Collsoft Payroll Reports

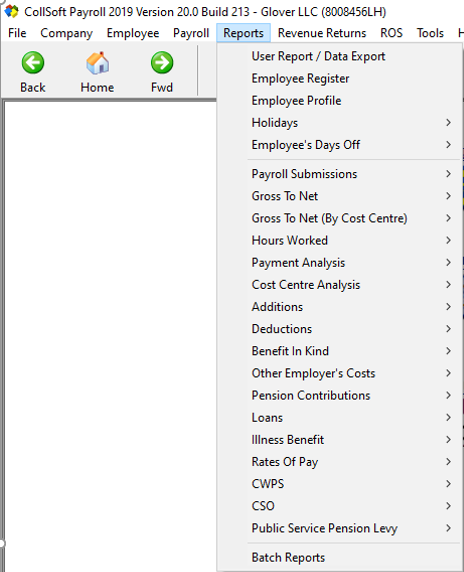

The Payroll software contains a wide range of reports that can be accessed by selecting the Reports Drop Down menu along the top of the Payroll, as shown below:

Collsoft Reports: Reports Drop Down Menu

There are a number of different types of payroll reports that can be viewed and printed, depending on what information you want a report on. There are also options to view certain reports, by Employee, By Week number etc.

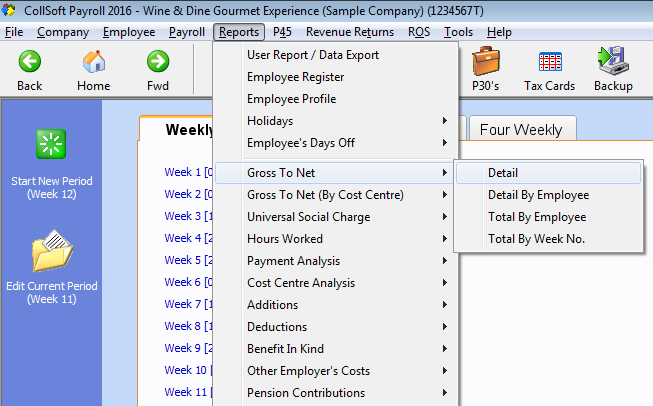

Collsoft Reports: Select the Report to View

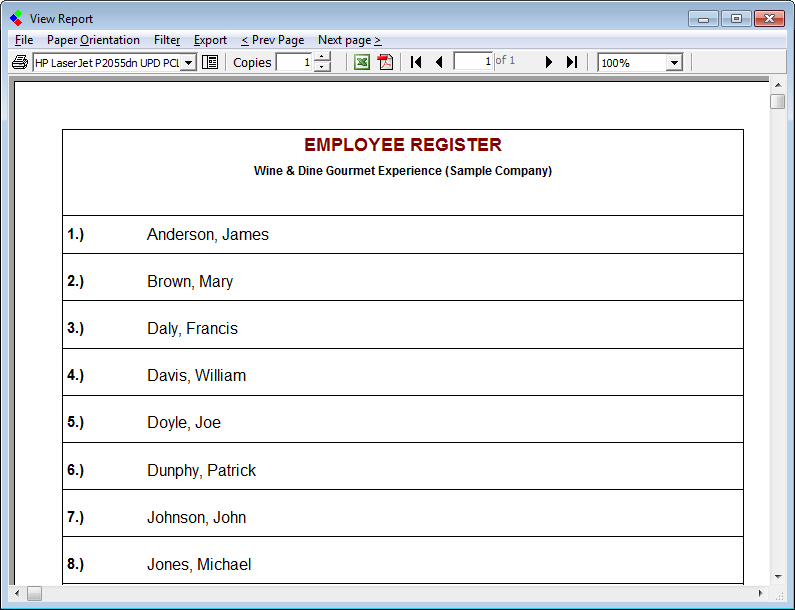

Employee Register Report

This report lists the names of all live employees. Terminated employees are not shown on this report. To view this report select the Reports drop down menu and select the Employee Register option.

Collsoft Reports: Employee Register Report

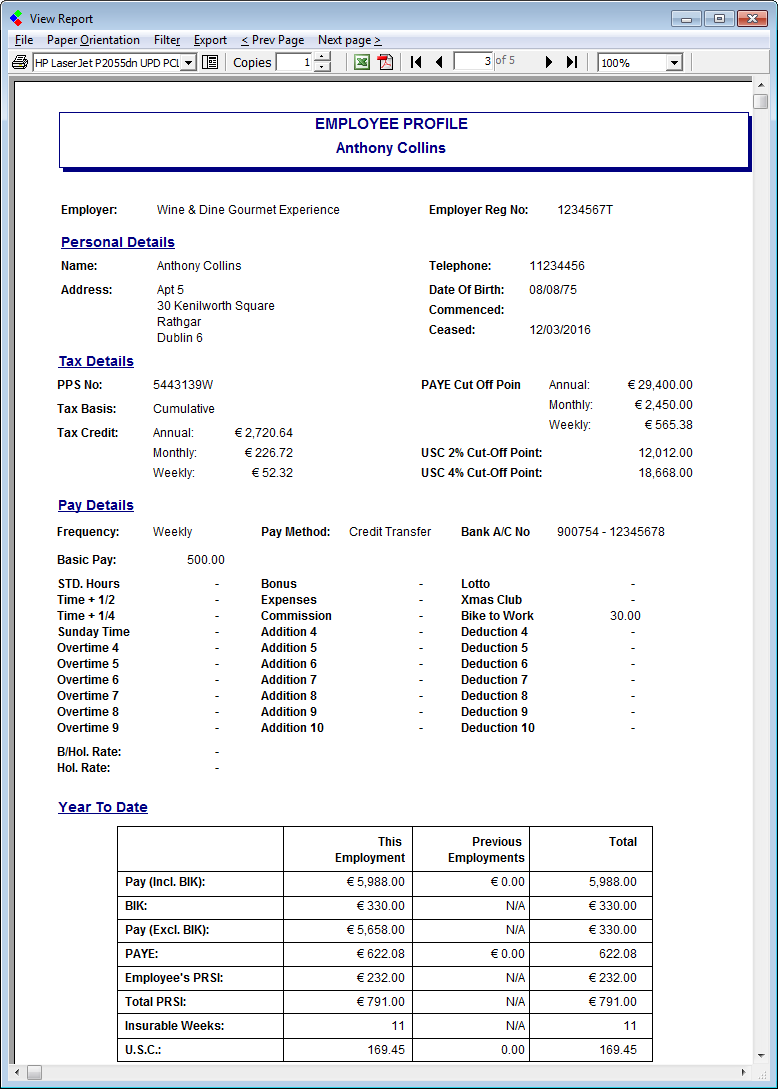

Employee Profile Report

This report produces one A4 page per employee, showing Personal, Tax, Pay and YTD Details. It contains a complete list of all employees, both live and terminated. To view this report select the Reports drop down menu and select the Employee Profile option.

