CSO Earnings, Hours & Employment Costs Survey

Introduction

What is the Earnings, Hours and Employment Costs Survey (EHECS)?

The Central Statistics Office is conducting a new quarterly earnings survey which will eventually replace all other short-term earnings surveys currently being carried out by the CSO. The new survey will, in time, be expanded to cover all sectors of the economy.

This survey will produce an index of labour costs per hour worked. The survey will require the collection of wages & salaries, employer’s social contributions, other non-wage costs, and hours worked. If your company does not currently record this information, you may need to make some adjustments to your payroll system in order to calculate these figures on a quarterly basis.

All EU member states are obliged to compile Labour Cost indices.

They will provide vital information for future social and economic planning, such as wage agreements, etc.

What’s involved?

Each quarter, you will receive a questionnaire relating to the number of people employed in your business during that quarter. Each employee will need to be categorised into one of the following three occupational groups:

1. Managers, Administrators, Professionals & Associate Professional (Legislators and senior officials, corporate managers, managers of small enterprises, professionals and associate professionals)

2. Clerical, Sales & Service Workers (Clerks, office workers, service & sales workers).

3. Production, Transport Workers, Craft & Trades-persons and Other Manual Workers (Plant & machine operators & assemblers, skilled craft & trade workers and other manual occupations)

You will need to provide the total labour costs, the total hours worked and the total hours not worked (e.g. annual leave) for each category of employee.

Instructions will be provided with the survey form. If you require any additional information or help see the contact details below.

Once the survey is fully operational, enterprises with small numbers employed will only be required to send data for a set number of quarters before being replaced by other enterprises. This will help to spread the burden of response while still providing good data on all sectors of the economy.

Is it compulsory?

Yes. The legislation is the Statistics (Labour Costs Surveys) Order 2005, and Council Regulation (EC) No. 530/1999.

Is my return confidential?

Yes. Under the 1993 Statistics Act, the CSO is legally obliged to treat all information received as confidential. Under no circumstances will any return be made available to any Government Department, Agency or outside organisation. Information provided will be used for aggregate statistical purposes only.

Want more information?

For further information on the Earnings, Hours & Employment Costs Survey please contact:

Earnings, Hours & Employment Costs Section

Central Statistics Office

Skehard Road

Cork

Phone: LoCall

1890 313 414 (ROI)

0870 8760256 (UK/NI)

Fax: 021 453 5553

Email: EHECS@cso.ie

CSO Website: www.cso.ie

Getting Started

There are some preliminary settings that you must configure before you can generate an EHECS return in CollSoft.

These settings are required to categorise pay elements and employees according to the categories required by the CSO.

Company Pay Elements

Each pay element in your payroll needs to be assigned an equivalent CSO type so that it can be categorised correctly on the EHECS report.

Pay elements can be categorised as follows:

Regular Pay

Regular wages and salaries are wages and salaries, inclusive of any allowances but exclusive of overtime, that are received at each pay period during the quarter.

It should include all payroll codes, except overtime, that affect gross earnings and are paid at each pay period, even though the amount paid may vary.

N.B. See footnote below about the correct treatment of sick and maternity pay.

Overtime Pay

The gross value of overtime payments made to workers.

It is the full amount paid for working overtime that should be entered here and not just the overtime premium.

Holiday / Bank Holiday Pay

This is actually counted as regular pay, but the number of hours taken by each employee for holidays and bank holidays is counted as “Paid Hours Not Worked” and reported separately.

Irregular Bonus

The total of gross irregular bonuses and allowances paid to all workers.

Irregular bonuses and allowances are payments, other than overtime, that affect gross earnings and are not paid at each pay period during the quarter, e.g. end of quarter productivity bonuses, golden handshakes, backdated pay awards relating to periods prior to the current quarter.

Redundancy Pay

Refers to both statutory and non-statutory redundancy payments.

Maternity Pay

This is actually counted as regular pay, but the number of hours taken by each employee for maternity leave is counted as “Paid Hours Not Worked” and reported separately.

Sick Pay

This is actually counted as regular pay, but the number of hours taken by each employee as sick leave is counted as “Paid Hours Not Worked” and reported separately.

