Advance and supplementary payments- 2023

Processing multiple payments for an employee within a single pay period

In Payroll 2023 we have added a new feature for users to process multiple payments for an employee within a

single pay period.

This is to enable employers reflect more accurately the situations that can arise in payroll

where unplanned payments need to be made to employees and reported to Revenue.

In addition to the Regular Payroll Run, users can now add to other types of payments to any payroll period –

Advance Payments and Supplementary Payments (sometimes referred to as a Bonus Run in other payroll

software)

Advance Payments – Paid and Recouped in same Pay Period

These are payments which are made to employees in advance of a normal payroll run, and which are to be

fully recouped from an employee in a subsequent regular payroll run.

For example, consider a monthly payroll where the wages are normally paid on the last Friday of the month,

but you have an employee who asks if he can have an advance of €1000 on the 10th of the month, and his

normal monthly salary is €5000 per month.

Using the new Advance Payment feature you will now be able to enter an advance payment of €1000 to this

employee on the 10th, and CollSoft will automatically deduct the €1000 when you run the regular monthly

payroll run.

Important Note: Under the Revenue PAYE Modernisation regulations employers are required to report all

such advance payments (also known as payments on account) to Revenue on or before the date the advance

payment is made to the employee.

Please refer to section 3.4.8 on page 31 of the following Revenue Guidance

document;

Part 42-04-35A - The Employers' Guide to PAYE with effect from January 2019 (revenue.ie)

You will be able to report such advance payments to Revenue using the usual PSR submission process.

Now, lets see how that work in practice in CollSoft Payroll by running the example given above;

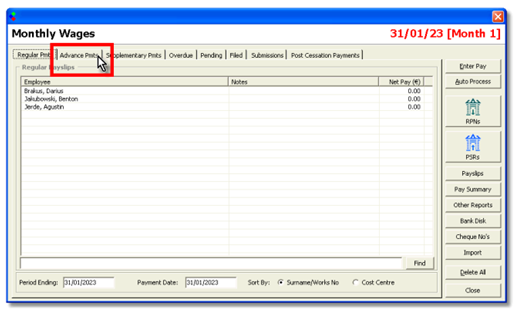

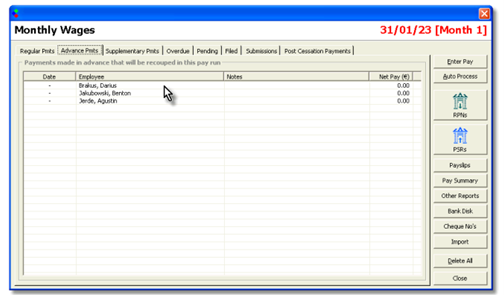

First, open the monthly payroll and click into the Advance Pmts tab shown below

Here will see a list of your employees, click on the employee for whom you want to process the advance

payment;

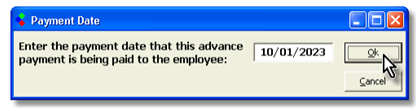

You will then be prompted for the date on which the advance payment is being made to the employee, in this

example the 10th January;

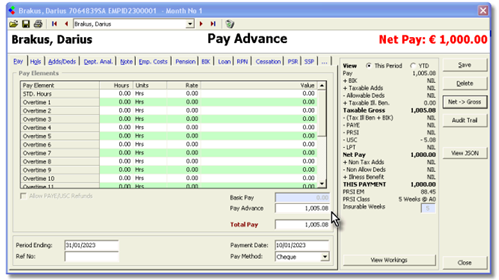

Next you will see the normal wage entry screen , however, all of the data fields with the exception of Pay

Advance will be disabled.

Also, please note that any default payments or deductions that exist on the employees file will be ignored for

this payment;

You can either enter a Pay Advance as a Gross Payment, or you can run a Net To Gross.

In this example we

have run it as a Net To Gross payment as we want to give the employee a net amount of €1,000.

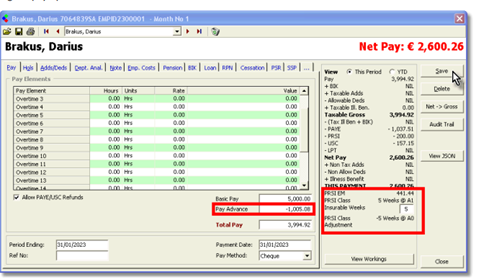

In this example the payment grosses up to €1,005.08, and this is the gross amount which will be reported to

Revenue as required under the regulations.