Collsoft Reports: Employee Profile Report

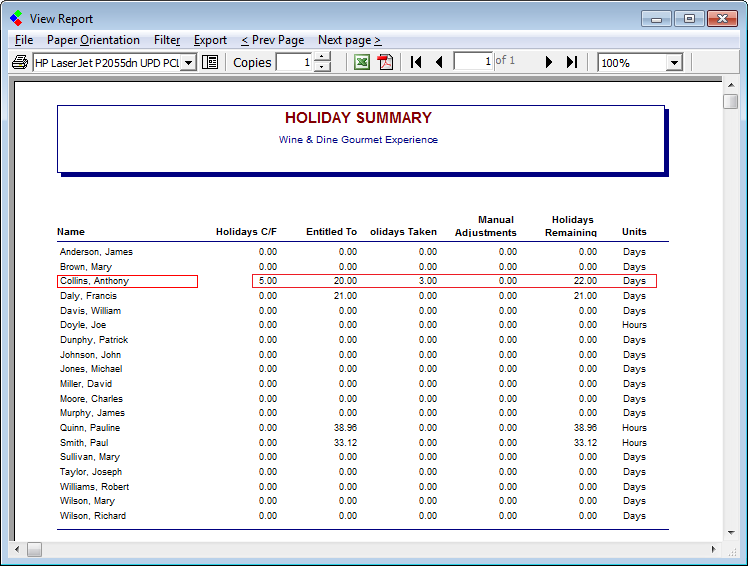

Holiday Reports

There are 4 reports in this section, Summary by Employee (Summary of Holidays taken/remaining for each employee), Detail by Employee (A4 Page for each employee detailing Holidays taken/remaining), Holiday Hours Summary (A4 Page for each employee accruing holidays by hours worked, detailing holidays accrued) and Holidays (Summary of Holidays taken per employee). To view these reports select the Reports drop down menu and select the Holiday option and the Holiday Report you require.

Collsoft Reports: Holiday Reports

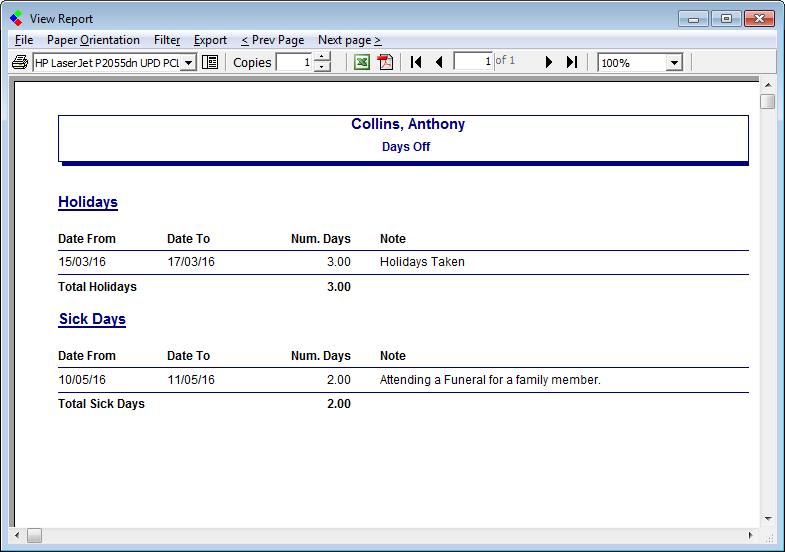

Employee’s Days Off Report

This “All Days” report provides details of sick days, days absent without leave as well as Annual Leave taken. It is a report showing all days off for whatever reason, throughout the year. To view this report select the Reports drop down menu and select the Employees Day Off option.

