail relevant to each employee's individual employment are then entered against the employee record so that the notional pay will flow through to the payroll for tax purposes. This will be itemised on the employee payslip also.

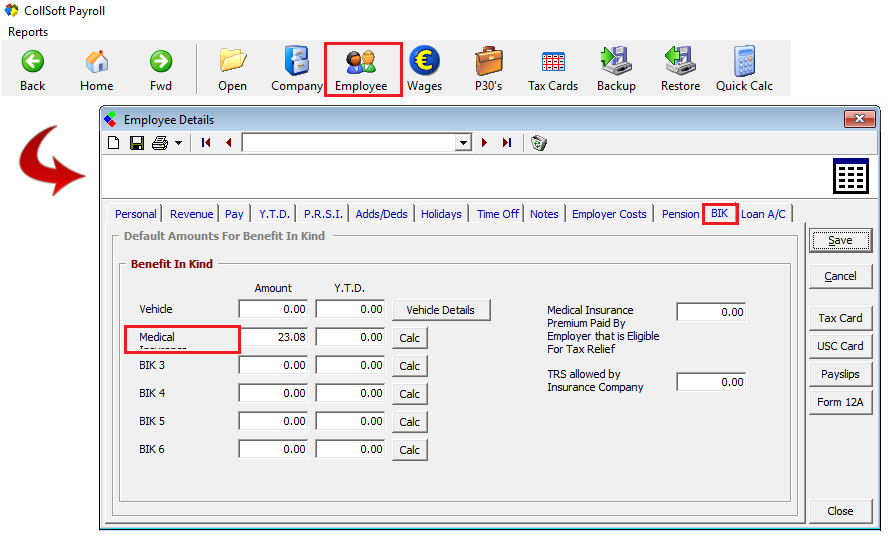

Accessing the BIK function at employee level

Medical Insurance Premiums: Entering the value for notional pay purposes at employee level

It is important that the GROSS medical insurance premium (i.e. before tax relief) as paid by the employer is entered as the amount for notional pay purposes. Please note the medical insurance statement may show the medical premium less the tax relief.

BIK operates on a cumulative basis, therefore, errors can be corrected in a subsequent payroll period within the tax year. However, this may result in excessive tax deductions for an employee in one particular payroll period.

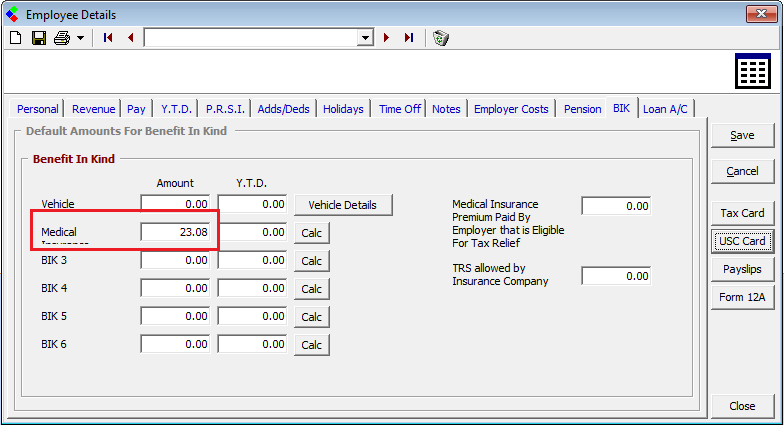

Enter the periodical notional pay

Enter the periodical value of the notional pay linked to the medical insurance premium.

