Employee Loan Account

Employee Details screen:

There is a Loan A/C on the employee details screen where you can set up the loan details and the relevant deductions.

There is a Loan A/C on the employee details screen where you can set up the loan details and the relevant deductions.

The Loan A/C section allows the employer add the loan details and to keep track of any loans that may have been made to employees. You can add the opening balance for the loan and the repayments to be made, including any interest that may be charged on the loan. The repayments will be deducted from the employee’s wages each week/month and the repayment will be recorded on the employees Loan A/C tab, along with the current balance after the repayment.

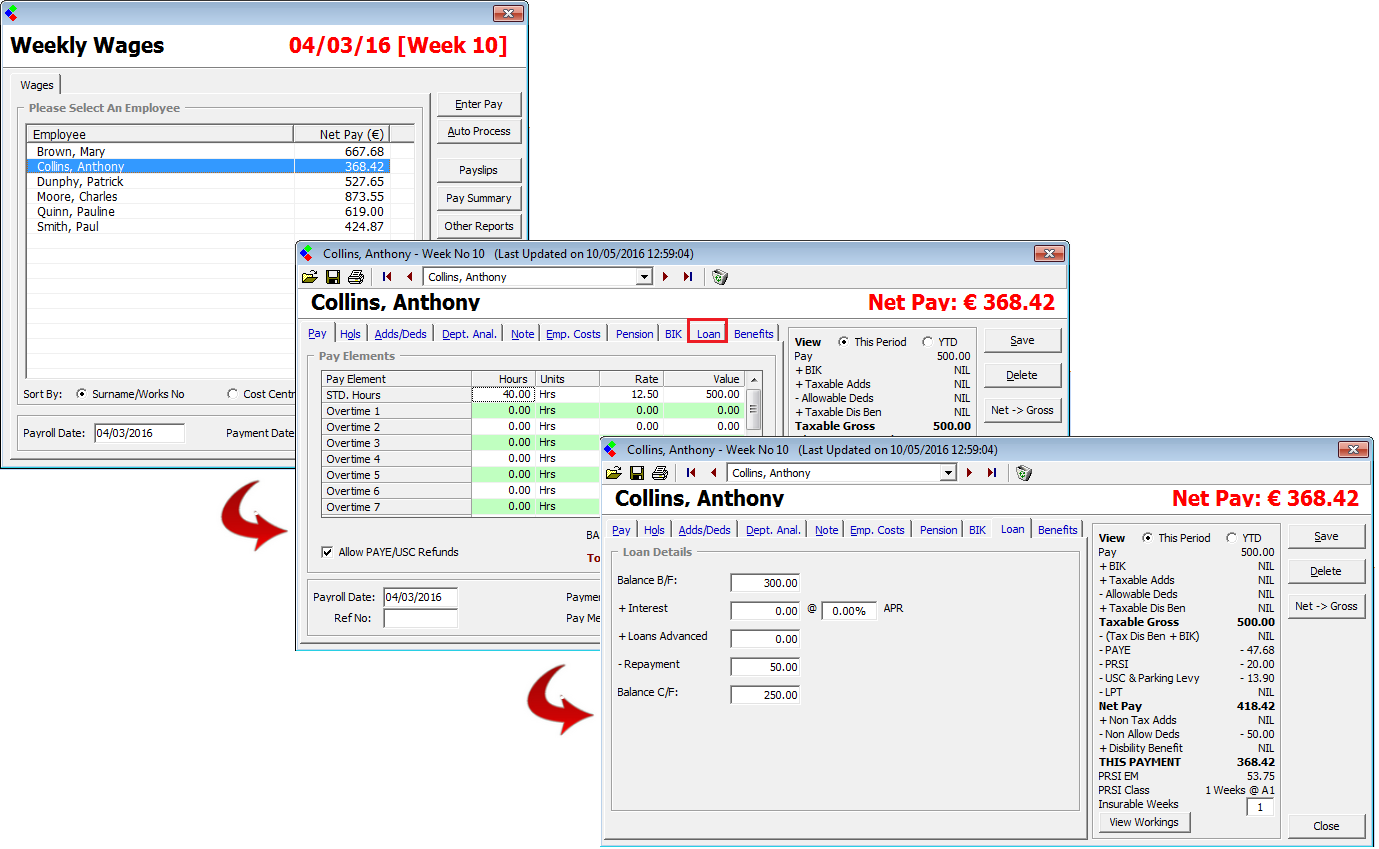

Save changes on the employee screen, when you run the next new wage you will see the pension deductions show in the wage. The Loan tab in an employee’s wages allows you to view any loan repayments that are being made by the employee in this pay period.

Any Loan figures entered on this employee’s employee details screen will filter through and be present here on their wage.

You can add, edit or remove the value of the repayment present, depending on how much of a repayment the employee wishes to make in that period. The repayment is deducted from the employee’s net pay and is recorded as a Non Allowable Deduction, as shown below.

Wages Employee Loan: Employee Loan Repayments

Once you have entered the employee's loan amount as above you can click save and close and the wage including the Loan figures will be saved for that employee.

Any Loan figures entered on this employee’s employee details screen will filter through and be present here on their wage.

You can add, edit or remove the value of the repayment present, depending on how much of a repayment the employee wishes to make in that period. The repayment is deducted from the employee’s net pay and is recorded as a Non Allowable Deduction, as shown below.

Wages Employee Loan: Employee Loan Repayments

Once you have entered the employee's loan amount as above you can click save and close and the wage including the Loan figures will be saved for that employee.

Note: The payroll does not prompt the user when an employees loan has been fully repaid, so the user must keep an eye on the Balance and stop deducting loan repayments once the loan has been fully repaid.

| Files | ||

|---|---|---|

| DataImage78.png | ||

| Employee Loan.png | ||

Get help for this page

Get help for this page