Collsoft Reports: Employee's Day Off Report

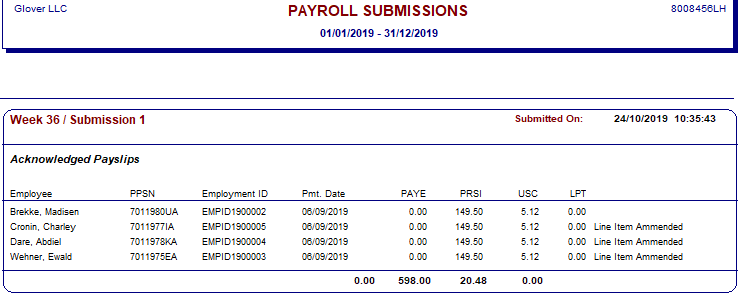

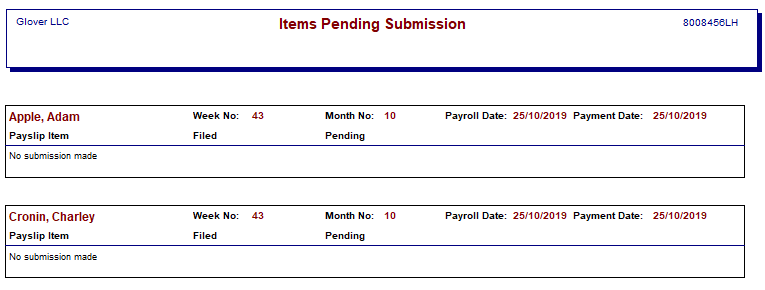

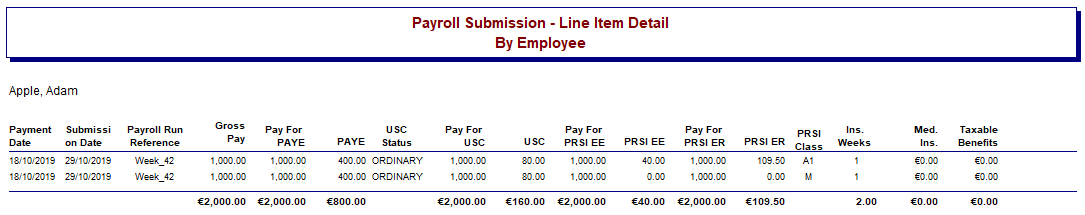

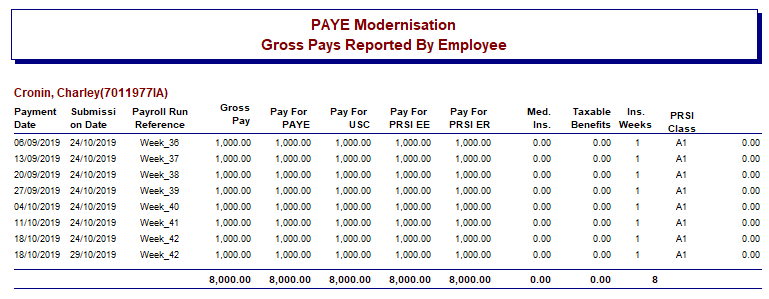

Payroll Submission Reports

There are 4 reports in this section, Submissions Filed (this report details the Revenue submission made, by week and submission number and includes the employee details for those submissions made), Submissions Pending (this report highlights all outstanding Revenue submission by employee name and relevant week), Line Items Detail by Employee (this report expands on the submission filed report and includes all pay related figures. This is detailed by employee) and Gross Pay Detail by Employee (A4 Page for each employee detailing Gross Pay).

Collsoft Reports: Payroll Submissions Report

Collsoft Reports: Items Pending Submission Report

Collsoft Reports: Line item Detail by Employee Report

Collsoft Reports: Gross Pays Report by Employee

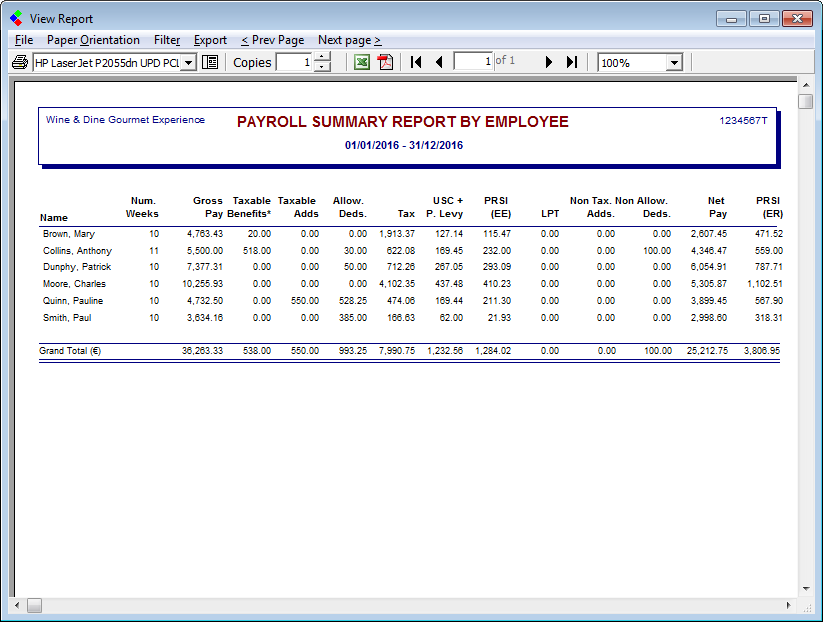

Gross to Net Reports

The Gross to Net reports provide an analysis of every payment made showing gross payments, additions, deductions, tax deducted, USC Paid, PRSI contributions etc. These reports can be date driven and can also be run By Employee, By Week Number, By Cost Centre etc. They will provide financial year end details as required by your tax advisers. To view these reports select the Reports drop down menu and select the Gross To Net option and then select the report that you require.

Collsoft Reports: Gross to Net Reports

Gross to Net Reports by Cost Centre

There is also an option to run Gross to Net reports by cost centre. This will display the Gross to Net information with the employees broken down into their respective cost centres or departments. These reports are also date driven and can also be run By Employee, By Week Number, By Cost Centre etc. To view these reports select the Reports drop down menu and select the Gross To Net (By Cost Centre) option and then select the report that you require.

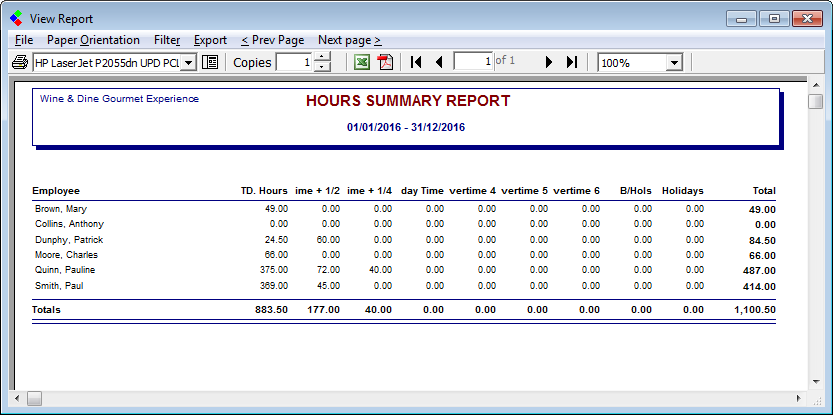

Hours Worked Reports

Hours Worked Reports display the amount of different types of hours worked by each employee i.e. number of Standard Hours worked, number of Overtime Hours worked, number of Bank Holiday hours worked etc. To view these reports select the Reports drop down menu and select the Hours Worked option, then select the report your require.