Medical Insurance Premiums: Entering the periodical value

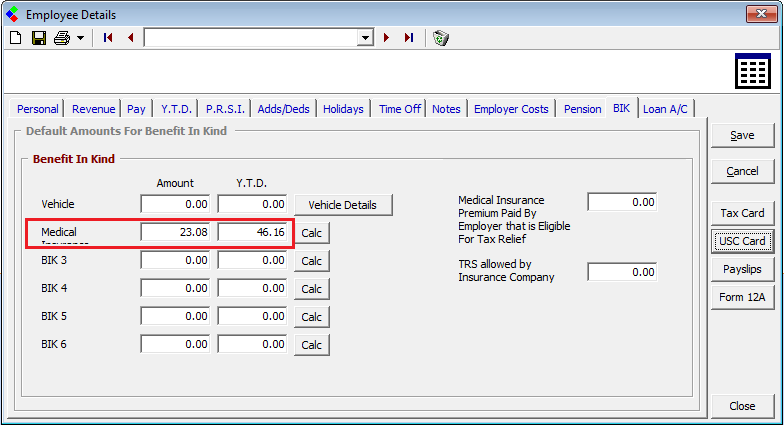

The periodical pay will increment for each pay period thereafter to accumulate to the total by the end of the year.

Medical Insurance Premiums: Periodical value incrementing

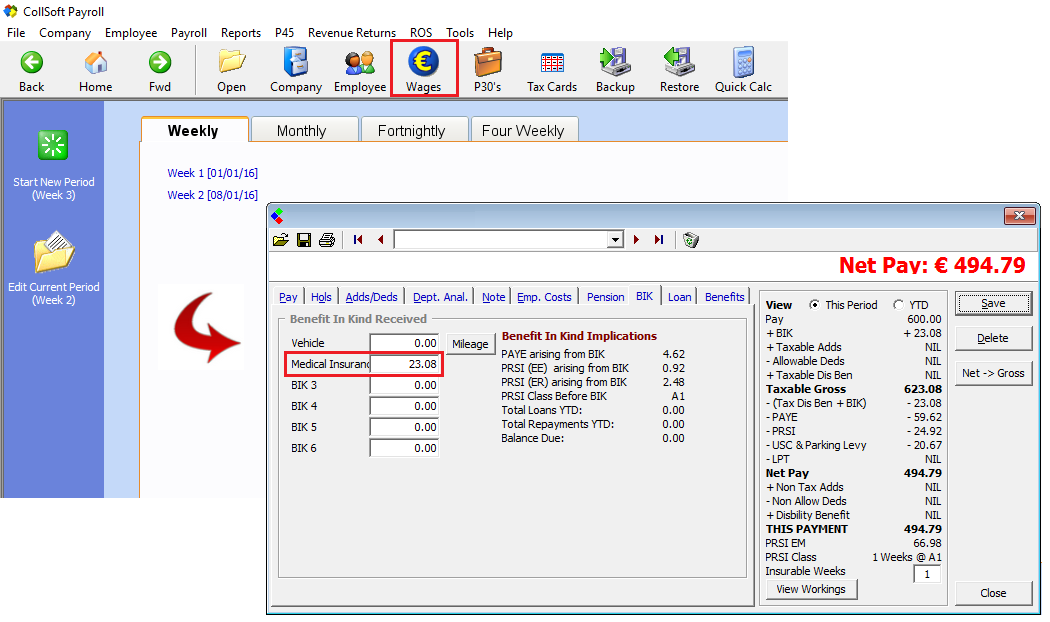

NOTIONAL PAY ON MEDICAL INSURANCE PREMIUMS IN THE WAGES

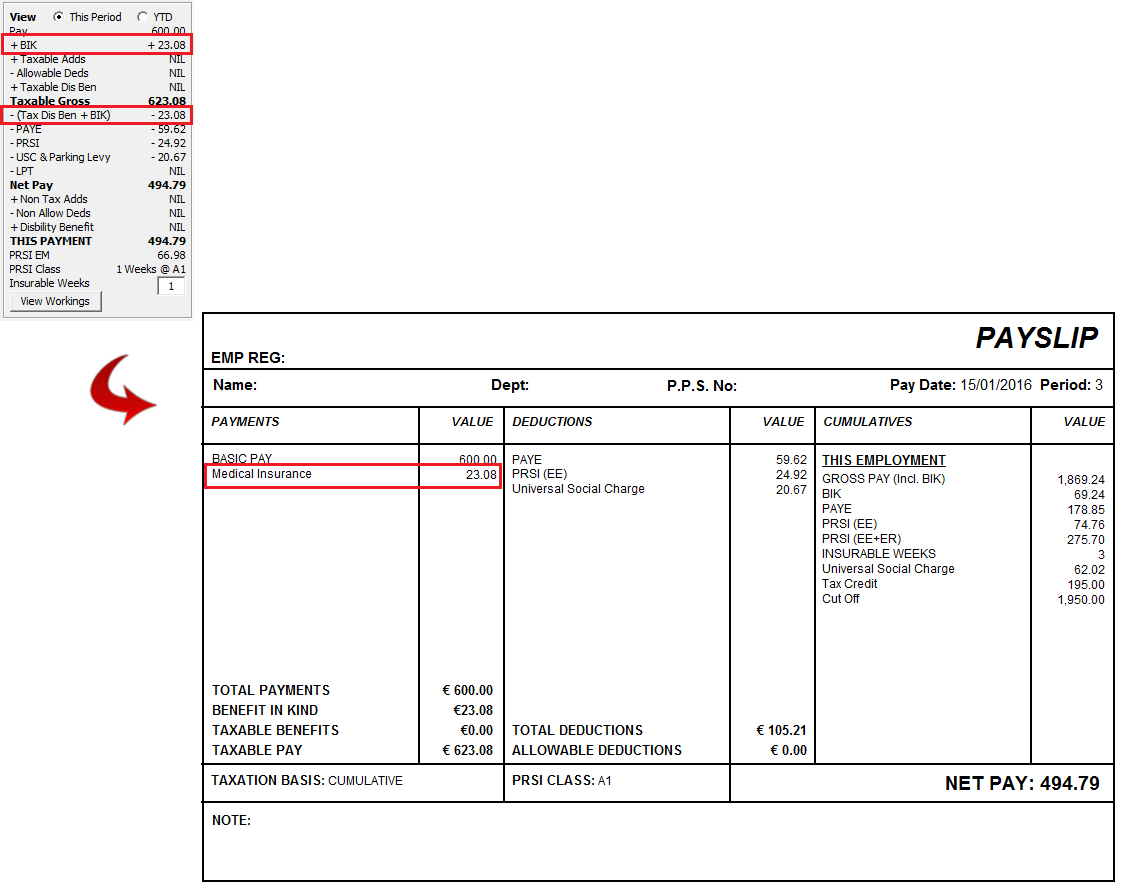

Now that the medical insurance premium detail has been set up against the employee record the notional pay (i.e. cash equivalent) will flow through to the employee's payroll.

Choose Wages from the toolbar Start the next payroll period or choose the current period, as appropriate. Choose the relevant Employee Select the BIK tab.

The medical insurance premium will display reflecting the current period notional pay as entered into CollSoft Payroll (as explained above).

Medical Insurance Premiums: Notional Pay in the wages

As explained earlier the notional pay is the cash equivalent benefit of the GROSS premium paid by the employer as an employment perk. Based on the periodical amount entered, each pay period will reflect the amount for each pay period, incrementing thereafter.

The notional pay will be added to the payroll for the period in order to calculate the PAYE, USC and PRSI attributable to this payment in kind, in addition to the wages/salary. The notional pay is merely added to the payroll in order to make the correct deductions based on total pay, it is then deducted so that the net effect does not have a payment element within the net pay figure as the employee has already received it in the form of the medical insurance paid premium.

Medical Insurance Premiums: BIK showing in the wages and on the payslip

TAX RELIEF AT SOURCE - NOTE FOR EMPLOYEES

Tax relief for medical insurance premiums paid to authorised insurers is granted at source. Subscribers pay a reduced premium to the Insurer. This is the same as giving tax relief at the standard rate of 20% and is claimed as Tax Relief at Source.

Employees, where medical insurance premiums are paid on their (or their dependents) behalf, will not have been allowed Tax Relief at Source. To claim relief due, employees must notify their Revenue office of the relevant details or complete an annual return form and send it to the Revenue office. For further details contact your local Revenue office.

MEDICAL INSURANCE PREMIUMS

Where an employer pays medical insurance premiums on behalf of an employee and/or their dependents, a Benefit in Kind charge will arise.

PAYE, USC and PRSI will be deducted by the employer in respect of the value of the benefit provided.

