Editing Wages

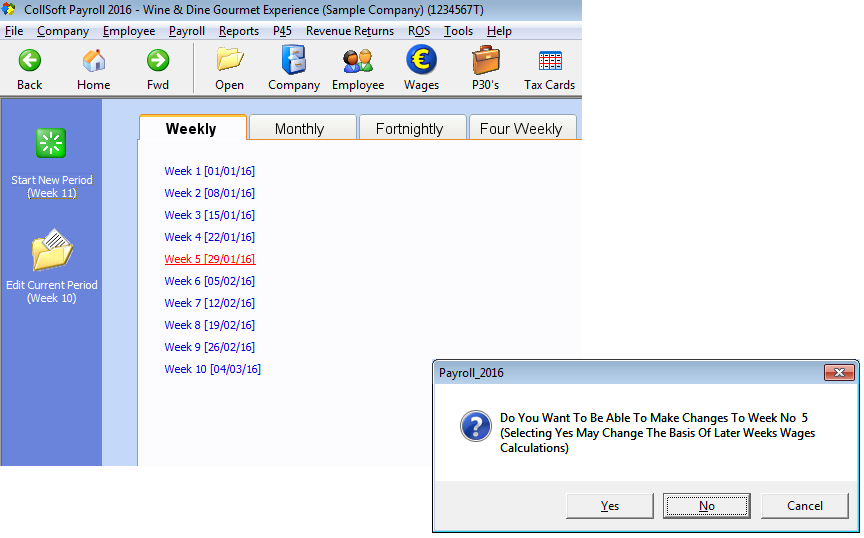

If you have made an error in posting employees wages, you can easily return to a previous week to make the necessary changes. Simply click on the week that you wish to amend, you will receive a warning from the system that you are about to make changes.