Collsoft Reports: Hours Worked Reports

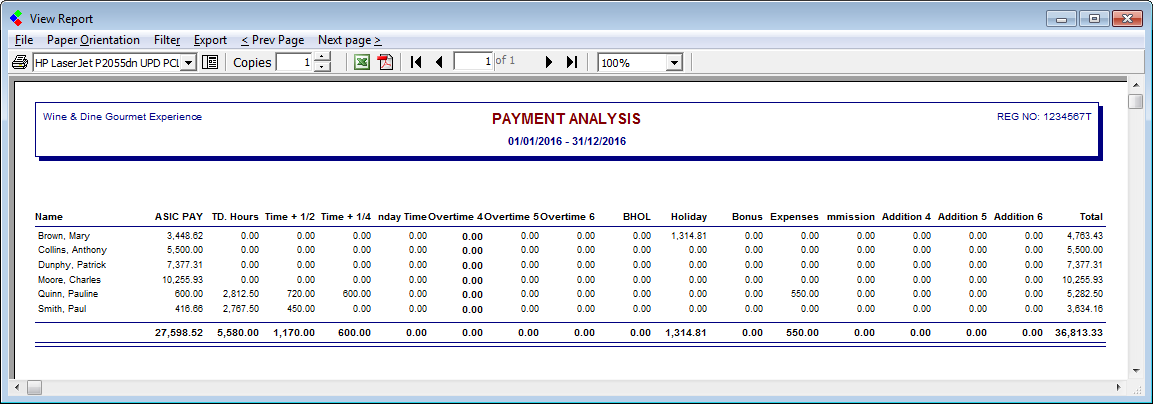

Payment Analysis Reports

The Payment Analysis Reports provide details of the amount of pay per employee per type of hours worked. i.e. Employee X has €240 worth

of Standard Hours worked this week. To view these reports select the Reports drop down menu and select the Payment Analysis option and then the report that you require.

Collsoft Reports: Payment Analysis Reports

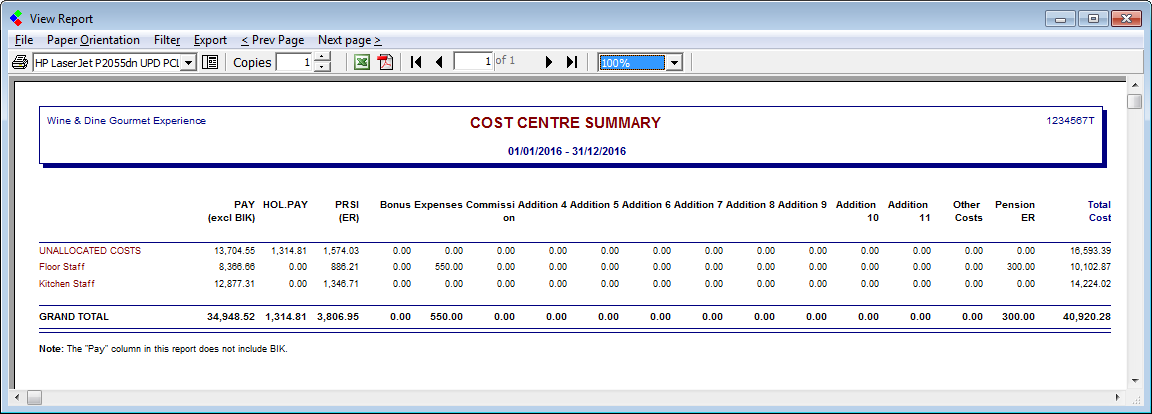

Cost Centre Analysis Reports

This is a very useful tool if you have set up cost centres. A detailed listing of all costs associated with each department of your business, showing gross payments made, Employer Contributions costs as well as additions and deductions. To view these reports select the Reports drop down menu and select the Cost Centre Analysis option and then the report that you require.

Collsoft Reports: Cost Centre Analysis Reports

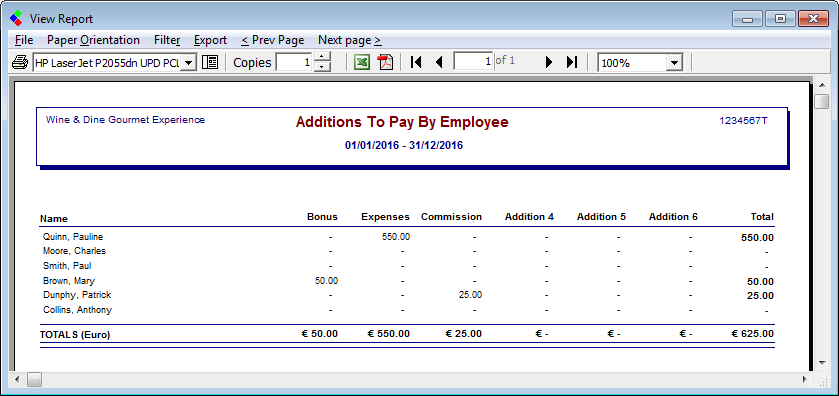

Additions Reports

These reports show a detailed listing of all individual additions. To view these reports select the Reports drop down menu and select the Additions option, then select the report that you require.

Collsoft Reports: Additions Report

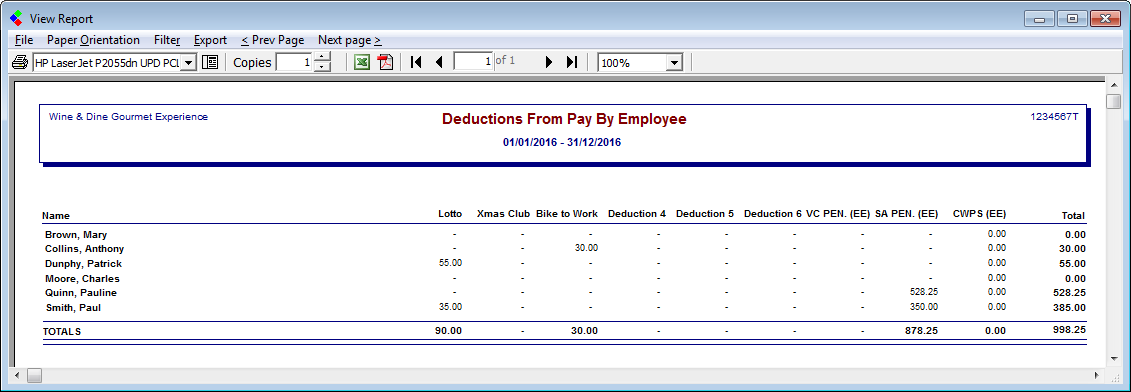

Deductions Reports

These reports show a detailed listing of all individual deductions. To view these reports select the Reports drop down menu and select the Deductions option and then the report that you require.