Employee Benefit – Motor

The total cost to the employer (or notional income calculation) of the private use of company vehicles (i.e. cars, commercial vehicles etc) for an employee.

Employee Benefit – Stock Options

The total cost to the employer of stock options and share purchase schemes provided to an employee.

N.B. It is the actual cost to the employer that is required here (i.e. exclude any amounts which are refunded to the employer through deductions from employees’ wages etc).

Employee Benefit – Health Insurance

The total cost to the employer (or notional income calculation) of voluntary sickness insurance (e.g. VHI, BUPA) provided to an employee.

Employee Benefit – Accommodation

The total cost to the employer (or notional income calculation) of staff housing provided to an employee.

Employee Benefit – Other

The total cost of other benefits provided buy an employer (e.g. meals, crèche, parking etc)

Training Cost

Cost related to the provision of training for an employee.

Other Cost

Cost to the employer of any other labour related expenditure. E.g. recruitment and relocation costs, uniforms/working clothes provided by the employer.

Continuance Insurance

Cost to the employer for the provision of Income Continuance insurance.

Other Employee related Payments

Other employee related payments e.g. study grants etc.

Excluded Pay Item

Items that should be excluded from the CSO report such as vouched expenses.

Notes: Particular care must be taken in situations where the employer receives refunds from the Dept. of Social and Family Affairs (DSFA) for sick and maternity pay. If the amount that is included as regular wages and salaries, includes sums that are subsequently refunded to the employer by DSFA, then the amount that is received/receivable from DSFA must be included as a refund in the relevant section.

Each pay element in payroll can be mapped to its CSO equivalent using the Pay element mappings Screen.

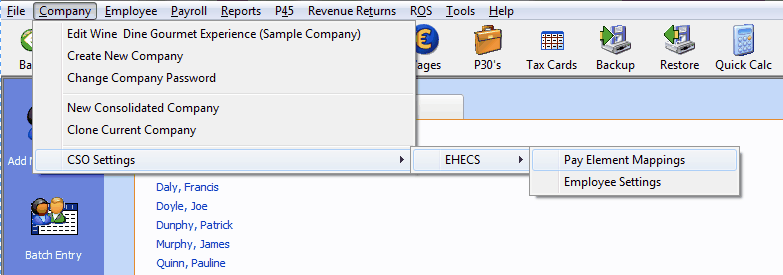

To open the “Pay Element Mapping Screen” select the “Company” > “CSO Settings” > “EHECS” > “Pay Element Mappings” menu (below)

CSO EHECS: Select Pay Element Mappings option

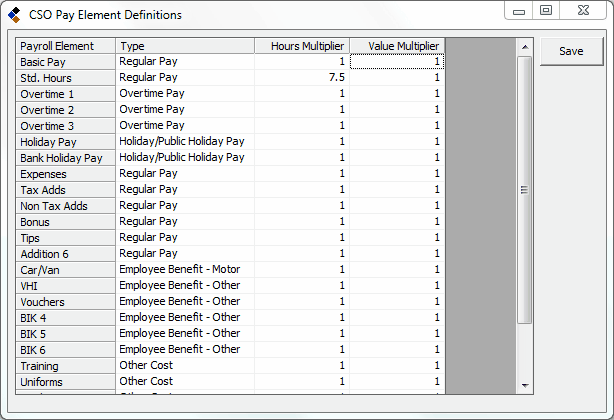

Selecting this option will open the following screen where you can make the relevant selections.

CSO EHECS: Pay Element Definitions

Press the “Save” button to save the setting once you are finished.

Please Note: Payroll will automatically assign default CSO categories to each Pay Element, but they may be incorrect. Please ensure that the settings are correct before you run the EHECS report to ensure that your return is correct.

Hours and Value Multipliers

When using the hourly rate fields in CollSoft, it is assumed that the user is entering the number of hours worked by an employee.

However this may not always be true. For example the User may be using the hourly rate fields to pay the employee for the number of days they have worked using a daily rate in place of an hourly rate. So when it comes to entering the number of hours the employee works in any one week, the user might have the number of days entered in place of the number of hours.

If the user were then to run the EHECS report, CollSoft Payroll would count that as 5 hours, which would be incorrect.