Also, please pay attention to the PRSI Class that has been allocated – 5 Weeks at A0

After you save the wage you can run other advance payments in the same way, and when you are complete

you are then ready to report the payments to Revenue using the PSR wizard as follows.

Simply press the PSR button.

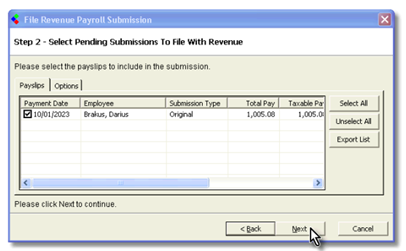

Then follow the PSR Submission Wizard as normal – note that only this advance payment is being reported

now.

And continue the submission process in the normal way, and that finished everything that you need to do for

this advance payment run.

You should print a payslip for this payment for the employee.

Later in the month you will continue to run your normal monthly payroll run, except that when you run the

payslip for this employee you will notice that the advance given on the 10th is automatically deducted from his

regular payslip.

You can of course zeroize this clawback of the advance payment in this payslip if you wish, but CollSoft will

keep trying to claw it back in subsequent payslips until its balances to zero.

You should also pay particular attention to the PRSI calculations and the insurable weeks.

When we processed the Advance Payment CollSoft deducted PRSI at Class A0 rates and allocated 5 insurable

weeks at A0.

In the regular pay run CollSoft has calculated the PRSI at A1 rates based on the total pay of both payslips, but

allowed for the PRSI already deducted on the first advance payslip.

CollSoft will then report 5 Weeks at A1 as well as minus 5 Weeks at A0 on the second payslip.

The over all net

effect across both payslips is that the employee will have 5 Insurable weeks at A1.

Now when you have finished the payroll you will need to make your second submission for this month to

Revenue. Simply click on the PSR button as normal to start the submission process.

You will notice that only the second payslip is listed as the advance payment was already reported earlier in

the month.

If you check your submission for this month on Revenue you will see two separate payslips for this employee,

which reflects the actual payments that you made to the employee.

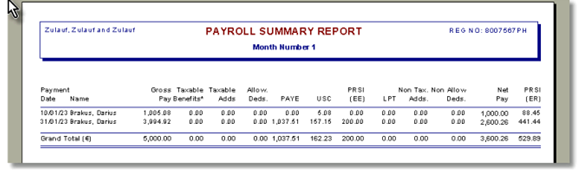

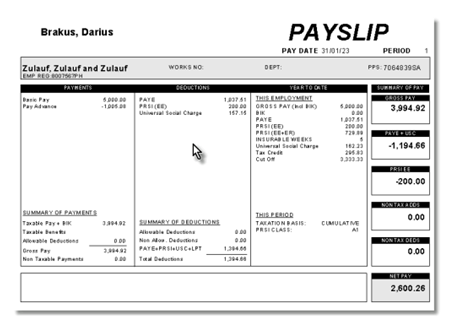

If you were now to run a Payroll Summary report for the month you would see the following;

This report shows the two separate payments, and if you take note you can see that the total gross is €5,000

and the total net is €3,600.26.

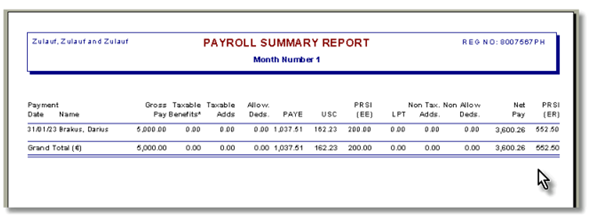

Now, imagine that we had not run any advance payments, and we had just run the normal monthly payroll for

this employee on 31st January, having done that you would have the following Payroll Summary;

As you can see all the totals match as if the payroll had all been run on a single payslip.

Important Note: In general if you make an advance payment and then recoup it in the same payroll period all

the totals should match.

However, if you run an advance payment in one payroll period, and then you recoup the advance in a later

period there is a possibility that the totals may not match. This will occur if the employee is taxed on a week 1

or emergency basis as their tax credits do not accumulate across multiple pay periods. This will eventually

correct itself when the employees moves onto a cumulative taxation basis, but it is something that you should

be aware of.

From the point of view of payslips, this employee is going to have two payslips for this pay period, the first of

which is going to show the payment of the advance.