Collsoft Reports: Deductions Report

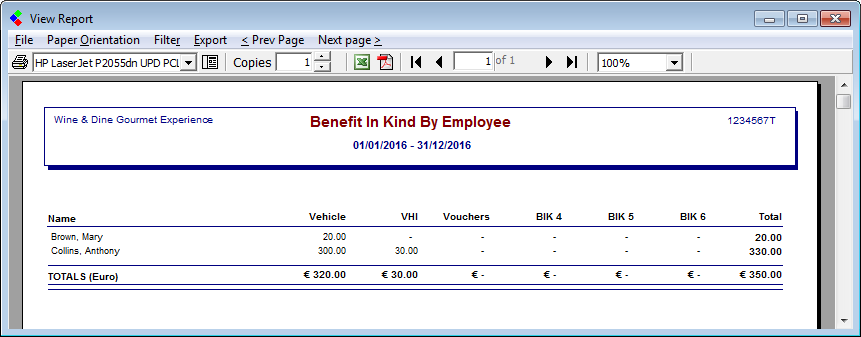

Benefit in Kind Reports

These reports show all the BIK payments made to each employee and the total BIK for all employees. You can view a detailed BIK report, an employee BIK summary report or a BIK summary by pay date report. To view these reports select the Reports drop down menu and select the Benefit In Kind option and then the report that you require.

Collsoft Reports: Benefit in Kind Reports

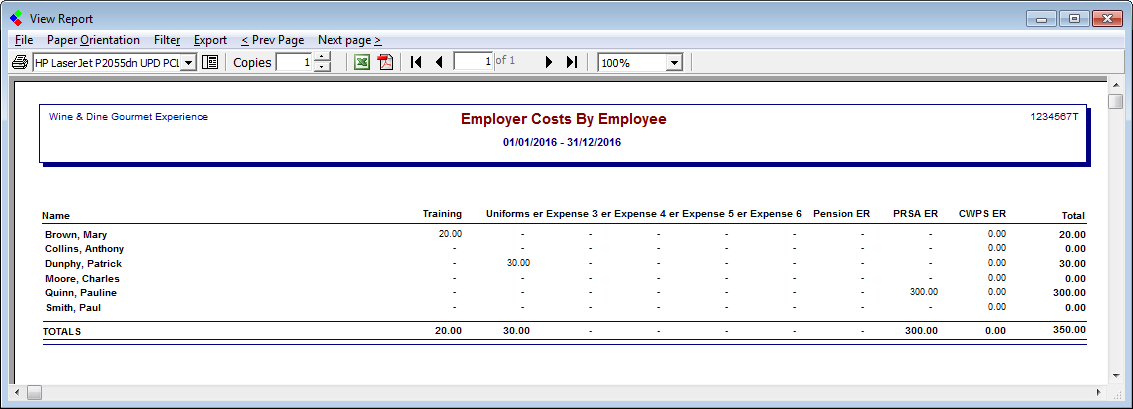

Other Employer Costs Reports

These reports show a detailed listing of all other additional Employer Costs. To view these reports select the Reports drop down menu and select the Other Employer Costs option Other Employer Costs and then the report that you require.

Collsoft Reports: Other Employee Costs Report

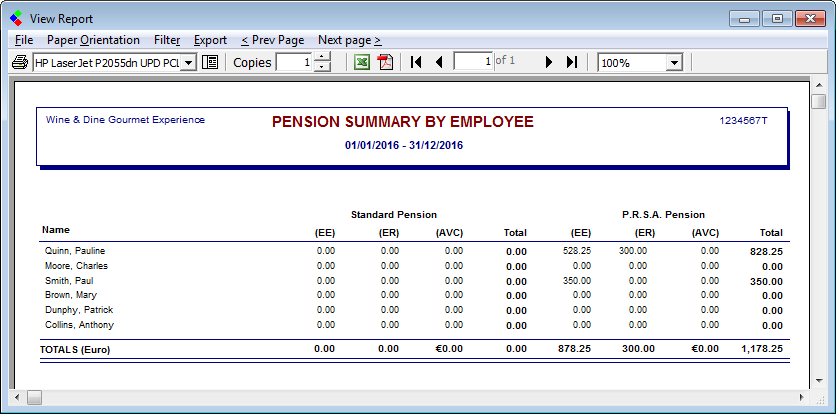

Pension Contributions Reports

These reports give a detailed analysis of all standard pension and PRSA contributions made by the individual employees and by the employer, option. as well as any additional AVC’s made by any employees. There is also an option here to create a Pension File which you can then return to your pension provider. To view these reports or to create a pension file select the Reports drop down menu and select the Pension Contributions and then select the report you require.

Collsoft Reports: Pension Contribution Reports

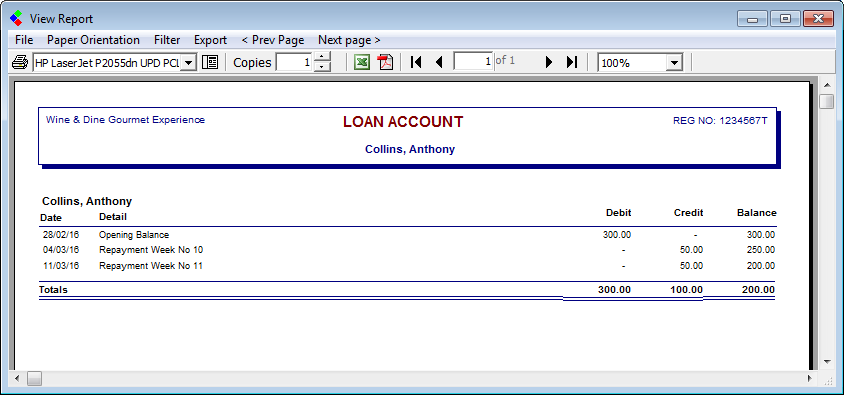

Loans Reports

This report provides a single A4 page per employee that is in receipt of a loan, listing the repayments made thus far and the current balance. To view this report select the Reports drop down menu and select the Loans option.