Editing Wages: Select the Week to Edit

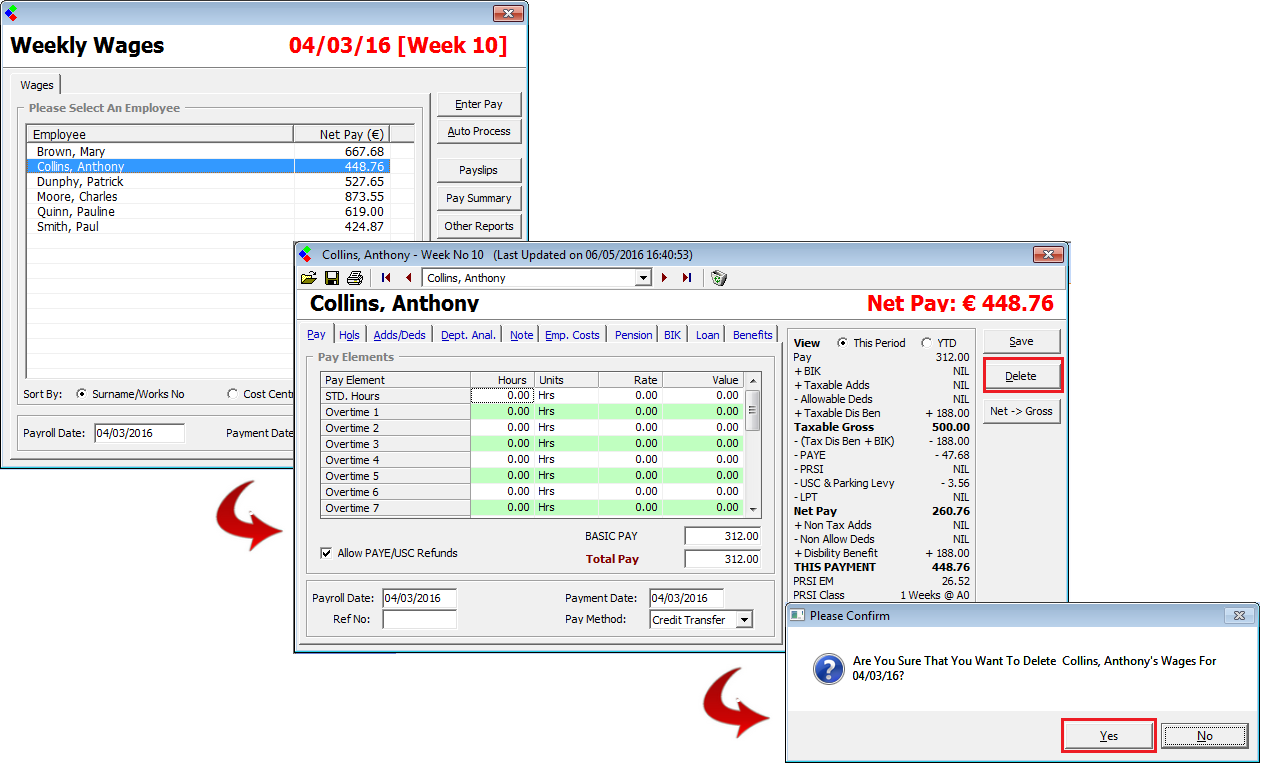

Proceed with change by clicking ‘Yes’ on this message and select the employee you wish to change. Click on the delete button on the right-hand side of the wage screen. The following message will appear. Click ‘Yes’ to delete the employee’s wage.

Editing Wages: Deleting the Original Wage

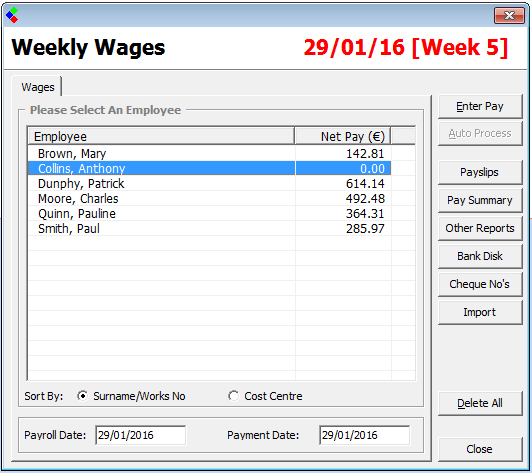

The Employees wage in now deleted and you will see this as the employee will now have a zero Net Pay on the weekly wages screen:

Editing Wages: Wage has been deleted

You can re-enter the necessary wage details for this employee by clicking on his name. When you have entered the correct details you can then save the correct wage for this employee.

Note: Please remember that if your employee is on a cumulative basis, by changing an earlier week it may affect subsequent weeks that have already been entered. Please ensure that you check and allow for any such changes. In the event that a P30 has been submitted for that period, your payments at year end will not balance and any such adjustments will be shown on your P35 Return and a balance may be due. We would recommend that you consult your financial advisor if you are not familiar with the cumulative tax credit system.

Editing Wages: Select the Week to Edit

Proceed with change by clicking ‘Yes’ on this message and select the employee you wish to change. Click on the delete button on the right-hand side of the wage screen. The following message will appear. Click ‘Yes’ to delete the employee’s wage.

Editing Wages: Deleting the Original Wage

The Employees wage in now deleted and you will see this as the employee will now have a zero Net Pay on the weekly wages screen:

Editing Wages: Wage has been deleted

You can re-enter the necessary wage details for this employee by clicking on his name. When you have entered the correct details you can then save the correct wage for this employee.

Note: Please remember that if your employee is on a cumulative basis, by changing an earlier week it may affect subsequent weeks that have already been entered. Please ensure that you check and allow for any such changes. In the event that a P30 has been submitted for that period, your payments at year end will not balance and any such adjustments will be shown on your P35 Return and a balance may be due. We would recommend that you consult your financial advisor if you are not familiar with the cumulative tax credit system.

| Files | ||

|---|---|---|

| Deleted Wage.png | ||

| Deleting Wages.png | ||

| Edit Wages.png | ||

Get help for this page

Get help for this page