Calculating PAYE

The purpose of the PAYE system is to ensure that an employee's tax liability is spread out evenly over the year. Employers act as tax collection agents on behalf of Revenue, adhering to and applying Revenue's guidelines pertaining to the operation of PAYE, withholding and remitting the applicable level of tax (PAYE/USC) and Social contributions (PRSI) from payments to employees in respect of their employment.

PAYE is deducted by applying the appropriate tax basis applicable to the employees circumstances and/or as advised, to the employer, by Revenue. These basis' include:

CALCULATION OF TAX

The calculation of tax for each pay period is made by applying the information supplied in the tax credit certificate against the net pay, using the following steps:

Calculating PAYE: Working Example

PAYE is deducted by applying the appropriate tax basis applicable to the employees circumstances and/or as advised, to the employer, by Revenue. These basis' include:

CALCULATION OF TAX

The calculation of tax for each pay period is made by applying the information supplied in the tax credit certificate against the net pay, using the following steps:

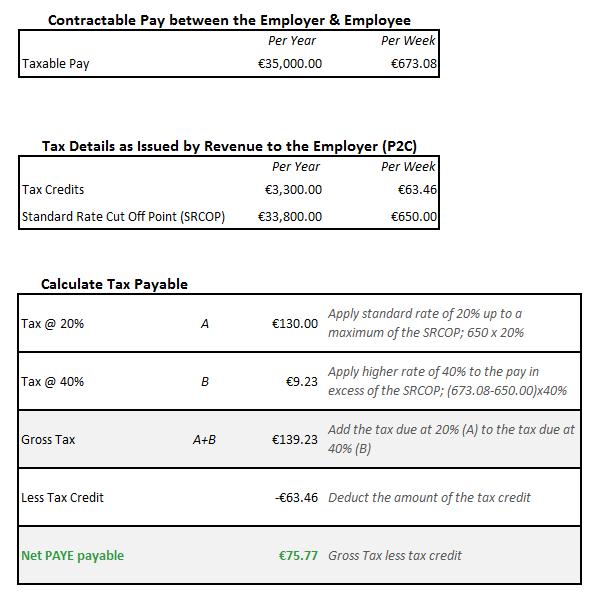

- Tax is calculated at the standard rate of tax on net pay up to the amount of the individual's standard rate cut-off point (SRCOP)

- Any balance of net pay above the cumulative standard rate cut-off point is taxed at the higher rate of tax

- The tax calculated at the standard rate is added to the tax calculated at the higher rate to arrive at the gross tax figure

- The gross tax figure is then reduced by the amount of the individual's tax credits, as advised by Revenue, to arrive at the tax payable in that pay period.

Calculating PAYE: Working Example

| Files | ||

|---|---|---|

| Basic PAYE Tax Calculation.png | ||

Get help for this page

Get help for this page