Collsoft Reports: Loan Reports

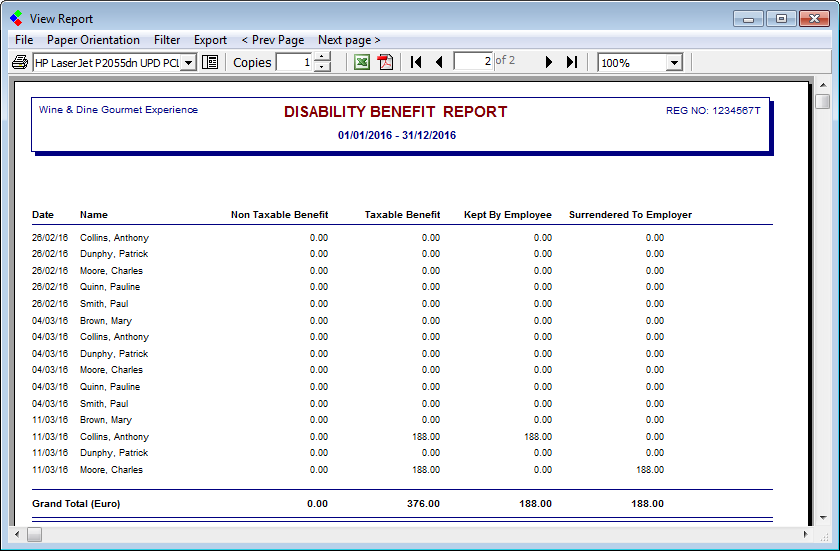

Illness Benefit Report

This report provides a summary of all illness benefit paid to each employee, whether it was taxable disability benefit or non taxable and whether the benefit was kept by the employer or the employee. To view this report select the Reports drop down menu and select the Illness Benefit option.

Collsoft Reports: Illness Benefit Report

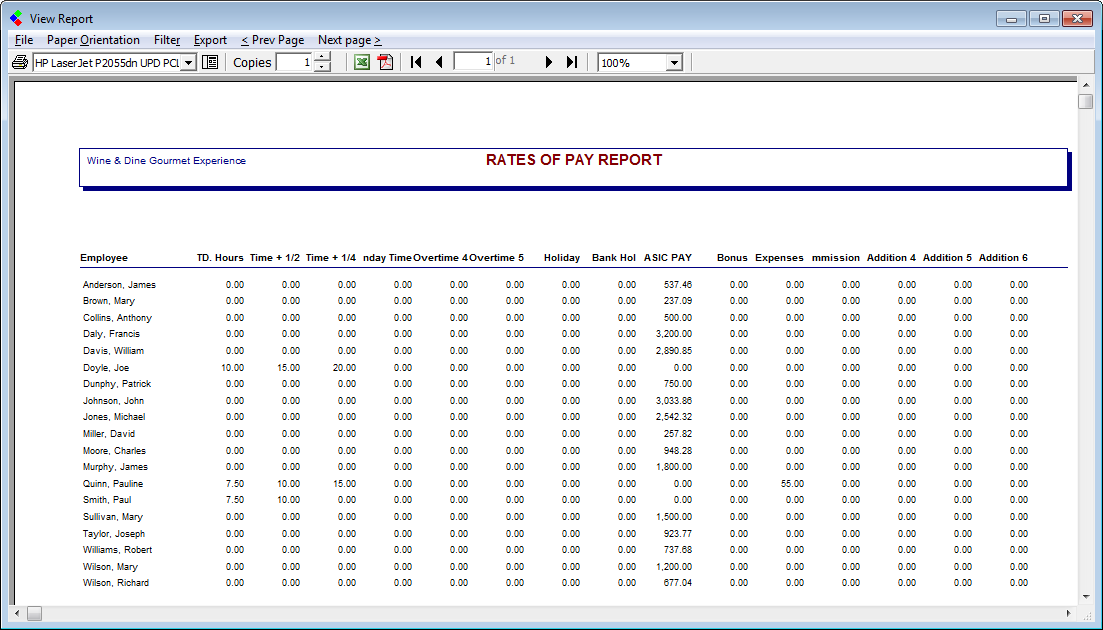

Rates of Pay Reports

These reports show what each employees total pay figure consists of so far this year. i.e. ‘x’ amount is basic pay, ‘y’ amount is overtime, ‘z’ amount is bank holidays worked etc. To view these reports select the Reports drop down menu and select the Rates Of Pay option and then select the report you require.

