Bike to Work Scheme

To setup the 'Bike to Work' scheme in Collsoft payroll, the first thing you need to do is create a Non-Taxable Deduction.

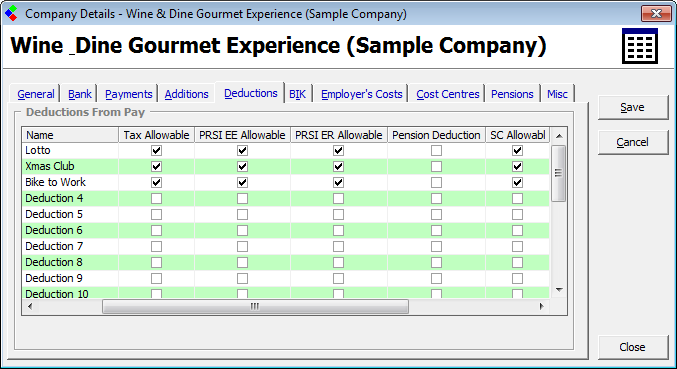

To do this, open the company details screen and select the Deductions Tab. Then rename one of the deductions that is not in use to 'Bike to Work' and tick the TAX, PRSI & USC allowable columns for this deduction, as shown below:

Bike to Work: Setting Up the Deduction

You then open the employee details screen for the employee in question and select the Adds/Deds tab. Here you can enter the amount that is to be paid back by the employee each period, in the deductions section.

Bike to Work: Enter the Amount

Now when you run a wage for the employee, the amount entered above will be deducted from the employees wage before Tax, PRSI and USC is calculated. It is up to the payroll user to stop taking the Bike to Work deduction from the employee once the total cost of the bike has been paid back. Payroll will NOT prompt you when the cost of the bike has been paid back in full.

Note: The 'Bike to work' scheme is PAYE, PRSI & USC allowable up to the value of €1250.00 *. The bicycle and equipment must be paid for over a 12 month period.

*For pedelecs or ebikes and related safety equipment, the limit is €1500.00. For other bicycles and related safety equipment, the limit is now €1250.00.

Prior to 1 August 2020 the limit for the bicycles and safety equipment was €1000.00

For more information on how the scheme works, go to the Revenue Cycle to Work FAQ

To do this, open the company details screen and select the Deductions Tab. Then rename one of the deductions that is not in use to 'Bike to Work' and tick the TAX, PRSI & USC allowable columns for this deduction, as shown below:

Bike to Work: Setting Up the Deduction

You then open the employee details screen for the employee in question and select the Adds/Deds tab. Here you can enter the amount that is to be paid back by the employee each period, in the deductions section.

Bike to Work: Enter the Amount

Now when you run a wage for the employee, the amount entered above will be deducted from the employees wage before Tax, PRSI and USC is calculated. It is up to the payroll user to stop taking the Bike to Work deduction from the employee once the total cost of the bike has been paid back. Payroll will NOT prompt you when the cost of the bike has been paid back in full.

Note: The 'Bike to work' scheme is PAYE, PRSI & USC allowable up to the value of €1250.00 *. The bicycle and equipment must be paid for over a 12 month period.

*For pedelecs or ebikes and related safety equipment, the limit is €1500.00. For other bicycles and related safety equipment, the limit is now €1250.00.

Prior to 1 August 2020 the limit for the bicycles and safety equipment was €1000.00

For more information on how the scheme works, go to the Revenue Cycle to Work FAQ

| Files | ||

|---|---|---|

| Bike to Work Amount.png | ||

| Bike to Work.png | ||

Get help for this page

Get help for this page