Using the “Hours Multiplier” the user can specify that the total in this field should be multiplied by a user defined amount. Suppose for instance that the employee works a 7.5 hours day, then in Payroll the user would specify a multiplier of 7.5 for this pay element, and when Payroll generates the data it will transfer 5 x 7.5 or 37.5 hours onto the EHECS report.

Another example of where you would use the Hours multiplier would be a case where the pay element was used to calculate pay that is not based on the amount of time the employee worked at all. Perhaps it’s the number of miles the employee has driven in the week, or the number of rooms they have cleaned in a hotel, or the number of new customers they have set up etc.

In these cases the quantity has nothing to do with hours worked, and as such should not be transferred onto the EHECS report.

For such items the user can specify a zero multiplier which will effectively zero the number of hours that this pay element contributes to the EHECS report, but it does not affect the monetary value of the payment on the return.

There is also a multiplier for the monetary multiplier that works in a similar manner as the hours multiplier, but it effects the monetary value of the pay element in the EHECS return.

Employee Settings

In the EHECS return each employee is categorised according to their grade and employment status.

Employees can be categorised as follows:

Grade - Manager, Administrator etc Or Clerical & Service worker Or Production, transport, craft & trades-person etc.

Type of Employment - Full time, Part Time, Apprentice or Other

By default Payroll will designate each employee to be a “Full Time Production Worker”, but these settings can be changed via the “CSO Employee Settings” screen.

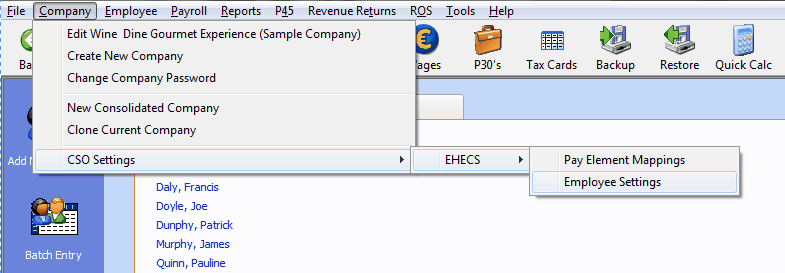

To edit these settings please select the “Company” > “CSO Settings” > “EHECS” > “Employee Settings” menu (below)

CSO EHECS: Select Employee Settings option

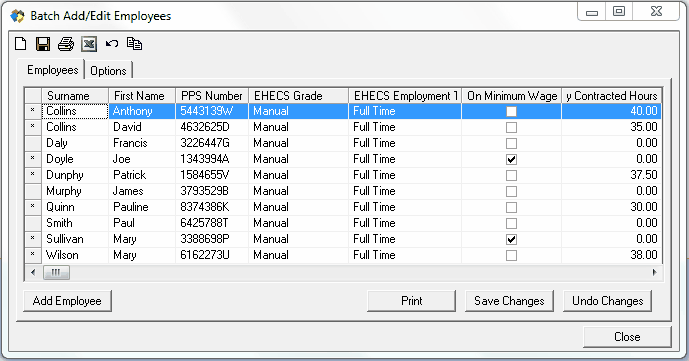

This will open the following screen where you can categorize each employee correctly.

CSO EHECS: Edit Employee Details

Please Note: The “Weekly Contracted Hours” field is used to specify the number of standard hours that a salaried employee works in any given week.

If your employee is paid by the number of hours that they work then you should leave this field zero as payroll will add up all the hours worked by such employees in the quarter.

In the case of a salaried employee where the hours worked each week has not been entered in Payroll, the figures used for the CSO EHECS return will be calculated as the “Weekly Contracted Hours” multiplied by the number of weeks worked.

What is the Earnings, Hours and Employment Costs Survey (EHECS)?

The Central Statistics Office is conducting a new quarterly earnings survey which will eventually replace all other short-term earnings surveys currently being carried out by the CSO. The new survey will, in time, be expanded to cover all sectors of the economy.

This survey will produce an index of labour costs per hour worked. The survey will require the collection of wages & salaries, employer’s social contributions, other non-wage costs, and hours worked. If your company does not currently record this information, you may need to make some adjustments to your payroll system in order to calculate these figures on a quarterly basis.

All EU member states are obliged to compile Labour Cost indices.

They will provide vital information for future social and economic planning, such as wage agreements, etc.

