PRSI Credit

With effect from 01st January 2016 a PRSI Credit has been introduced specifically for PRSI Class A, whereby earnings between €352.01 and €424, are reduced by a tapered weekly PRSI credit (subject to a maximum credit of €12.00).

HOW TO CALCULATE THE PRSI CREDIT ADJUSTMENT

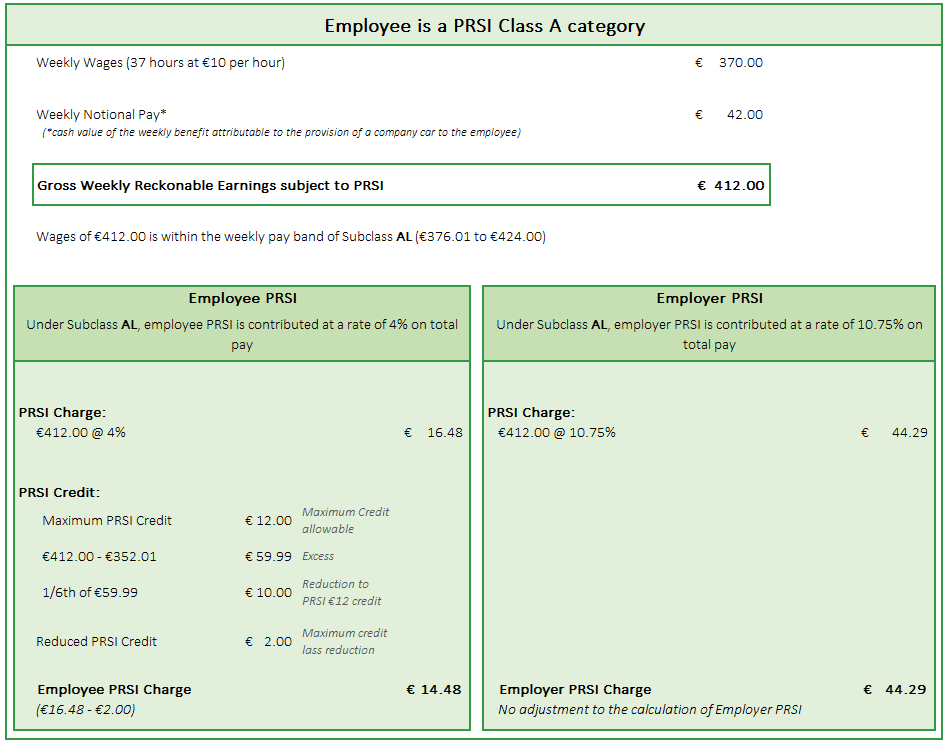

As PRSI is a weekly calculation the PRSI credit adjustment is very straightforward, refer to the below example for step by step guidance to manually calculate PRSI;

PRSI Credit : Subclass AL PRSI calculation

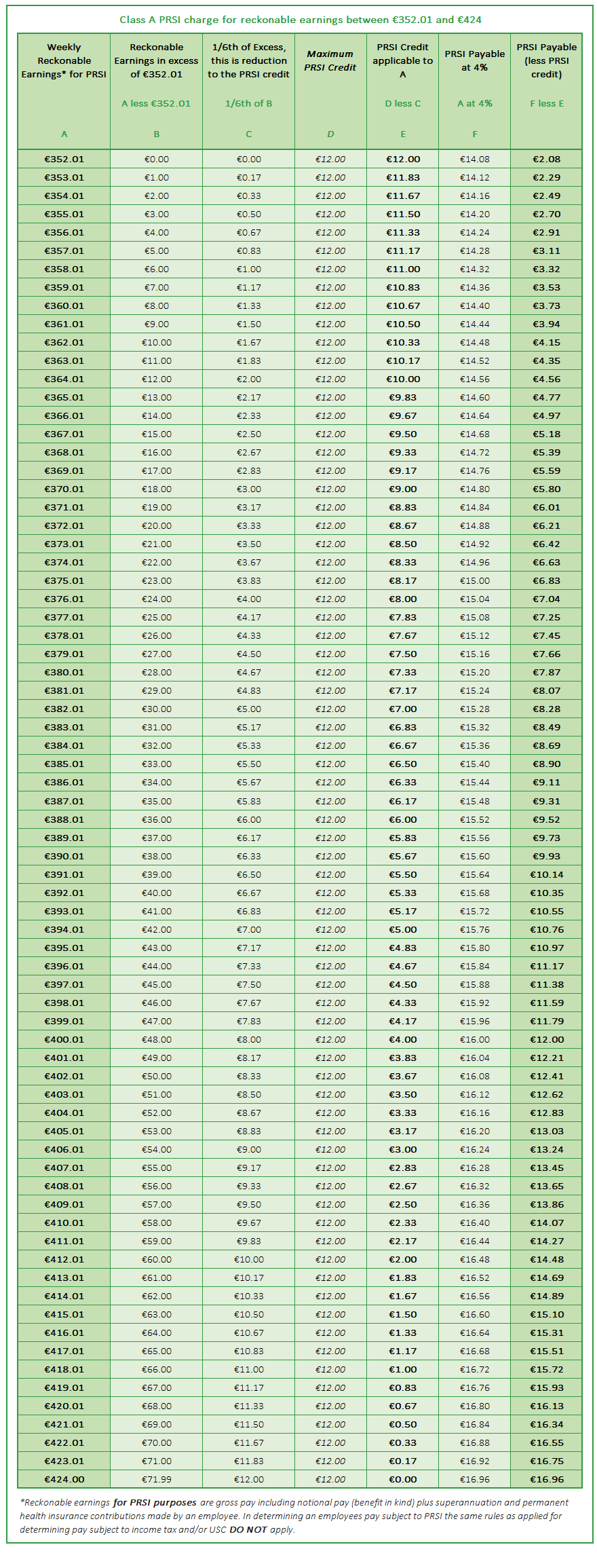

PRSI CREDIT: TABLE OF ADJUSTMENTS

The maximum allowable PRSI credit for 2016 is €12.00, applicable only to earnings within the range of €352.01 to €424 within the PRSI contribution classes of A & H.

The PRSI credit is reduced on a tapering basis as earnings approach the €424 threshold. Below is a table of the PRSI credit applicable to reckonable earnings within the range.

PRSI Credit: Earnings Table with adjustments

HOW TO CALCULATE THE PRSI CREDIT ADJUSTMENT

As PRSI is a weekly calculation the PRSI credit adjustment is very straightforward, refer to the below example for step by step guidance to manually calculate PRSI;

PRSI Credit : Subclass AL PRSI calculation

PRSI CREDIT: TABLE OF ADJUSTMENTS

The maximum allowable PRSI credit for 2016 is €12.00, applicable only to earnings within the range of €352.01 to €424 within the PRSI contribution classes of A & H.

The PRSI credit is reduced on a tapering basis as earnings approach the €424 threshold. Below is a table of the PRSI credit applicable to reckonable earnings within the range.

PRSI Credit: Earnings Table with adjustments

| Files | ||

|---|---|---|

| PRSI - PRSI Class A Calculation.png | ||

| PRSI - PRSI Credit Tables.png | ||

Get help for this page

Get help for this page