Collsoft Reports: Rates of Pay Reports

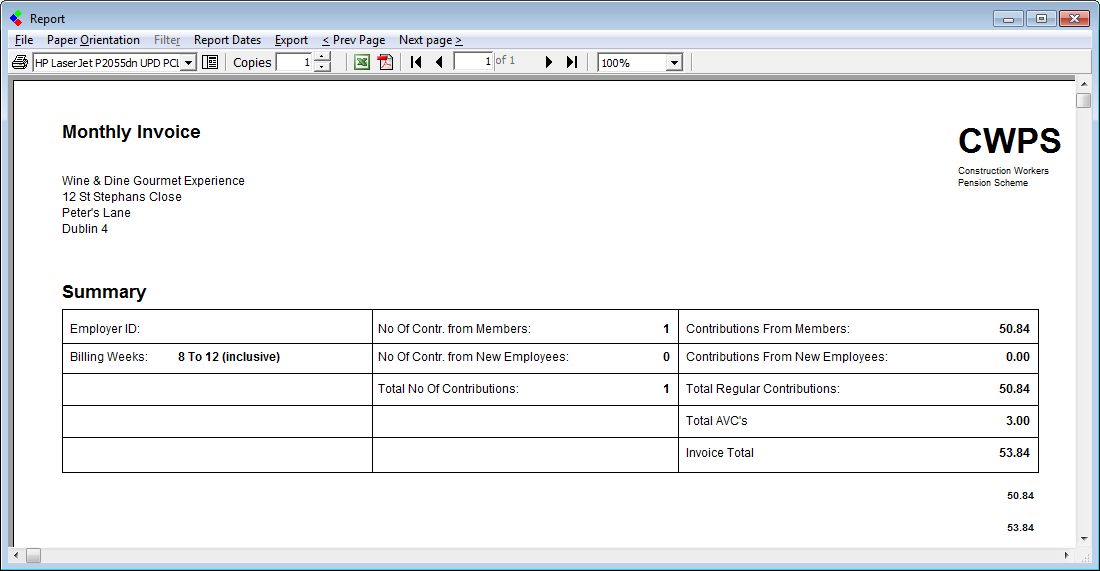

CWPS Report

This Report gives a summary of the contributions made by employees to the construction workers pension scheme. To view this report select the Reports drop down menu and select the CWPS option.

Collsoft Reports: CWPS Report

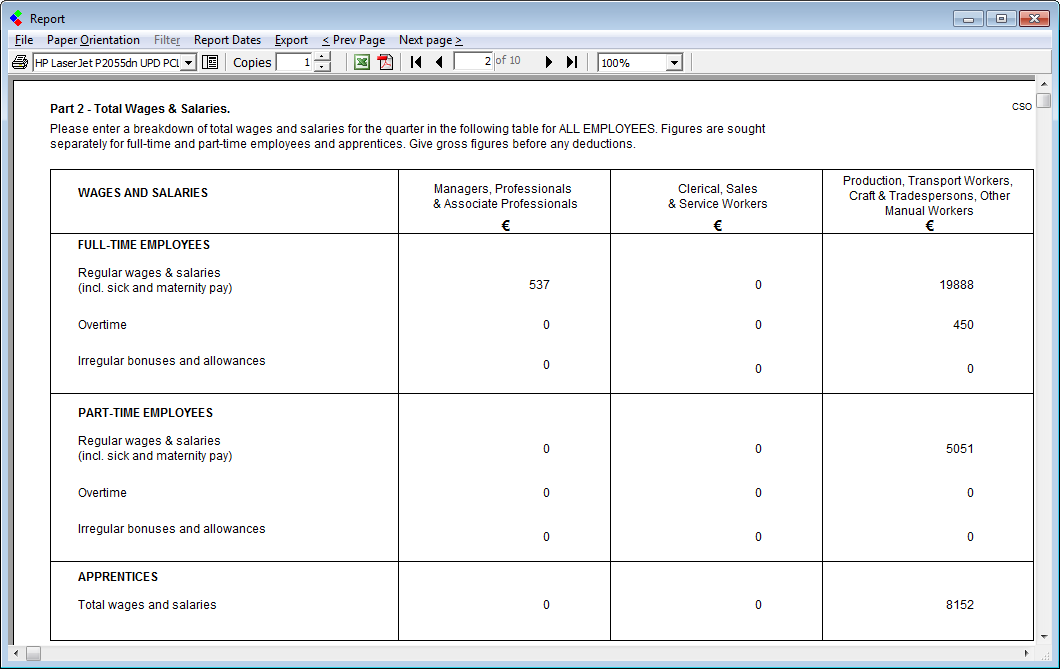

CSO Report

This Report provides information for the Central Statistics Office (CSO) on earnings made by employees in your employment. It is a survey that requires information on wages & salaries, employer’s social contributions, other non wage costs and hours worked. It is compulsory for all employers to provide this information to the CSO. To view this report select the Reports drop down menu and select the CSO option.

Collsoft Reports: CSO Report

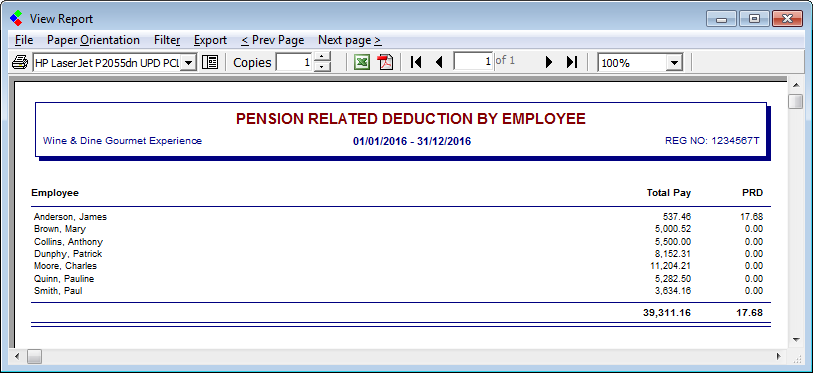

Public Service Pension Levy Report

These reports provide details of all Public Service Pension Related Deductions made by employees in this tax year to date. It also provides the total PRD deductions made by all employees in this tax year. You can view a detailed breakdown, a summary breakdown or a breakdown by week number of PRD’s made by employees. To view this report select the Reports drop down menu and select the Public Service Pension Levy option and then select the report that you require.

Collsoft Reports: PRD Report

Collsoft Reports: Reports Drop Down Menu

There are a number of different types of payroll reports that can be viewed and printed, depending on what information you want a report on. There are also options to view certain reports, by Employee, By Week number etc.

Collsoft Reports: Select the Report to View

Employee Register Report

This report lists the names of all live employees. Terminated employees are not shown on this report. To view this report select the Reports drop down menu and select the Employee Register option.

Collsoft Reports: Employee Register Report

Employee Profile Report

This report produces one A4 page per employee, showing Personal, Tax, Pay and YTD Details. It contains a complete list of all employees, both live and terminated. To view this report select the Reports drop down menu and select the Employee Profile option.