What’s involved?

Each quarter, you will receive a questionnaire relating to the number of people employed in your business during that quarter. Each employee will need to be categorised into one of the following three occupational groups:

1. Managers, Administrators, Professionals & Associate Professional (Legislators and senior officials, corporate managers, managers of small enterprises, professionals and associate professionals)

2. Clerical, Sales & Service Workers (Clerks, office workers, service & sales workers).

3. Production, Transport Workers, Craft & Trades-persons and Other Manual Workers (Plant & machine operators & assemblers, skilled craft & trade workers and other manual occupations)

You will need to provide the total labour costs, the total hours worked and the total hours not worked (e.g. annual leave) for each category of employee.

Instructions will be provided with the survey form. If you require any additional information or help see the contact details below.

Once the survey is fully operational, enterprises with small numbers employed will only be required to send data for a set number of quarters before being replaced by other enterprises. This will help to spread the burden of response while still providing good data on all sectors of the economy.

Is it compulsory?

Yes. The legislation is the Statistics (Labour Costs Surveys) Order 2005, and Council Regulation (EC) No. 530/1999.

Is my return confidential?

Yes. Under the 1993 Statistics Act, the CSO is legally obliged to treat all information received as confidential. Under no circumstances will any return be made available to any Government Department, Agency or outside organisation. Information provided will be used for aggregate statistical purposes only.

Want more information?

For further information on the Earnings, Hours & Employment Costs Survey please contact:

Earnings, Hours & Employment Costs Section

Central Statistics Office

Skehard Road

Cork

Phone: LoCall

1890 313 414 (ROI)

0870 8760256 (UK/NI)

Fax: 021 453 5553

Email: EHECS@cso.ie

CSO Website: www.cso.ie

Getting Started

There are some preliminary settings that you must configure before you can generate an EHECS return in CollSoft.

These settings are required to categorise pay elements and employees according to the categories required by the CSO.

Company Pay Elements

Each pay element in your payroll needs to be assigned an equivalent CSO type so that it can be categorised correctly on the EHECS report.

Pay elements can be categorised as follows:

Regular Pay

Regular wages and salaries are wages and salaries, inclusive of any allowances but exclusive of overtime, that are received at each pay period during the quarter.

It should include all payroll codes, except overtime, that affect gross earnings and are paid at each pay period, even though the amount paid may vary.

N.B. See footnote below about the correct treatment of sick and maternity pay.

Overtime Pay

The gross value of overtime payments made to workers.

It is the full amount paid for working overtime that should be entered here and not just the overtime premium.

Holiday / Bank Holiday Pay

This is actually counted as regular pay, but the number of hours taken by each employee for holidays and bank holidays is counted as “Paid Hours Not Worked” and reported separately.

Irregular Bonus

The total of gross irregular bonuses and allowances paid to all workers.

Irregular bonuses and allowances are payments, other than overtime, that affect gross earnings and are not paid at each pay period during the quarter, e.g. end of quarter productivity bonuses, golden handshakes, backdated pay awards relating to periods prior to the current quarter.

Redundancy Pay

Refers to both statutory and non-statutory redundancy payments.

Maternity Pay

This is actually counted as regular pay, but the number of hours taken by each employee for maternity leave is counted as “Paid Hours Not Worked” and reported separately.

Sick Pay

This is actually counted as regular pay, but the number of hours taken by each employee as sick leave is counted as “Paid Hours Not Worked” and reported separately.

Employee Benefit – Motor

The total cost to the employer (or notional income calculation) of the private use of company vehicles (i.e. cars, commercial vehicles etc) for an employee.

Employee Benefit – Stock Options

The total cost to the employer of stock options and share purchase schemes provided to an employee.

N.B. It is the actual cost to the employer that is required here (i.e. exclude any amounts which are refunded to the employer through deductions from employees’ wages etc).

Employee Benefit – Health Insurance

The total cost to the employer (or notional income calculation) of voluntary sickness insurance (e.g. VHI, BUPA) provided to an employee.

Employee Benefit – Accommodation

The total cost to the employer (or notional income calculation) of staff housing provided to an employee.

Employee Benefit – Other

The total cost of other benefits provided buy an employer (e.g. meals, crèche, parking etc)

Training Cost

Cost related to the provision of training for an employee.

