Consolidated Companies

The Consolidated Companies feature in CollSoft Payroll enables the user to view the data from two or more standard companies, as a single company for reporting purposes.

Examples of why you may use a Consolidated Company are:

- Where Employees have been split into multiple companies for management or security purposes.

- Where Payroll is run independently at different sites, but both sites share the same Employers Registration number.

The Consolidated Company can only be used to run reports or generate ROS returns. You can't add/edit employees, run wages etc, while logged into the Consolidated Company. These functions can only be performed by logging into the relevant subsidiary company.

Creating a Consolidated Company

To create a Consolidated Company the user must do the following:

1. Open CollSoft Payroll and open one of the intended subsidiary companies.

2. From the "Company" menu select the "New Consolidated Company".

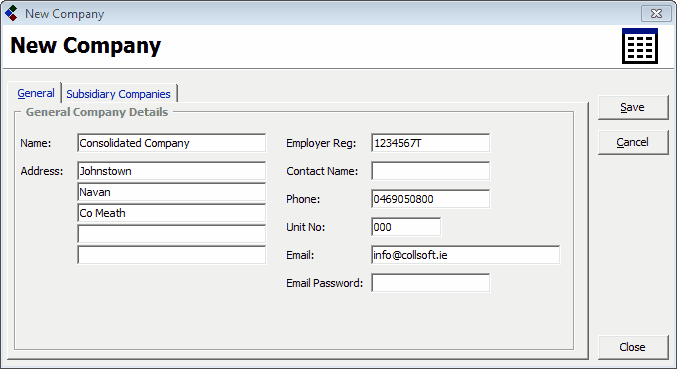

3. Enter the basic company Details as per example below:

Consolidated Company: General Consolidated Company Details

4. Press the "Save" button to save your details.

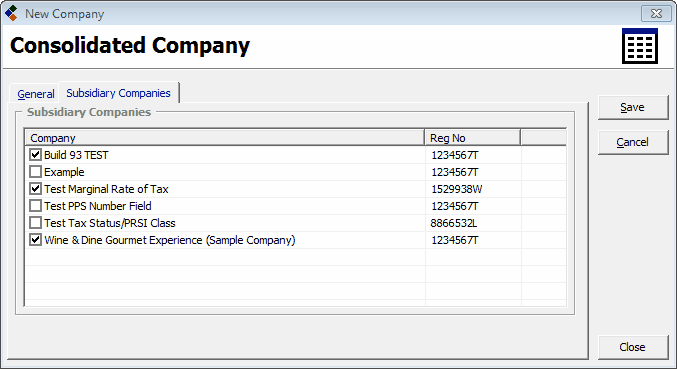

5. Click into the "Subsidiary Companies" tab and select the relevant subsidiary companies:

Consolidated Company: Select Subsidiary Companies

6. Press the "Save" button again to save your changes.

7. Click Close and the Consolidated Company will be added to your list of current companies.

Examples of why you may use a Consolidated Company are:

- Where Employees have been split into multiple companies for management or security purposes.

- Where Payroll is run independently at different sites, but both sites share the same Employers Registration number.

The Consolidated Company can only be used to run reports or generate ROS returns. You can't add/edit employees, run wages etc, while logged into the Consolidated Company. These functions can only be performed by logging into the relevant subsidiary company.

Creating a Consolidated Company

To create a Consolidated Company the user must do the following:

1. Open CollSoft Payroll and open one of the intended subsidiary companies.

2. From the "Company" menu select the "New Consolidated Company".

3. Enter the basic company Details as per example below:

Consolidated Company: General Consolidated Company Details

4. Press the "Save" button to save your details.

5. Click into the "Subsidiary Companies" tab and select the relevant subsidiary companies:

Consolidated Company: Select Subsidiary Companies

6. Press the "Save" button again to save your changes.

7. Click Close and the Consolidated Company will be added to your list of current companies.

| Files | ||

|---|---|---|

| Consolidated Company.png | ||

| Subsidiary Companies.png | ||

Get help for this page

Get help for this page