Collsoft Reports: Employee Profile Report

Holiday Reports

There are 4 reports in this section, Summary by Employee (Summary of Holidays taken/remaining for each employee), Detail by Employee (A4 Page for each employee detailing Holidays taken/remaining), Holiday Hours Summary (A4 Page for each employee accruing holidays by hours worked, detailing holidays accrued) and Holidays (Summary of Holidays taken per employee). To view these reports select the Reports drop down menu and select the Holiday option and the Holiday Report you require.

Collsoft Reports: Holiday Reports

Employee’s Days Off Report

This “All Days” report provides details of sick days, days absent without leave as well as Annual Leave taken. It is a report showing all days off for whatever reason, throughout the year. To view this report select the Reports drop down menu and select the Employees Day Off option.

Collsoft Reports: Employee's Day Off Report

Payroll Submission Reports

There are 4 reports in this section, Submissions Filed (this report details the Revenue submission made, by week and submission number and includes the employee details for those submissions made), Submissions Pending (this report highlights all outstanding Revenue submission by employee name and relevant week), Line Items Detail by Employee (this report expands on the submission filed report and includes all pay related figures. This is detailed by employee) and Gross Pay Detail by Employee (A4 Page for each employee detailing Gross Pay).

Collsoft Reports: Payroll Submissions Report

Collsoft Reports: Items Pending Submission Report

Collsoft Reports: Line item Detail by Employee Report

Collsoft Reports: Gross Pays Report by Employee

Gross to Net Reports

The Gross to Net reports provide an analysis of every payment made showing gross payments, additions, deductions, tax deducted, USC Paid, PRSI contributions etc. These reports can be date driven and can also be run By Employee, By Week Number, By Cost Centre etc. They will provide financial year end details as required by your tax advisers. To view these reports select the Reports drop down menu and select the Gross To Net option and then select the report that you require.

Collsoft Reports: Gross to Net Reports

Gross to Net Reports by Cost Centre

There is also an option to run Gross to Net reports by cost centre. This will display the Gross to Net information with the employees broken down into their respective cost centres or departments. These reports are also date driven and can also be run By Employee, By Week Number, By Cost Centre etc. To view these reports select the Reports drop down menu and select the Gross To Net (By Cost Centre) option and then select the report that you require.

Hours Worked Reports

Hours Worked Reports display the amount of different types of hours worked by each employee i.e. number of Standard Hours worked, number of Overtime Hours worked, number of Bank Holiday hours worked etc. To view these reports select the Reports drop down menu and select the Hours Worked option, then select the report your require.

Collsoft Reports: Hours Worked Reports

Payment Analysis Reports

The Payment Analysis Reports provide details of the amount of pay per employee per type of hours worked. i.e. Employee X has €240 worth

of Standard Hours worked this week. To view these reports select the Reports drop down menu and select the Payment Analysis option and then the report that you require.

Collsoft Reports: Payment Analysis Reports

Cost Centre Analysis Reports

This is a very useful tool if you have set up cost centres. A detailed listing of all costs associated with each department of your business, showing gross payments made, Employer Contributions costs as well as additions and deductions. To view these reports select the Reports drop down menu and select the Cost Centre Analysis option and then the report that you require.

Collsoft Reports: Cost Centre Analysis Reports

Additions Reports

These reports show a detailed listing of all individual additions. To view these reports select the Reports drop down menu and select the Additions option, then select the report that you require.

Collsoft Reports: Additions Report

Deductions Reports

These reports show a detailed listing of all individual deductions. To view these reports select the Reports drop down menu and select the Deductions option and then the report that you require.

Collsoft Reports: Deductions Report

Benefit in Kind Reports

These reports show all the BIK payments made to each employee and the total BIK for all employees. You can view a detailed BIK report, an employee BIK summary report or a BIK summary by pay date report. To view these reports select the Reports drop down menu and select the Benefit In Kind option and then the report that you require.

Collsoft Reports: Benefit in Kind Reports

Other Employer Costs Reports

These reports show a detailed listing of all other additional Employer Costs. To view these reports select the Reports drop down menu and select the Other Employer Costs option Other Employer Costs and then the report that you require.

Collsoft Reports: Other Employee Costs Report

Pension Contributions Reports

These reports give a detailed analysis of all standard pension and PRSA contributions made by the individual employees and by the employer, option. as well as any additional AVC’s made by any employees. There is also an option here to create a Pension File which you can then return to your pension provider. To view these reports or to create a pension file select the Reports drop down menu and select the Pension Contributions and then select the report you require.

Collsoft Reports: Pension Contribution Reports

Loans Reports

This report provides a single A4 page per employee that is in receipt of a loan, listing the repayments made thus far and the current balance. To view this report select the Reports drop down menu and select the Loans option.

Collsoft Reports: Loan Reports

Illness Benefit Report

This report provides a summary of all illness benefit paid to each employee, whether it was taxable disability benefit or non taxable and whether the benefit was kept by the employer or the employee. To view this report select the Reports drop down menu and select the Illness Benefit option.

Collsoft Reports: Illness Benefit Report

Rates of Pay Reports

These reports show what each employees total pay figure consists of so far this year. i.e. ‘x’ amount is basic pay, ‘y’ amount is overtime, ‘z’ amount is bank holidays worked etc. To view these reports select the Reports drop down menu and select the Rates Of Pay option and then select the report you require.

Collsoft Reports: Rates of Pay Reports

CWPS Report

This Report gives a summary of the contributions made by employees to the construction workers pension scheme. To view this report select the Reports drop down menu and select the CWPS option.

Collsoft Reports: CWPS Report

CSO Report

This Report provides information for the Central Statistics Office (CSO) on earnings made by employees in your employment. It is a survey that requires information on wages & salaries, employer’s social contributions, other non wage costs and hours worked. It is compulsory for all employers to provide this information to the CSO. To view this report select the Reports drop down menu and select the CSO option.

Collsoft Reports: CSO Report

Public Service Pension Levy Report

These reports provide details of all Public Service Pension Related Deductions made by employees in this tax year to date. It also provides the total PRD deductions made by all employees in this tax year. You can view a detailed breakdown, a summary breakdown or a breakdown by week number of PRD’s made by employees. To view this report select the Reports drop down menu and select the Public Service Pension Levy option and then select the report that you require.

Collsoft Reports: PRD Report

Get help for this page

Get help for this page