The second payslip is going to show the normal full salary, along with the claw back of the advance as shown

below;

Advance Payments – Paid and Recouped in different Pay Period

In the previous example the advance payment and the deduction from the regular wage all happened in the

same payroll period, however this may not always be the case.

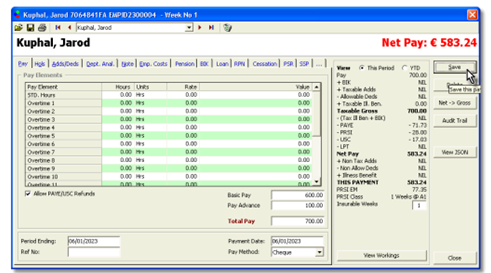

Lets look at an example of a weekly payroll which is paid on a Friday.

Here we have one employee who is normally paid €600 (gross) and they have also asked for a pay advance of

€100 to be made;

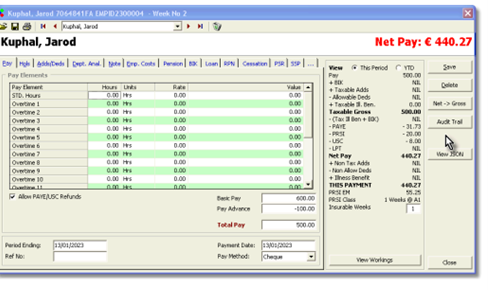

Then in the next week the €100 advance is automatically recouped;

So any balance on an Advance payment will always carry forward and Payroll will always try to recoup the full

amount.

Just be aware that when you run advance payments which wont be repaid until a later pay period, there is a

chance that the total net payments may differ, as may the total amounts of PAYE, USC and PRSI across the

payslips.

Supplementary Payments (or Bonus Run)

Supplementary payments are extra payments which occur after the main payroll run has been processed and

in some other payroll systems they are referred to as a Bonus Run.

They may very well be related to a bonus payment, but they are not restricted to such things.

For example, you may have an employee who had worked some extra overtime, but for whatever reason that

overtime was not included in his regular payslip. With a supplementary payment you could make a separate

payment for the overtime to this employee.

From a calculation point of view the employee will have the full benefit of whatever tax credits etc apply to the

period as a whole, and in general the figures across the two payslips should be the same as if they were all

processed on a single payslip.

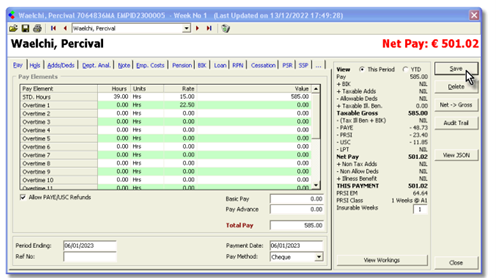

So lets take the example of an employee who worked 39 hours at his standard rate, but who also had worked

5 hours overtime which was not paid in the regular payroll run.

So his regular payslip looks like this, with 39 hours at the standard rate;

This payment was processed in your normal bank run and reported to Revenue in the normal manner.

Then the next day the employee reports that he has not been paid for his 5 hours of overtime and it is decided

that a supplementary payment will be made to make up the shortfall.

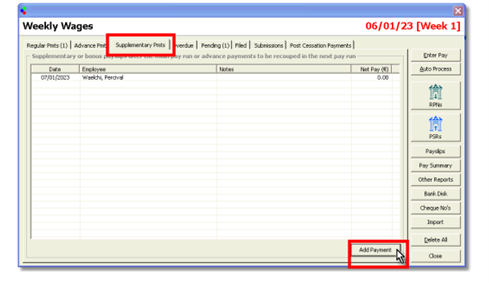

The user can add a Supplementary Payment by clicking into the Supplementary Pmt tab and pressing the Add

Payment button to add an additional payment for this employee.

Then you can add the 5 hours overtime, save the wage, process another payment and report it to Revenue.

Remember, the PRSI calculations will take account of the regular payment already processed and will adjust

the Insurable weeks and PRSI class as required to ensure that the employee’s overall PRSI record is correct.

Indeed, the PAYE and USC will also balance across all the payslips for this employee over the payroll period.

Note: You can also use the Supplementary Payments tab to make an Advance Payment to an employee after

their main payslip has been processed and where the advance is going to be recouped in a future period.

Get help for this page

Get help for this page