Other Cost

Cost to the employer of any other labour related expenditure. E.g. recruitment and relocation costs, uniforms/working clothes provided by the employer.

Continuance Insurance

Cost to the employer for the provision of Income Continuance insurance.

Other Employee related Payments

Other employee related payments e.g. study grants etc.

Excluded Pay Item

Items that should be excluded from the CSO report such as vouched expenses.

Notes: Particular care must be taken in situations where the employer receives refunds from the Dept. of Social and Family Affairs (DSFA) for sick and maternity pay. If the amount that is included as regular wages and salaries, includes sums that are subsequently refunded to the employer by DSFA, then the amount that is received/receivable from DSFA must be included as a refund in the relevant section.

Each pay element in payroll can be mapped to its CSO equivalent using the Pay element mappings Screen.

To open the “Pay Element Mapping Screen” select the “Company” > “CSO Settings” > “EHECS” > “Pay Element Mappings” menu (below)

CSO EHECS: Select Pay Element Mappings option

Selecting this option will open the following screen where you can make the relevant selections.

CSO EHECS: Pay Element Definitions

Press the “Save” button to save the setting once you are finished.

Please Note: Payroll will automatically assign default CSO categories to each Pay Element, but they may be incorrect. Please ensure that the settings are correct before you run the EHECS report to ensure that your return is correct.

Hours and Value Multipliers

When using the hourly rate fields in CollSoft, it is assumed that the user is entering the number of hours worked by an employee.

However this may not always be true. For example the User may be using the hourly rate fields to pay the employee for the number of days they have worked using a daily rate in place of an hourly rate. So when it comes to entering the number of hours the employee works in any one week, the user might have the number of days entered in place of the number of hours.

If the user were then to run the EHECS report, CollSoft Payroll would count that as 5 hours, which would be incorrect.

Using the “Hours Multiplier” the user can specify that the total in this field should be multiplied by a user defined amount. Suppose for instance that the employee works a 7.5 hours day, then in Payroll the user would specify a multiplier of 7.5 for this pay element, and when Payroll generates the data it will transfer 5 x 7.5 or 37.5 hours onto the EHECS report.

Another example of where you would use the Hours multiplier would be a case where the pay element was used to calculate pay that is not based on the amount of time the employee worked at all. Perhaps it’s the number of miles the employee has driven in the week, or the number of rooms they have cleaned in a hotel, or the number of new customers they have set up etc.

In these cases the quantity has nothing to do with hours worked, and as such should not be transferred onto the EHECS report.

For such items the user can specify a zero multiplier which will effectively zero the number of hours that this pay element contributes to the EHECS report, but it does not affect the monetary value of the payment on the return.

There is also a multiplier for the monetary multiplier that works in a similar manner as the hours multiplier, but it effects the monetary value of the pay element in the EHECS return.

Employee Settings

In the EHECS return each employee is categorised according to their grade and employment status.

Employees can be categorised as follows:

Grade - Manager, Administrator etc Or Clerical & Service worker Or Production, transport, craft & trades-person etc.

Type of Employment - Full time, Part Time, Apprentice or Other

By default Payroll will designate each employee to be a “Full Time Production Worker”, but these settings can be changed via the “CSO Employee Settings” screen.

To edit these settings please select the “Company” > “CSO Settings” > “EHECS” > “Employee Settings” menu (below)

CSO EHECS: Select Employee Settings option

This will open the following screen where you can categorize each employee correctly.

CSO EHECS: Edit Employee Details

Please Note: The “Weekly Contracted Hours” field is used to specify the number of standard hours that a salaried employee works in any given week.

If your employee is paid by the number of hours that they work then you should leave this field zero as payroll will add up all the hours worked by such employees in the quarter.

In the case of a salaried employee where the hours worked each week has not been entered in Payroll, the figures used for the CSO EHECS return will be calculated as the “Weekly Contracted Hours” multiplied by the number of weeks worked.

| Files | ||

|---|---|---|

| CSO Employee Settings.png | ||

| CSO Pay Elements.png | ||

| Open Employee Settings.png | ||

| Open Pay Elements.png | ||

Get help for this page

Get help for this page