Benefit in Kind is treated like all other pay-in-the-hand of the employee's and so, is a taxable prerequisite of employment. Each benefit is given a 'cash equivalent' value so that tax and PRSI can be calculated and deducted, The 'cash equivalent' value is referred to as 'notional pay'.

CALCULATING THE VALUE OF THE BENEFIT IN KIND (NOTIONAL PAY)

Where the employer pays the employee's medical insurance notional pay is calculated as the gross amount of the medical insurance premium less amounts contributed to the cost of the premium by the employee (sometimes referred to as 'amounts made good' by the employee).

It is important that the GROSS medical insurance premium (i.e. before tax relief) as paid by the employer is entered as the amount for notional pay purposes.

For more information about tax relief on medical insurance premiums refer to our article Medical Insurance Premiums - Tax Relief.

See BENEFIT IN KIND SETTINGS AT COMPANY LEVEL for guidance prior to setting up the medical insurance at the employee level.

SETTING UP MEDICAL INSURANCE PREMIUM BENEFITS AT EMPLOYEE LEVEL IN COLLSOFT

The specific detail relevant to each employee's individual employment are then entered against the employee record so that the notional pay will flow through to the payroll for tax purposes. This will be itemised on the employee payslip also.

Accessing the BIK function at employee level

- Choose the Employee Icon from the toolbar.

- Select the Employee for whom the medical insurance premium has been paid.

- Select the BIK tab.

- The first benefit defaults to Vehicle by default, choose the next BIK item that you would have customized when setting it up at employer level.

Medical Insurance Premiums: Entering the value for notional pay purposes at employee level

It is important that the GROSS medical insurance premium (i.e. before tax relief) as paid by the employer is entered as the amount for notional pay purposes. Please note the medical insurance statement may show the medical premium less the tax relief.

BIK operates on a cumulative basis, therefore, errors can be corrected in a subsequent payroll period within the tax year. However, this may result in excessive tax deductions for an employee in one particular payroll period.

Enter the periodical notional pay

Enter the periodical value of the notional pay linked to the medical insurance premium.

- Take the Gross Premium for the year, or the pro-rata value if the employee is employed for less than a year.

- If paid weekly enter 1/52 of the premium. If paid monthly enter 1/12th of the premium.

- The amount will hold in the BIK field to be taken account of within each subsequent payroll period within the tax year thereafter.

Medical Insurance Premiums: Entering the periodical value

The periodical pay will increment for each pay period thereafter to accumulate to the total by the end of the year.

Medical Insurance Premiums: Periodical value incrementing

NOTIONAL PAY ON MEDICAL INSURANCE PREMIUMS IN THE WAGES

Now that the medical insurance premium detail has been set up against the employee record the notional pay (i.e. cash equivalent) will flow through to the employee's payroll.

The medical insurance premium will display reflecting the current period notional pay as entered into CollSoft Payroll (as explained above).

Medical Insurance Premiums: Notional Pay in the wages

As explained earlier the notional pay is the cash equivalent benefit of the GROSS premium paid by the employer as an employment perk. Based on the periodical amount entered, each pay period will reflect the amount for each pay period, incrementing thereafter.

The notional pay will be added to the payroll for the period in order to calculate the PAYE, USC and PRSI attributable to this payment in kind, in addition to the wages/salary. The notional pay is merely added to the payroll in order to make the correct deductions based on total pay, it is then deducted so that the net effect does not have a payment element within the net pay figure as the employee has already received it in the form of the medical insurance paid premium.

Medical Insurance Premiums: BIK showing in the wages and on the payslip

TAX RELIEF AT SOURCE - NOTE FOR EMPLOYEES

Tax relief for medical insurance premiums paid to authorised insurers is granted at source. Subscribers pay a reduced premium to the Insurer. This is the same as giving tax relief at the standard rate of 20% and is claimed as Tax Relief at Source.

Employees, where medical insurance premiums are paid on their (or their dependents) behalf, will not have been allowed Tax Relief at Source. To claim relief due, employees must notify their Revenue office of the relevant details or complete an annual return form and send it to the Revenue office. For further details contact your local Revenue office.

Get help for this page

Get help for this page