Directors PRSI

Section 16 of the Social Welfare and Pensions (Miscellaneous Provisions) Act 2013 clarifies the status, for social insurance purposes, of working directors who own or control 50% or more of the shares in the company in which they work.

CLASSIFICATION OF WORKING DIRECTORS

Up to 2013 the classification for PRSI purposes, of directors of limited companies who work in that company (“proprietary directors”), has been determined on a case by case basis. This determination takes into consideration the Code of Practice for Determining Employment or Self-Employment Status of Individuals.

Under the provisions of Section 16 of the Social Welfare and Pensions (Miscellaneous Provisions) Act 2013 proprietary directors who own or control 50% or more of the shareholding of the company, either directly or indirectly, cannot be an employee of that company. This provision comes into effect from 1 July 2013. In these circumstances, the individual is classified as self-employed and is liable to pay PRSI at Class S.

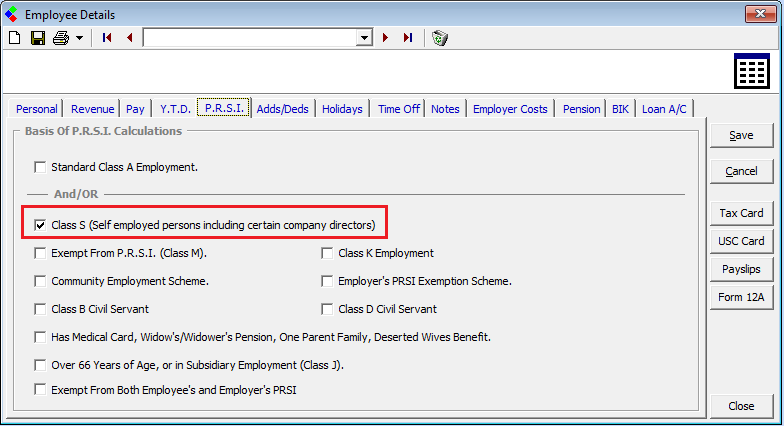

On set up, you must assign Class S within the PRSI detail of the Directors employee record.

Directors PRSI: Assign Class S on Employee record

The classification of proprietary directors who own or control less than 50% of the shareholding of the company will continue to be determined on a case by case basis, taking into consideration the Code of Practice for Determining the Employment or Self-employment Status of Individuals.

DIRECTORS REACH AGE 66

Once Class S categorised Directors reach age 66, their PRSI class changes from Class S to Class M.

This differs from non-proprietary Directors who were classified as Class A. Any such Director will change from Class A to Class J on reaching the age of 66 similar to all other Class A employee's.

When, either a Class A or Class S Director, reaches their 66th birthday you must change the assigned PRSI class within the PRSI detail of the employee record manually so that the updated PRSI class takes effect from the next payment.

CLASSIFICATION OF WORKING DIRECTORS

Up to 2013 the classification for PRSI purposes, of directors of limited companies who work in that company (“proprietary directors”), has been determined on a case by case basis. This determination takes into consideration the Code of Practice for Determining Employment or Self-Employment Status of Individuals.

Under the provisions of Section 16 of the Social Welfare and Pensions (Miscellaneous Provisions) Act 2013 proprietary directors who own or control 50% or more of the shareholding of the company, either directly or indirectly, cannot be an employee of that company. This provision comes into effect from 1 July 2013. In these circumstances, the individual is classified as self-employed and is liable to pay PRSI at Class S.

On set up, you must assign Class S within the PRSI detail of the Directors employee record.

Directors PRSI: Assign Class S on Employee record

The classification of proprietary directors who own or control less than 50% of the shareholding of the company will continue to be determined on a case by case basis, taking into consideration the Code of Practice for Determining the Employment or Self-employment Status of Individuals.

DIRECTORS REACH AGE 66

Once Class S categorised Directors reach age 66, their PRSI class changes from Class S to Class M.

This differs from non-proprietary Directors who were classified as Class A. Any such Director will change from Class A to Class J on reaching the age of 66 similar to all other Class A employee's.

When, either a Class A or Class S Director, reaches their 66th birthday you must change the assigned PRSI class within the PRSI detail of the employee record manually so that the updated PRSI class takes effect from the next payment.

| Files | ||

|---|---|---|

| Class S indicator.png | ||

Get help for this page

Get help for this page